Form 5305 R Rev March Roth Individual Retirement Trust Account

What is the Form 5305 R Rev March Roth Individual Retirement Trust Account

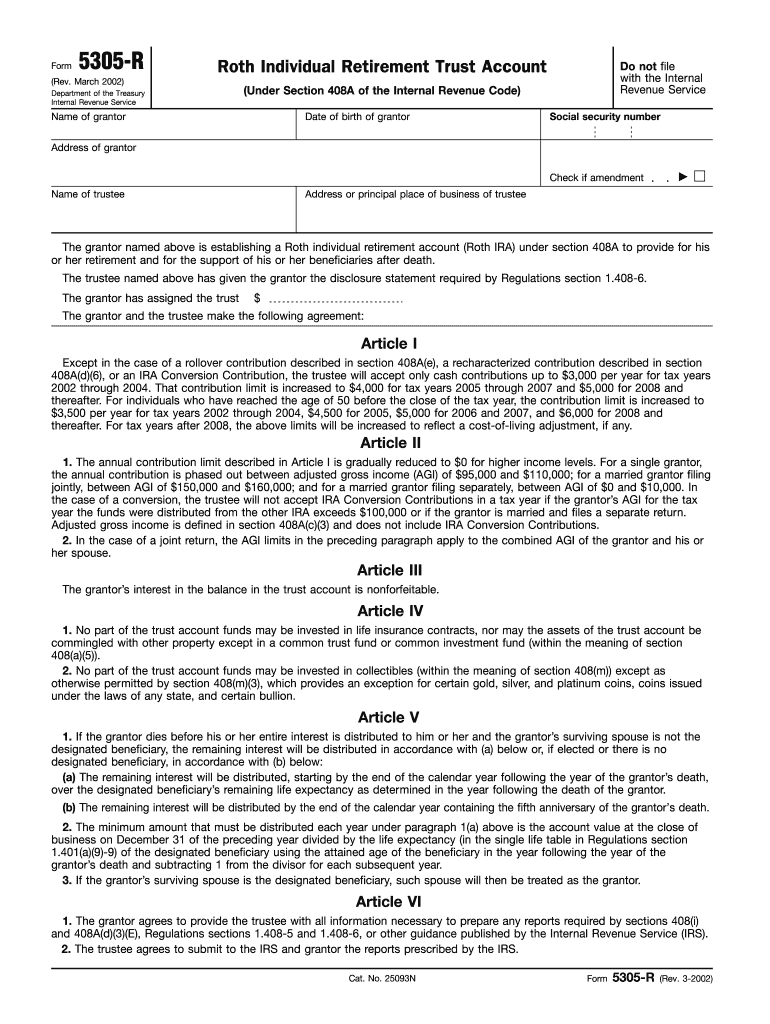

The Form 5305 R Rev March Roth Individual Retirement Trust Account is a document used to establish a Roth IRA trust account. This form is essential for individuals looking to create a tax-advantaged retirement savings vehicle that allows for tax-free withdrawals in retirement. The Roth IRA is particularly appealing because contributions are made with after-tax dollars, meaning that qualified withdrawals during retirement are not subject to income tax. This form ensures compliance with IRS regulations and outlines the terms under which the account operates.

How to use the Form 5305 R Rev March Roth Individual Retirement Trust Account

Using the Form 5305 R Rev March Roth Individual Retirement Trust Account involves a few straightforward steps. First, individuals must complete the form by providing personal information, including their name, address, and Social Security number. Next, they must designate a trustee who will manage the account. After filling out the form, it should be signed and dated by both the account holder and the trustee. Finally, the completed form should be submitted to the financial institution where the Roth IRA will be held, ensuring that all required information is accurately provided to avoid delays.

Steps to complete the Form 5305 R Rev March Roth Individual Retirement Trust Account

Completing the Form 5305 R Rev March Roth Individual Retirement Trust Account involves several key steps:

- Gather necessary personal information, including your Social Security number and contact details.

- Choose a trustee who will oversee the account and ensure compliance with IRS rules.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before signing.

- Submit the completed form to your chosen financial institution to officially establish the account.

Key elements of the Form 5305 R Rev March Roth Individual Retirement Trust Account

Several key elements are included in the Form 5305 R Rev March Roth Individual Retirement Trust Account. These elements define the structure and operation of the account:

- Account Holder Information: Personal details of the individual establishing the account.

- Trustee Information: Details about the trustee responsible for managing the account.

- Contribution Limits: Guidelines on how much can be contributed annually to the Roth IRA.

- Withdrawal Rules: Regulations governing when and how funds can be withdrawn without penalties.

- Tax Implications: Information regarding the tax treatment of contributions and withdrawals.

Legal use of the Form 5305 R Rev March Roth Individual Retirement Trust Account

The legal use of the Form 5305 R Rev March Roth Individual Retirement Trust Account is crucial for ensuring compliance with IRS regulations. This form must be completed accurately to establish the account as a legitimate Roth IRA. By using this form, individuals can take advantage of tax benefits associated with Roth IRAs, such as tax-free growth and withdrawals in retirement. It is important to adhere to the guidelines outlined in the form to avoid potential penalties or disqualification of the account.

Eligibility Criteria

To establish a Roth IRA using the Form 5305 R Rev March Roth Individual Retirement Trust Account, individuals must meet certain eligibility criteria. These include:

- Having earned income from employment or self-employment.

- Meeting the income limits set by the IRS for contributing to a Roth IRA.

- Being of legal age to enter into a trust agreement, typically eighteen years old.

These criteria ensure that the account is used appropriately and that individuals benefit from the tax advantages offered by a Roth IRA.

Quick guide on how to complete form 5305 r rev march roth individual retirement trust account

Prepare [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal standing as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5305 R Rev March Roth Individual Retirement Trust Account

Create this form in 5 minutes!

How to create an eSignature for the form 5305 r rev march roth individual retirement trust account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5305 R Rev March Roth Individual Retirement Trust Account?

The Form 5305 R Rev March Roth Individual Retirement Trust Account is a crucial document used to establish a Roth IRA. This form provides the framework for contributions, distributions, and rules governing your retirement account. Understanding this form can help you maximize the benefits of your retirement savings.

-

How do I complete the Form 5305 R Rev March Roth Individual Retirement Trust Account?

Completing the Form 5305 R Rev March Roth Individual Retirement Trust Account involves filling in your personal information, selecting beneficiaries, and providing your financial institution details. It's important to read the instructions carefully to ensure compliance with IRS regulations. You may also wish to consult a financial advisor for assistance.

-

What are the benefits of using a Roth Individual Retirement Trust Account?

A Roth Individual Retirement Trust Account offers tax-free growth and tax-free withdrawals in retirement, which can lead to signNow savings over time. Additionally, contributions to the account are made with after-tax dollars, allowing you to withdraw your contributions at any time without penalties. This combination of benefits makes it an attractive option for long-term savers.

-

What is the price for setting up a Form 5305 R Rev March Roth Individual Retirement Trust Account?

The cost to set up a Form 5305 R Rev March Roth Individual Retirement Trust Account can vary by financial institution. Many banks and investment firms offer low-cost or even free setup options, but it’s important to review any associated fees or minimum requirements. Always inquire directly to understand the charges for maintaining your account over time.

-

Are there annual contribution limits for the Form 5305 R Rev March Roth Individual Retirement Trust Account?

Yes, there are annual contribution limits for the Form 5305 R Rev March Roth Individual Retirement Trust Account, which are periodically adjusted for inflation. For 2023, individuals can contribute up to $6,500, or $7,500 if you are aged 50 or older. It's crucial to stay updated with IRS guidelines to ensure you're compliant with contribution rules.

-

How can I integrate electronic signatures with my Form 5305 R Rev March Roth Individual Retirement Trust Account?

Integrating electronic signatures with your Form 5305 R Rev March Roth Individual Retirement Trust Account simplifies the process of signing and submitting your documents online. Solutions like airSlate SignNow can help you securely eSign and manage your forms electronically, enhancing efficiency while ensuring compliance with legal standards. Many financial institutions support such integrations for ease of use.

-

Can I transfer funds from other retirement accounts to my Form 5305 R Rev March Roth Individual Retirement Trust Account?

Yes, you can transfer funds from other eligible retirement accounts into your Form 5305 R Rev March Roth Individual Retirement Trust Account through a process called a rollover. This can include moving funds from traditional IRAs or 401(k) plans, provided you adhere to IRS guidelines. It's an effective way to consolidate your retirement savings.

Get more for Form 5305 R Rev March Roth Individual Retirement Trust Account

Find out other Form 5305 R Rev March Roth Individual Retirement Trust Account

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation