Form 9465 SP Rev December Internal Revenue Service

What is Form 9465 SP Rev December Internal Revenue Service

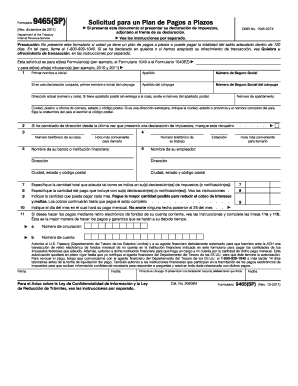

Form 9465 SP, also known as the Installment Agreement Request, is a tax form used by individuals who owe taxes to the Internal Revenue Service (IRS) and wish to set up a payment plan. This Spanish version of the form is specifically designed to assist Spanish-speaking taxpayers in managing their tax liabilities. By completing this form, taxpayers can propose a monthly payment plan to the IRS, allowing them to pay off their tax debt over time rather than in a lump sum.

How to use Form 9465 SP Rev December Internal Revenue Service

Using Form 9465 SP involves several straightforward steps. First, taxpayers must gather their financial information, including income, expenses, and any outstanding tax liabilities. Next, they should fill out the form accurately, providing details such as the amount owed and the proposed monthly payment. Once completed, the form can be submitted to the IRS either electronically or via mail. It is important to ensure that the form is submitted along with any required documentation to avoid delays in processing.

Steps to complete Form 9465 SP Rev December Internal Revenue Service

Completing Form 9465 SP requires careful attention to detail. Here are the key steps:

- Download the form from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount you owe and propose a monthly payment amount that you can afford.

- Provide information about your financial situation, including income and expenses.

- Review the form for accuracy before submission.

- Submit the completed form to the IRS, either online or by mail, and keep a copy for your records.

Eligibility Criteria for Form 9465 SP Rev December Internal Revenue Service

To be eligible to use Form 9465 SP, taxpayers must meet certain criteria. They should owe $50,000 or less in combined tax, penalties, and interest. Additionally, the taxpayer must be current on all filing requirements and not have any previous installment agreements in default. If these conditions are met, taxpayers can apply for an installment agreement using this form, making it easier to manage their tax obligations.

Form Submission Methods for Form 9465 SP Rev December Internal Revenue Service

Taxpayers have multiple options for submitting Form 9465 SP to the IRS. The form can be filed electronically through the IRS e-file system, which is a convenient and quick method. Alternatively, taxpayers can print the completed form and mail it to the appropriate address listed in the form instructions. For those who prefer in-person interactions, visiting a local IRS office may also be an option to submit the form directly.

IRS Guidelines for Form 9465 SP Rev December Internal Revenue Service

The IRS provides specific guidelines for completing and submitting Form 9465 SP. Taxpayers should ensure that they follow these guidelines closely to avoid delays or rejections. This includes providing accurate financial information, ensuring the proposed payment amount is reasonable, and submitting any required documentation. The IRS may also provide additional instructions based on individual circumstances, so it is beneficial to review all available resources before submission.

Quick guide on how to complete form 9465 sp rev december internal revenue service

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-based procedure today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools offered by airSlate SignNow designed for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 9465 SP Rev December Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form 9465 sp rev december internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 9465 SP Rev December Internal Revenue Service?

Form 9465 SP Rev December Internal Revenue Service is a request for a payment plan to pay your tax liabilities. This Spanish version of Form 9465 helps Spanish-speaking taxpayers to understand their options for managing tax debt effectively.

-

How can airSlate SignNow help with Form 9465 SP Rev December Internal Revenue Service?

airSlate SignNow simplifies the process of signing and submitting Form 9465 SP Rev December Internal Revenue Service. Our platform allows users to electronically sign the form and send it to the IRS quickly, ensuring compliance and timely submissions.

-

Is there a cost associated with using airSlate SignNow for Form 9465 SP Rev December Internal Revenue Service?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, which include features for handling Form 9465 SP Rev December Internal Revenue Service. The pricing is competitive and designed to provide cost-effective solutions for electronic document management.

-

What features does airSlate SignNow offer for handling tax forms like Form 9465 SP Rev December Internal Revenue Service?

airSlate SignNow offers features such as electronic signatures, secure storage, and document templates specifically for tax forms like Form 9465 SP Rev December Internal Revenue Service. This ensures your documents are handled securely and efficiently.

-

Can I track the status of my Form 9465 SP Rev December Internal Revenue Service submission with airSlate SignNow?

Yes, with airSlate SignNow, you can track the status of your Form 9465 SP Rev December Internal Revenue Service submission in real-time. This helps you ensure that your requests are processed and provides peace of mind during the submission process.

-

Are there any integrations available with airSlate SignNow for submitting Form 9465 SP Rev December Internal Revenue Service?

airSlate SignNow offers integrations with various platforms that streamline workflows, allowing for efficient submission of Form 9465 SP Rev December Internal Revenue Service. This enhances your ability to manage tax documents and increase productivity.

-

What are the benefits of using airSlate SignNow for Form 9465 SP Rev December Internal Revenue Service?

Using airSlate SignNow for Form 9465 SP Rev December Internal Revenue Service offers multiple benefits, including faster processing times, enhanced security, and increased accessibility. Our platform is user-friendly, making it easy for anyone to manage their tax forms effectively.

Get more for Form 9465 SP Rev December Internal Revenue Service

Find out other Form 9465 SP Rev December Internal Revenue Service

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed