SCHEDULE D Form 1120S Department of the Treasury Internal Revenue Service Name Capital Gains and Losses and Built in Gains See O

Understanding the SCHEDULE D Form 1120S

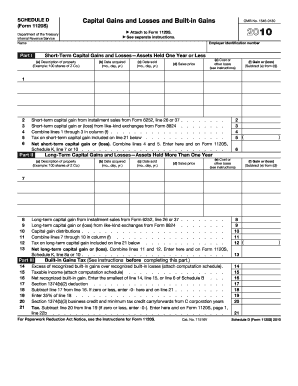

The SCHEDULE D Form 1120S is a crucial document used by S corporations in the United States to report capital gains and losses. This form is filed with the Internal Revenue Service (IRS) and is essential for accurately reflecting the financial activities of the corporation during the tax year. It specifically addresses the built-in gains tax, which applies to certain assets that were appreciated at the time of conversion to an S corporation. Understanding this form is vital for compliance and accurate tax reporting.

How to Complete the SCHEDULE D Form 1120S

Completing the SCHEDULE D Form 1120S involves several steps. First, gather all necessary financial records, including details of capital assets sold during the tax year. Next, report the sales proceeds and the cost basis of these assets in the appropriate sections of the form. It is important to categorize gains and losses correctly, distinguishing between short-term and long-term transactions. After filling out the form, review it for accuracy before submitting it with your tax return.

Obtaining the SCHEDULE D Form 1120S

The SCHEDULE D Form 1120S can be obtained directly from the IRS website or through tax preparation software. It is available in a printable format, allowing for easy access and completion. Ensure you are using the most current version of the form, as tax regulations can change. If you prefer a digital approach, many tax software programs include this form as part of their package, streamlining the filing process.

Key Elements of the SCHEDULE D Form 1120S

The SCHEDULE D Form 1120S includes several critical sections. These sections require detailed information about capital gains and losses, including the description of assets, dates acquired and sold, and amounts realized. Additionally, the form features a section for calculating the built-in gains tax, which is essential for S corporations that have converted from C corporations. Understanding these elements is crucial for accurate reporting and compliance with IRS regulations.

Filing Deadlines for the SCHEDULE D Form 1120S

Filing deadlines for the SCHEDULE D Form 1120S align with the overall tax return deadlines for S corporations. Typically, the deadline is the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. It is important to adhere to these deadlines to avoid penalties and ensure timely processing of your tax return.

Penalties for Non-Compliance with the SCHEDULE D Form 1120S

Failure to file the SCHEDULE D Form 1120S accurately and on time can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, incorrect reporting of capital gains and losses may lead to audits or further scrutiny. It is essential to ensure that the form is completed correctly and submitted by the deadline to avoid these potential issues.

Quick guide on how to complete schedule d form 1120s department of the treasury internal revenue service name capital gains and losses and built in gains see

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a great eco-friendly substitute for conventional printed and signed forms, enabling you to locate the appropriate template and securely store it online. airSlate SignNow provides you with all the tools needed to create, adjust, and electronically sign your documents quickly and without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Employ the tools provided to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method to share your form, via email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SCHEDULE D Form 1120S Department Of The Treasury Internal Revenue Service Name Capital Gains And Losses And Built in Gains See O

Create this form in 5 minutes!

How to create an eSignature for the schedule d form 1120s department of the treasury internal revenue service name capital gains and losses and built in gains see

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SCHEDULE D Form 1120S and why is it important?

The SCHEDULE D Form 1120S is a crucial document used by S corporations to report capital gains and losses to the Department of the Treasury Internal Revenue Service. This form helps ensure accurate tax reporting and compliance with IRS regulations, making it essential for businesses managing capital transactions.

-

How can airSlate SignNow help with the SCHEDULE D Form 1120S?

airSlate SignNow offers an efficient platform for sending and eSigning the SCHEDULE D Form 1120S Department Of The Treasury Internal Revenue Service Name Capital Gains And Losses And Built in Gains See OMB No. It simplifies the process by providing a secure, user-friendly interface that can speed up document management and signing.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans catering to different business needs. Whether you're a small business or a large corporation, you can choose a plan that fits your budget while ensuring compliance with important forms like the SCHEDULE D Form 1120S Department Of The Treasury Internal Revenue Service Name Capital Gains And Losses And Built in Gains See OMB No.

-

Can I integrate airSlate SignNow with existing software?

Yes, airSlate SignNow seamlessly integrates with various software and applications to streamline your workflow. This feature allows you to easily manage documents related to the SCHEDULE D Form 1120S Department Of The Treasury Internal Revenue Service Name Capital Gains And Losses And Built in Gains See OMB No., enhancing productivity without switching platforms.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including improved security, faster turnaround times, and enhanced accessibility. This is especially advantageous for documents like the SCHEDULE D Form 1120S Department Of The Treasury Internal Revenue Service Name Capital Gains And Losses And Built in Gains See OMB No., as it ensures timely and secure submission.

-

Is airSlate SignNow user-friendly for new users?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, allowing even those unfamiliar with eSigning to navigate the platform easily. This simplicity is particularly beneficial when filling out and managing the SCHEDULE D Form 1120S Department Of The Treasury Internal Revenue Service Name Capital Gains And Losses And Built in Gains See OMB No.

-

What security measures does airSlate SignNow implement?

airSlate SignNow prioritizes security and compliance, employing robust encryption and authentication measures to protect sensitive data. This ensures that your SCHEDULE D Form 1120S Department Of The Treasury Internal Revenue Service Name Capital Gains And Losses And Built in Gains See OMB No. and other important documents remain safe throughout the eSigning process.

Get more for SCHEDULE D Form 1120S Department Of The Treasury Internal Revenue Service Name Capital Gains And Losses And Built in Gains See O

Find out other SCHEDULE D Form 1120S Department Of The Treasury Internal Revenue Service Name Capital Gains And Losses And Built in Gains See O

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy