Form 2350SP Application for Extension of Time to File U S Income Tax Return Spanish Version

What is the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

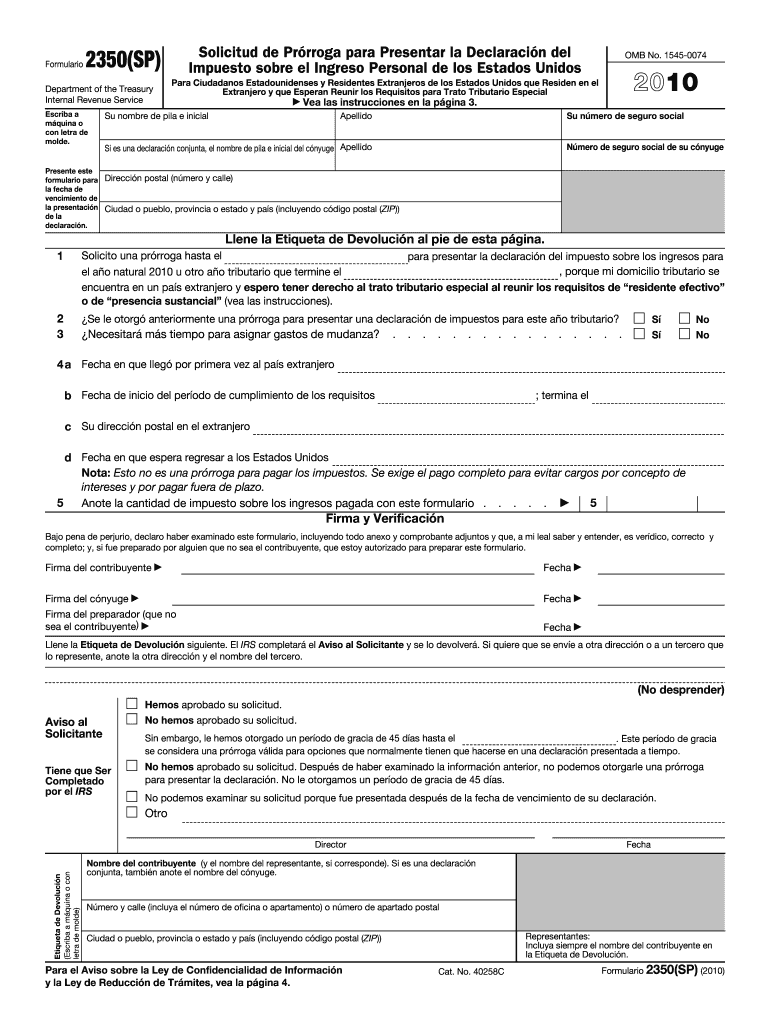

The Form 2350SP is a specialized application designed for Spanish-speaking taxpayers in the United States who require an extension of time to file their U.S. income tax return. This form allows individuals to request additional time beyond the standard filing deadline, ensuring they can adequately prepare their tax documents. It is particularly beneficial for those who may face language barriers or require assistance in understanding the filing process. By using the Spanish version of this form, taxpayers can navigate their tax obligations more comfortably and effectively.

How to use the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

Using the Form 2350SP involves several straightforward steps. First, ensure that you have the correct version of the form, which is specifically tailored for Spanish speakers. Next, fill out the form with accurate information, including your personal details and the reason for requesting an extension. Once completed, submit the form to the appropriate IRS office. It is important to keep a copy of the submitted form for your records. Additionally, be aware of any specific instructions provided by the IRS regarding the submission process and deadlines.

Steps to complete the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

Completing the Form 2350SP involves the following steps:

- Obtain the Form 2350SP from a reliable source, ensuring it is the latest version.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are requesting an extension.

- Provide a brief explanation of why you need the extension.

- Sign and date the form to certify the information is accurate.

- Submit the completed form to the IRS by the designated deadline.

Required Documents

When submitting the Form 2350SP, certain documents may be required to support your application. These may include:

- Proof of your identity, such as a government-issued ID.

- Any relevant tax documents that substantiate your request for an extension.

- Previous tax returns, if applicable, to provide context for your current filing situation.

Ensure that all documents are clear and legible to avoid any delays in processing your request.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 2350SP. Generally, the request for an extension must be submitted by the original due date of your tax return. For most taxpayers, this is April 15. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. Be sure to check the IRS website or consult a tax professional for the most current information regarding deadlines and any changes that may occur.

Eligibility Criteria

To be eligible to use the Form 2350SP, you must meet specific criteria. Primarily, you should be a U.S. taxpayer who is proficient in Spanish and requires additional time to file your income tax return. This form is particularly useful for individuals who may be living abroad or who have complex tax situations that necessitate more time for proper documentation. Additionally, ensure that you are not already under audit or facing other IRS compliance issues that could affect your eligibility.

Quick guide on how to complete form 2350sp application for extension of time to file u s income tax return spanish version

Prepare [SKS] effortlessly on any device

Web-based document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign [SKS] without any hassle

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

Create this form in 5 minutes!

How to create an eSignature for the form 2350sp application for extension of time to file u s income tax return spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version?

The Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version is a tax form that allows taxpayers to request an extension for filing their U.S. income tax return in Spanish. This version ensures that Spanish-speaking individuals can complete their tax obligations accurately and efficiently.

-

How can airSlate SignNow help with the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version?

airSlate SignNow streamlines the process of completing and eSigning the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version. With our platform, you can easily fill out the form, add your electronic signature, and send it directly to the IRS, all from one convenient interface.

-

Is there a cost to use airSlate SignNow for completing the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Each plan provides you with access to features that can help you manage the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version effectively and affordably.

-

What features does airSlate SignNow offer for the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version?

airSlate SignNow provides features such as document templates, electronic signatures, and secure cloud storage for the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version. Additionally, our platform allows for real-time collaboration and tracking of document status.

-

Can I integrate airSlate SignNow with other applications for handling the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version?

Absolutely! airSlate SignNow supports various integrations with applications like Google Drive, Dropbox, and more, allowing you to manage the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version within your existing workflows effortlessly.

-

How secure is using airSlate SignNow for the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version?

Security is a top priority for airSlate SignNow. We employ advanced encryption standards and secure cloud storage to ensure that your Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version and other sensitive documents remain confidential and protected.

-

Can airSlate SignNow assist with tracking the status of my Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version?

Yes, airSlate SignNow offers tracking capabilities for documents processed through our platform. You can easily monitor the status of your Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version to know when it has been viewed, signed, or completed.

Get more for Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

Find out other Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy