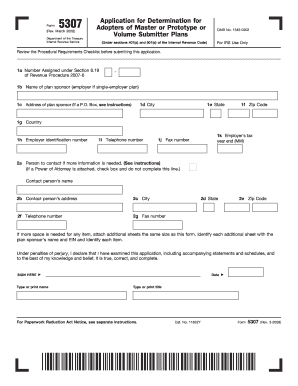

Form 5307 Rev March Application for Determination for Adopters of Master or Prototype or Volume Submitter Plans

Understanding the Form 5307 Rev March Application

The Form 5307 Rev March is designed for individuals and organizations seeking a determination regarding the qualification of their master, prototype, or volume submitter plans under the Employee Retirement Income Security Act (ERISA). This form is crucial for plan sponsors who want to ensure compliance with the Internal Revenue Code and obtain a favorable determination letter from the IRS. By using this form, adopters can confirm that their retirement plans meet the necessary requirements, which can help in avoiding potential penalties and ensuring tax advantages.

Steps to Complete the Form 5307 Rev March

Completing the Form 5307 Rev March involves several key steps. First, gather all necessary information about your retirement plan, including details about the plan sponsor, the type of plan, and any amendments made. Next, accurately fill out each section of the form, ensuring that all required fields are completed. It's important to review the instructions provided by the IRS to avoid common mistakes. Once the form is completed, you should sign and date it before submission. Double-check that all supporting documents are included, as this can expedite the review process.

Obtaining the Form 5307 Rev March

The Form 5307 Rev March can be obtained directly from the IRS website or through authorized tax professionals. It is available in a downloadable format, allowing users to print and fill it out manually. Alternatively, some software solutions may offer the ability to complete the form electronically, which can streamline the process. Ensure that you are using the most current version of the form to avoid any issues during submission.

Legal Use of the Form 5307 Rev March

The legal use of the Form 5307 Rev March is primarily for obtaining a determination letter from the IRS regarding the qualification of retirement plans. This form is essential for plan sponsors to demonstrate compliance with federal regulations. Using the form correctly can protect against penalties and ensure that the retirement plan retains its tax-favored status. It is advisable to consult with a legal or tax professional if there are any uncertainties regarding the form's usage or implications.

Key Elements of the Form 5307 Rev March

Key elements of the Form 5307 Rev March include the identification of the plan sponsor, a detailed description of the retirement plan, and the specific provisions that are being adopted. Additionally, the form requires information about the plan's compliance with IRS regulations, including any amendments that have been made. Providing accurate and comprehensive information is critical, as it directly impacts the IRS's determination regarding the plan's qualification.

Filing Deadlines and Important Dates

Filing deadlines for the Form 5307 Rev March are crucial for plan sponsors to keep in mind. Generally, it is recommended to submit the form during the plan's initial setup or when significant amendments are made. The IRS has specific timelines for when the form must be filed to ensure that the plan maintains its qualified status. Missing these deadlines can result in penalties or loss of tax benefits, so it is essential to stay informed about any changes in IRS regulations or deadlines.

Application Process and Approval Time

The application process for the Form 5307 Rev March involves submitting the completed form along with any required documentation to the IRS. After submission, the approval time can vary based on the complexity of the plan and the IRS's current workload. Typically, it may take several months to receive a determination letter. It is advisable to follow up with the IRS if there are significant delays, as this can help ensure that your application is processed in a timely manner.

Quick guide on how to complete form 5307 rev march application for determination for adopters of master or prototype or volume submitter plans

Complete [SKS] effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without complications. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5307 Rev March Application For Determination For Adopters Of Master Or Prototype Or Volume Submitter Plans

Create this form in 5 minutes!

How to create an eSignature for the form 5307 rev march application for determination for adopters of master or prototype or volume submitter plans

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5307 Rev March Application For Determination For Adopters Of Master Or Prototype Or Volume Submitter Plans?

The Form 5307 Rev March Application For Determination For Adopters Of Master Or Prototype Or Volume Submitter Plans is designed for plan sponsors looking to obtain IRS approval of their retirement plans. This application helps ensure compliance with applicable tax rules and regulations.

-

How does airSlate SignNow facilitate the submission of the Form 5307 Rev March application?

airSlate SignNow streamlines the submission process of the Form 5307 Rev March Application For Determination For Adopters Of Master Or Prototype Or Volume Submitter Plans. With its user-friendly interface, you can easily fill out, sign, and send the form electronically for efficient documentation.

-

Are there any fees associated with using airSlate SignNow for the Form 5307 Rev March application?

Yes, airSlate SignNow offers a range of pricing plans to accommodate different business needs. You can choose a plan that best suits your budget while efficiently managing the Form 5307 Rev March Application For Determination For Adopters Of Master Or Prototype Or Volume Submitter Plans.

-

What are the benefits of using airSlate SignNow for my Form 5307 Rev March Application?

Utilizing airSlate SignNow for your Form 5307 Rev March Application For Determination For Adopters Of Master Or Prototype Or Volume Submitter Plans allows for secure eSigning, reduced paperwork, and faster processing times. This enhances productivity and ensures that your retirement plans remain compliant.

-

Can I integrate airSlate SignNow with other applications for my Form 5307 Rev March submissions?

Yes, airSlate SignNow supports integration with numerous applications, making it easy to incorporate the Form 5307 Rev March Application For Determination For Adopters Of Master Or Prototype Or Volume Submitter Plans into your existing workflows. This ensures seamless data transfer and improved efficiency.

-

What features does airSlate SignNow offer for the Form 5307 Rev March application process?

airSlate SignNow provides features such as customizable templates, electronic signatures, and secure document storage to optimize your Form 5307 Rev March Application For Determination For Adopters Of Master Or Prototype Or Volume Submitter Plans. These tools make the application process smoother and more efficient.

-

Is customer support available for assistance with the Form 5307 Rev March application?

Absolutely! airSlate SignNow offers dedicated customer support to assist with any inquiries related to the Form 5307 Rev March Application For Determination For Adopters Of Master Or Prototype Or Volume Submitter Plans. Our team is here to help guide you through the process and resolve any issues.

Get more for Form 5307 Rev March Application For Determination For Adopters Of Master Or Prototype Or Volume Submitter Plans

Find out other Form 5307 Rev March Application For Determination For Adopters Of Master Or Prototype Or Volume Submitter Plans

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple