Form 8818 Rev December Optional Form to Record Redemption of Series EE and I U S Savings Bonds Issued After 1989

Understanding Form 8818

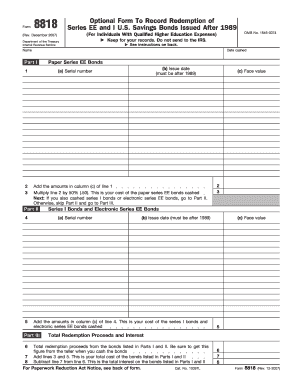

Form 8818, officially known as the Optional Form To Record Redemption Of Series EE And I U.S. Savings Bonds Issued After 1989, is a document used by individuals to report the redemption of these specific savings bonds. This form is particularly useful for taxpayers who wish to document the interest earned on these bonds for tax purposes. The IRS requires this form to ensure that taxpayers accurately report any income generated from the redemption of Series EE and I bonds, which may be subject to federal income tax.

Steps to Complete Form 8818

Completing Form 8818 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary information related to the bonds being redeemed, including the bond serial numbers and the dates of redemption. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Then, provide details about each bond redeemed, including the amount received and the interest earned. Finally, review the form for any errors before submitting it to the IRS.

Obtaining Form 8818

Form 8818 can be obtained directly from the IRS website or through various tax preparation software that supports IRS forms. It is available in a printable format, allowing users to fill it out manually. For those who prefer digital solutions, many online tax services also provide electronic versions of the form that can be completed and filed online.

Legal Use of Form 8818

The legal use of Form 8818 is primarily for reporting the redemption of Series EE and I U.S. savings bonds. Taxpayers must accurately complete and submit this form to the IRS to comply with federal tax laws. Failure to report the income from these bonds may result in penalties or additional taxes owed. It is essential to understand the legal implications of not filing this form when required, as it can lead to complications during tax assessments.

Key Elements of Form 8818

Form 8818 includes several key elements that are crucial for proper completion. These elements consist of the taxpayer's identification information, details about the bonds redeemed, and the total amount of interest earned. Additionally, the form requires the taxpayer's signature, affirming that the information provided is accurate and complete. Understanding these elements ensures that taxpayers can effectively report their bond redemptions and comply with IRS requirements.

Filing Deadlines for Form 8818

It is important to be aware of the filing deadlines associated with Form 8818. Generally, the form should be submitted along with your federal income tax return for the year in which the bonds were redeemed. This means that if you redeemed bonds in the tax year, you must include Form 8818 when filing your tax return, typically due by April fifteenth of the following year. Being mindful of these deadlines helps avoid potential penalties for late filing.

Quick guide on how to complete form 8818

Manage form 8818 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle form 8818 on any device using airSlate SignNow's Android or iOS apps and simplify any document-related process today.

How to modify and electronically sign form 8818 with ease

- Locate form 8818 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Select how you prefer to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign form 8818 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 8818

Create this form in 5 minutes!

How to create an eSignature for the form 8818

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 8818

-

What is form 8818 and how is it used?

Form 8818, also known as the 'Optional Form to Notify the IRS of Bankruptcy or other Liquidation,' is a critical document for businesses. It allows organizations to formally communicate financial changes to the IRS, ensuring compliance with tax regulations. Using airSlate SignNow, you can quickly fill out and eSign form 8818, streamlining the process.

-

How can airSlate SignNow help with filling out form 8818?

airSlate SignNow provides a user-friendly interface for completing form 8818. With our platform, you can easily enter your information, attach necessary documents, and eSign the form. This feature saves you time and ensures that your submission is accurate and compliant.

-

Is there a cost associated with using airSlate SignNow for form 8818?

Yes, airSlate SignNow offers various pricing plans tailored to fit your business needs. Each plan includes features for eSigning and managing documents like form 8818 efficiently. You can choose a plan that suits your budget while enjoying the benefits of our platform.

-

What are the main benefits of using airSlate SignNow for form 8818?

Using airSlate SignNow for form 8818 offers numerous benefits, including enhanced efficiency and compliance. Our platform allows for seamless eSigning and document management, reducing processing time. Additionally, you'll have access to secure storage options for your completed forms.

-

Can I integrate airSlate SignNow with other tools for managing form 8818?

Absolutely! airSlate SignNow offers integrations with popular tools like Google Drive, Dropbox, and CRM software. This means you can easily store, share, and manage your form 8818 alongside other critical business documents in one centralized location.

-

What is the process for eSigning form 8818 with airSlate SignNow?

The process for eSigning form 8818 with airSlate SignNow is straightforward. After completing the form, you can invite others to review and sign it electronically. Our secure eSignature feature ensures that your form 8818 is signed legally and efficiently.

-

How do I ensure my form 8818 is secure while using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform for form 8818, your data is protected with advanced encryption and strict access controls. We're committed to maintaining your privacy and ensuring that your sensitive documents remain confidential.

Get more for form 8818

Find out other form 8818

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer