February Certificate of Foreign Intermediary, Foreign Flow through Entity, or Certain U Form

What is the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

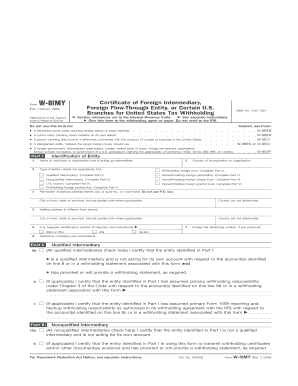

The February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U is a specific tax form used primarily by foreign entities engaged in business activities within the United States. This form is essential for ensuring compliance with U.S. tax regulations, particularly in reporting income and withholding tax obligations. It serves to certify the status of foreign intermediaries and flow-through entities, providing necessary information to the Internal Revenue Service (IRS) regarding their tax responsibilities.

How to use the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

Using the February Certificate involves accurately completing the form with relevant information about the foreign entity's status and activities. It is crucial to provide details such as the entity's name, address, and taxpayer identification number, if applicable. The completed form should be submitted to the relevant U.S. withholding agent or financial institution, which will use it to determine the appropriate withholding tax rates applicable to the entity's U.S.-sourced income.

Steps to complete the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

Completing the February Certificate requires several key steps:

- Gather necessary information about the foreign entity, including its legal name and address.

- Identify the type of entity (e.g., corporation, partnership) and its tax classification.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the form for accuracy to avoid potential penalties or delays in processing.

- Submit the completed form to the U.S. withholding agent or financial institution.

Legal use of the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

The legal use of the February Certificate is critical for foreign entities to comply with U.S. tax laws. By submitting this form, entities can establish their eligibility for reduced withholding tax rates under applicable tax treaties. It also protects U.S. withholding agents from liability by providing them with the necessary documentation to support their tax withholding decisions. Failure to use this form correctly may result in higher withholding rates or penalties for non-compliance.

Key elements of the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

Key elements of the February Certificate include:

- The legal name and address of the foreign entity.

- Tax identification number, if applicable.

- Type of entity and its classification for tax purposes.

- Certification of the entity's status as a foreign intermediary or flow-through entity.

- Signature of an authorized representative affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the February Certificate vary depending on the specific circumstances of the foreign entity and its U.S. income sources. Generally, the form should be submitted prior to the payment of U.S.-sourced income to ensure proper withholding rates are applied. It is advisable for entities to consult IRS guidelines or a tax professional to determine specific deadlines relevant to their situation.

Quick guide on how to complete february certificate of foreign intermediary foreign flow through entity or certain u

Complete [SKS] effortlessly on any gadget

Online document administration has gained immense traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without any delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to alter and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

Create this form in 5 minutes!

How to create an eSignature for the february certificate of foreign intermediary foreign flow through entity or certain u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

The February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. is a compliance document required for reporting income earned by foreign entities. It certifies that certain income is subject to specific tax regulations. Understanding this certificate is crucial for businesses engaging with foreign intermediaries or entities.

-

How can airSlate SignNow assist with the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. process?

airSlate SignNow provides a streamlined platform for electronically signing and managing the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. documents. With our user-friendly interface, you can easily upload, sign, and store your documents securely. This saves time and simplifies compliance processes.

-

What are the main features of airSlate SignNow relevant to the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

Key features of airSlate SignNow for handling the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. include customizable templates, collaborative editing tools, and secure document storage. Additionally, automated workflows help ensure timely submissions and compliance. These features enhance efficiency for businesses managing their foreign entity documentation.

-

Is there a cost associated with using airSlate SignNow for the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

Yes, airSlate SignNow offers flexible pricing plans tailored to meet the diverse needs of businesses processing the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. You can choose from various subscription options depending on your usage and organizational needs. This cost-effective solution ensures value for your investment.

-

Can airSlate SignNow integrate with other software for managing the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and document management software, facilitating the handling of the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. By connecting to your existing tools, you can streamline workflows and maintain accurate records without disrupting established processes.

-

What are the benefits of using airSlate SignNow for the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

Using airSlate SignNow for the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. provides numerous benefits, including quick document turnaround, enhanced collaboration, and improved compliance tracking. The platform's security measures ensure that your sensitive information remains protected. Ultimately, it simplifies the complexity surrounding foreign entity documentation.

-

How secure is airSlate SignNow when dealing with the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

airSlate SignNow prioritizes security with features like advanced encryption and secure access controls to protect your documents, including the February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. We comply with industry standards to ensure data protection, giving you peace of mind while managing critical compliance documents.

Get more for February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

- Miami dade finance department form

- 196 996 9527 0 sample report laboratory testing results form

- Cs1665 form

- Medicaid application louisiana bhsf form 1 l rev 06 11

- Da form 4856 example 100040583

- Dss 1688 form

- Bury staff travel questionnaire amendeddoc form

- Enter name date and place of birthideath and names of parents as information bedfordtx

Find out other February Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online