Form 1065 B U S Return of Income for Electing Large Partnerships

What is the Form 1065 B U S Return Of Income For Electing Large Partnerships

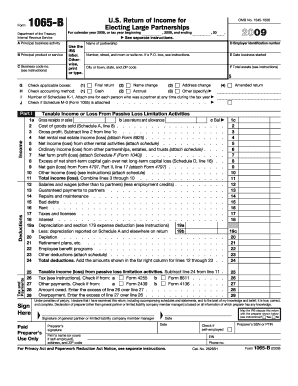

The Form 1065 B U S Return Of Income For Electing Large Partnerships is a tax document specifically designed for partnerships that have elected to be treated as large partnerships under IRS regulations. This form allows these entities to report their income, deductions, and other necessary financial information to the Internal Revenue Service (IRS). It is essential for maintaining compliance with federal tax laws and ensuring accurate reporting of partnership income.

How to use the Form 1065 B U S Return Of Income For Electing Large Partnerships

Using the Form 1065 B involves several steps. First, the partnership must gather all necessary financial information, including income, expenses, and deductions. Next, the partnership completes the form by providing details about its financial activities and any applicable elections. Once completed, the form must be filed with the IRS by the designated deadline. It is crucial to ensure that all information is accurate to avoid penalties.

Steps to complete the Form 1065 B U S Return Of Income For Electing Large Partnerships

Completing the Form 1065 B requires careful attention to detail. The following steps outline the process:

- Gather all financial records, including income statements and expense reports.

- Fill out the identifying information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report total income and deductions in the appropriate sections of the form.

- Complete the schedules that apply to your partnership's specific tax situation.

- Review the completed form for accuracy and completeness.

- File the form with the IRS by the due date.

Key elements of the Form 1065 B U S Return Of Income For Electing Large Partnerships

The Form 1065 B includes several key elements that are crucial for accurate reporting. These elements consist of:

- Partnership identification information, including name and EIN.

- Income and deductions, which must be reported clearly to reflect the partnership's financial status.

- Schedule B, which includes questions regarding the partnership's activities and structure.

- Schedule K, which reports the partnership's income, deductions, and credits to be passed through to partners.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1065 B are crucial for compliance. Typically, the form must be filed by the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. Extensions may be available, but it is important to file for an extension before the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file the Form 1065 B or filing it late can result in significant penalties. The IRS imposes fines for each month the form is late, which can accumulate quickly. Additionally, inaccuracies on the form may lead to further penalties or audits. It is essential for partnerships to ensure timely and accurate filing to avoid these consequences.

Quick guide on how to complete form 1065 b u s return of income for electing large partnerships

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the necessary template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1065 B U S Return Of Income For Electing Large Partnerships

Create this form in 5 minutes!

How to create an eSignature for the form 1065 b u s return of income for electing large partnerships

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1065 B U S Return Of Income For Electing Large Partnerships?

The Form 1065 B U S Return Of Income For Electing Large Partnerships is a tax form that electing partnerships use to report income, gains, losses, and deductions. It is specifically designed for large partnerships that have made the election under Section 771 of the Internal Revenue Code to be taxed as such. This form is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow help with filing the Form 1065 B U S Return Of Income For Electing Large Partnerships?

airSlate SignNow provides an efficient platform to manage and eSign essential tax documents like the Form 1065 B U S Return Of Income For Electing Large Partnerships. With easy document uploads and signature functionalities, users can streamline their filing process and ensure all necessary signatures are collected timely.

-

What are the pricing options for using airSlate SignNow for Form 1065 B U S Return Of Income For Electing Large Partnerships?

airSlate SignNow offers various pricing plans tailored to fit different business needs, starting at an affordable rate that accommodates features required for completing Form 1065 B U S Return Of Income For Electing Large Partnerships efficiently. Each tier includes essential tools for document management, eSigning, and compliance tracking.

-

Are there any specific features in airSlate SignNow that assist with Form 1065 B U S Return Of Income For Electing Large Partnerships?

Yes, airSlate SignNow includes features such as document templates, customizable workflows, and automated reminders, all of which can assist in the effective preparation and filing of the Form 1065 B U S Return Of Income For Electing Large Partnerships. These tools enhance collaboration and ensure that deadlines are met.

-

What are the benefits of using airSlate SignNow for my partnership's tax documents?

Using airSlate SignNow provides multiple benefits, including reduced turnaround time, enhanced accuracy, and heightened security for your Form 1065 B U S Return Of Income For Electing Large Partnerships. The platform is user-friendly, allowing for seamless navigation through the complex tax filing processes.

-

Can airSlate SignNow integrate with other accounting software for Form 1065 B U S Return Of Income For Electing Large Partnerships?

Yes, airSlate SignNow offers integrations with popular accounting software that can help streamline the preparation and submission of the Form 1065 B U S Return Of Income For Electing Large Partnerships. This capability allows for automatic data transfers and synchronization, minimizing the risk of errors.

-

How secure is airSlate SignNow when handling sensitive forms like the Form 1065 B U S Return Of Income For Electing Large Partnerships?

airSlate SignNow prioritizes security, employing advanced encryption methods to protect sensitive forms such as the Form 1065 B U S Return Of Income For Electing Large Partnerships. User access controls and audit trails further ensure that your data remains confidential and compliant.

Get more for Form 1065 B U S Return Of Income For Electing Large Partnerships

Find out other Form 1065 B U S Return Of Income For Electing Large Partnerships

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online