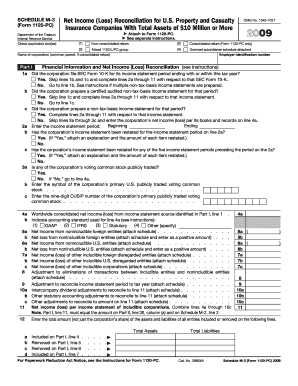

SCHEDULE M 3 Form 1120 PC Department of the Treasury Internal Revenue Service Check Applicable Boxes Net Income Loss Reconciliat

Overview of SCHEDULE M 3 Form 1120 PC

The SCHEDULE M 3 Form 1120 PC is a crucial document issued by the Department of the Treasury Internal Revenue Service. It is designed for corporations to reconcile net income or loss for tax purposes. This form provides a comprehensive breakdown of the differences between financial accounting income and taxable income, ensuring accurate reporting and compliance with IRS regulations. Understanding this form is essential for corporations to maintain transparency and avoid potential penalties.

Steps to Complete the SCHEDULE M 3 Form 1120 PC

Completing the SCHEDULE M 3 Form 1120 PC involves several key steps:

- Gather all relevant financial documents, including income statements and balance sheets.

- Identify the applicable boxes to check based on your corporation's specific financial situation.

- Fill out the form by entering the necessary figures, ensuring accuracy in calculations.

- Review the completed form for any errors or omissions before submission.

Taking the time to carefully complete each section will help ensure compliance and facilitate a smoother filing process.

Legal Use of the SCHEDULE M 3 Form 1120 PC

The SCHEDULE M 3 Form 1120 PC serves a legal purpose in the context of corporate tax filings. It is required for certain corporations to report their income and reconcile discrepancies between book income and taxable income. Filing this form accurately is essential to comply with federal tax laws and avoid potential audits or penalties. Corporations must ensure they are using the correct version of the form and adhering to IRS guidelines to maintain legal compliance.

Key Elements of the SCHEDULE M 3 Form 1120 PC

Several key elements are included in the SCHEDULE M 3 Form 1120 PC:

- Net income or loss reconciliation: This section requires detailed information on how the corporation's financial statements differ from its taxable income.

- Applicable boxes: Corporations must check the boxes that apply to their specific tax situations, which can affect their overall tax liability.

- Supporting documentation: Corporations may need to provide additional documentation to support the figures reported on the form.

Understanding these elements is vital for accurate completion and compliance with IRS requirements.

Obtaining the SCHEDULE M 3 Form 1120 PC

The SCHEDULE M 3 Form 1120 PC can be obtained directly from the IRS website or through authorized tax professionals. It is important to ensure that you are using the most current version of the form, as updates may occur annually. Keeping a copy of the form for your records is advisable, as it may be needed for future reference or audits.

Filing Deadlines for the SCHEDULE M 3 Form 1120 PC

Corporations must adhere to specific filing deadlines for the SCHEDULE M 3 Form 1120 PC. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is usually due by April 15. Failure to file on time can result in penalties and interest, making it essential to stay informed about these deadlines.

Quick guide on how to complete schedule m 3 form 1120 pc department of the treasury internal revenue service check applicable boxes net income loss

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a suitable eco-friendly substitute for traditional printed and signed documents, enabling you to locate the right form and securely keep it online. airSlate SignNow equips you with all the essential tools to create, alter, and eSign your documents swiftly without delays. Handle [SKS] on any platform utilizing airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to alter and eSign [SKS] without any hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools available specifically for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SCHEDULE M 3 Form 1120 PC Department Of The Treasury Internal Revenue Service Check Applicable Boxes Net Income Loss Reconciliat

Create this form in 5 minutes!

How to create an eSignature for the schedule m 3 form 1120 pc department of the treasury internal revenue service check applicable boxes net income loss

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SCHEDULE M 3 Form 1120 PC Department Of The Treasury Internal Revenue Service?

The SCHEDULE M 3 Form 1120 PC Department Of The Treasury Internal Revenue Service is a document that helps corporations report their net income or loss reconciliation. This form plays a crucial role in providing detailed information about the income adjustments, helping both businesses and the IRS understand financial standings clearly.

-

How does airSlate SignNow assist with SCHEDULE M 3 Form 1120 PC submissions?

airSlate SignNow streamlines the process of preparing and submitting the SCHEDULE M 3 Form 1120 PC Department Of The Treasury Internal Revenue Service. Our platform allows users to create, edit, and eSign documents effortlessly, ensuring compliance and accuracy in reporting net income losses.

-

What features does airSlate SignNow offer for handling tax forms like SCHEDULE M 3 Form 1120 PC?

AirSlate SignNow offers several features including document templates, eSign capabilities, and automated workflows specifically designed for tax forms like the SCHEDULE M 3 Form 1120 PC Department Of The Treasury Internal Revenue Service. These features simplify the preparation process and reduce the time needed for completion.

-

Is there a cost associated with using airSlate SignNow for SCHEDULE M 3 Form 1120 PC?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, allowing you to choose one that fits your budget while providing tools for the SCHEDULE M 3 Form 1120 PC Department Of The Treasury Internal Revenue Service. Our pricing is competitive, offering a cost-effective solution for document management.

-

Can I integrate airSlate SignNow with other financial software for the SCHEDULE M 3 Form 1120 PC?

Absolutely! airSlate SignNow can be integrated with numerous financial and accounting software applications to enhance workflows related to the SCHEDULE M 3 Form 1120 PC Department Of The Treasury Internal Revenue Service. This integration helps ensure that all necessary data is easily accessible and manageable.

-

What are the benefits of using airSlate SignNow for tax forms like SCHEDULE M 3 Form 1120 PC?

Using airSlate SignNow for your tax documents like the SCHEDULE M 3 Form 1120 PC Department Of The Treasury Internal Revenue Service brings numerous benefits, including increased efficiency, enhanced accuracy, and improved compliance. It simplifies your tax filing process, allowing you to focus on your core business activities.

-

How secure is data with airSlate SignNow when filing SCHEDULE M 3 Form 1120 PC?

Data security is paramount at airSlate SignNow. Our platform employs advanced security measures, including encryption and secure cloud storage, ensuring that all information related to the SCHEDULE M 3 Form 1120 PC Department Of The Treasury Internal Revenue Service is protected against unauthorized access.

Get more for SCHEDULE M 3 Form 1120 PC Department Of The Treasury Internal Revenue Service Check Applicable Boxes Net Income Loss Reconciliat

Find out other SCHEDULE M 3 Form 1120 PC Department Of The Treasury Internal Revenue Service Check Applicable Boxes Net Income Loss Reconciliat

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online