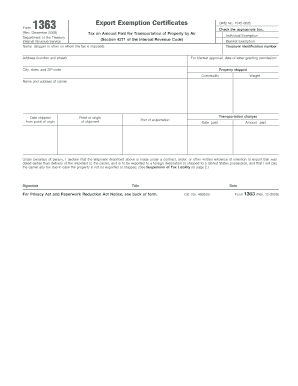

Individual Exemption Form

What is the Individual Exemption

The Individual Exemption refers to a tax provision that allows eligible individuals to exclude a certain amount of income from taxation. This exemption is particularly relevant for those who may not meet the standard deduction threshold or have specific financial circumstances that warrant a reduction in taxable income. Understanding this exemption is vital for accurate tax reporting and compliance with IRS regulations.

How to use the Individual Exemption

Utilizing the Individual Exemption involves identifying your eligibility based on your income level and filing status. Taxpayers can apply this exemption when completing their tax returns, effectively lowering their taxable income. It is essential to ensure that all qualifying criteria are met to avoid any discrepancies during the filing process.

Steps to complete the Individual Exemption

Completing the Individual Exemption requires several steps:

- Determine your eligibility based on IRS guidelines.

- Gather necessary documentation, including income statements and prior tax returns.

- Fill out the appropriate tax forms, ensuring to include the exemption amount.

- Review your completed forms for accuracy.

- Submit your tax return by the designated deadline.

Eligibility Criteria

To qualify for the Individual Exemption, taxpayers must meet specific criteria set forth by the IRS. This typically includes factors such as income level, filing status, and any applicable deductions or credits. It is important for individuals to review these criteria annually, as they may change based on tax law updates.

Required Documents

When applying for the Individual Exemption, certain documents are essential for verification. These may include:

- W-2 forms or 1099 forms that report income.

- Previous year’s tax return for reference.

- Any documentation supporting claims for deductions or credits.

IRS Guidelines

The IRS provides detailed guidelines regarding the Individual Exemption, including eligibility requirements and filing procedures. Taxpayers should familiarize themselves with these guidelines to ensure compliance and maximize their tax benefits. Regularly checking for updates on the IRS website can help individuals stay informed about any changes that may affect their exemption status.

Quick guide on how to complete individual exemption

Effortlessly prepare [SKS] on any device

Digital document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, adjust, and electronically sign your documents quickly without any delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest way to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and electronically sign [SKS] while ensuring seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Individual Exemption

Create this form in 5 minutes!

How to create an eSignature for the individual exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Individual Exemption in relation to airSlate SignNow?

The Individual Exemption within airSlate SignNow refers to a provision allowing users to bypass certain regulatory requirements in specific cases. This feature is designed to simplify the signing process for documents that meet particular criteria, enhancing the overall efficiency of transactions for individuals and businesses alike.

-

How does airSlate SignNow support the Individual Exemption process?

airSlate SignNow provides features that streamline the Individual Exemption process, enabling users to easily set up eSignatures that comply with applicable regulations. The platform ensures that documents qualifying for Individual Exemptions can be securely signed and stored, fostering quicker and safer transactions.

-

Are there any additional costs associated with using the Individual Exemption feature?

Utilizing the Individual Exemption feature in airSlate SignNow is included in the standard pricing plans, offering a cost-effective solution for features that support regulatory compliance. Users can take advantage of this without worrying about hidden fees, making it accessible for all types of businesses.

-

What benefits does the Individual Exemption offer to users of airSlate SignNow?

The Individual Exemption offers users signNow benefits, including reduced processing time and increased efficiency when handling specific document types. By facilitating quicker approvals and signatures, businesses can enhance their workflow while remaining compliant with necessary regulations.

-

Can I integrate Individual Exemption features with other applications?

Yes, airSlate SignNow allows seamless integration of Individual Exemption features with numerous third-party applications. This capability ensures that businesses can manage their document workflows efficiently while leveraging existing tools to support their unique operational needs.

-

Is the Individual Exemption clearly defined within airSlate SignNow?

Yes, airSlate SignNow provides clear guidelines and documentation regarding the Individual Exemption. This transparency helps users understand how to properly utilize the feature and ensures that they can confidently manage their electronic signatures in compliance with legal requirements.

-

What types of documents qualify for the Individual Exemption in airSlate SignNow?

Documents that typically qualify for the Individual Exemption in airSlate SignNow include those related to personal agreements, specific legal disclosures, and certain financial documents. It's important to refer to the platform's documentation for detailed specifications on document eligibility to ensure compliance.

Get more for Individual Exemption

- Tanging yaman foundation scholarship form

- Apbieap form

- Temporary event notice sedgemoor district council sedgemoor gov form

- Pennant project research sheet docx form

- Nys pistol permit application monroe county form

- Diabetes assessment form

- Sawyer trust form

- Elevated gas pressure request texas gas service form

Find out other Individual Exemption

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now