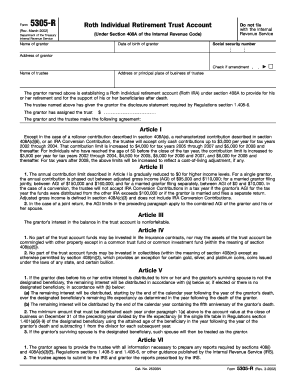

Under Section 408A of the Internal Revenue Code Form

Understanding Section 408A of the Internal Revenue Code

Section 408A of the Internal Revenue Code outlines the rules governing Roth IRAs, a type of individual retirement account that allows for tax-free growth and tax-free withdrawals in retirement. This section is crucial for individuals looking to maximize their retirement savings while benefiting from favorable tax treatment. Contributions to a Roth IRA are made with after-tax dollars, meaning that qualified distributions are not subject to federal income tax. This feature makes Roth IRAs an attractive option for many savers.

Eligibility Criteria for Roth IRAs

To contribute to a Roth IRA under Section 408A, individuals must meet certain eligibility requirements. These include having earned income, which can come from wages, salaries, or self-employment. Additionally, there are income limits that determine how much one can contribute. For tax year 2023, single filers with a modified adjusted gross income (MAGI) of less than $138,000 can contribute the full amount, while those earning between $138,000 and $153,000 may be eligible for a reduced contribution. Married couples filing jointly have a higher threshold, with full contributions allowed for MAGI under $218,000.

Steps to Contribute to a Roth IRA

Contributing to a Roth IRA involves a straightforward process. First, individuals must select a financial institution that offers Roth IRA accounts. After that, they will need to complete an application, providing personal information and verifying eligibility based on income. Once the account is established, contributions can be made through various methods, such as direct deposit or electronic transfer. It is important to keep track of annual contribution limits, which for 2023 is $6,500 for individuals under age fifty and $7,500 for those fifty and older.

Required Documents for Opening a Roth IRA

When opening a Roth IRA, individuals will need several documents to verify their identity and eligibility. Typically, this includes a government-issued ID, such as a driver's license or passport, and Social Security number. Additionally, proof of income may be required, especially if the applicant's income is near the eligibility limits. Some institutions may also request bank statements or tax returns to confirm financial status.

IRS Guidelines on Roth IRAs

The IRS provides detailed guidelines regarding Roth IRAs, including rules about contributions, withdrawals, and conversions from traditional IRAs. According to IRS regulations, contributions to a Roth IRA can be withdrawn at any time without penalty, while earnings may be subject to taxes and penalties if withdrawn before age fifty-nine and a half unless certain conditions are met. Understanding these guidelines is essential for effective retirement planning.

Filing Deadlines for Contributions

Contributions to a Roth IRA for a given tax year must be made by the tax filing deadline, typically April fifteenth of the following year. For example, contributions for the 2023 tax year must be completed by April fifteenth, 2024. It is important for individuals to plan their contributions accordingly to maximize their retirement savings and take full advantage of the tax benefits offered by Roth IRAs.

Quick guide on how to complete under section 408a of the internal revenue code

Complete [SKS] effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Under Section 408A Of The Internal Revenue Code

Create this form in 5 minutes!

How to create an eSignature for the under section 408a of the internal revenue code

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of Under Section 408A Of The Internal Revenue Code?

Under Section 408A Of The Internal Revenue Code, the rules for Roth IRAs are outlined, allowing individuals to make after-tax contributions. This section is crucial for those looking to maximize their retirement savings with tax-free growth. Understanding this code can help individuals make informed decisions about their financial future.

-

How does airSlate SignNow support document management related to Section 408A?

airSlate SignNow provides a seamless platform for managing documents associated with Section 408A Of The Internal Revenue Code. Users can easily create, send, and eSign documents that comply with this regulation, ensuring a smooth process for all involved parties. The platform's user-friendly interface simplifies complex document management tasks.

-

Are there any costs associated with using airSlate SignNow for documents under Section 408A?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. Each plan includes features specifically designed for managing documents under Section 408A Of The Internal Revenue Code, ensuring compliance while providing cost-effective solutions. Detailed pricing information can be found on our website.

-

What features does airSlate SignNow offer for compliance with Section 408A?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure eSignature capabilities tailored for documents under Section 408A Of The Internal Revenue Code. These features help ensure that all documents are compliant and properly managed, reducing the risks of errors. This makes it easier for businesses to adhere to regulatory requirements.

-

Can airSlate SignNow integrate with other platforms to assist with Section 408A documentation?

Absolutely! airSlate SignNow integrates with various business platforms and software to streamline workflows related to Section 408A Of The Internal Revenue Code. These integrations enhance productivity and ensure that all your documentation processes are efficiently managed without leaving your preferred applications.

-

How can airSlate SignNow benefit my business concerning Section 408A?

Using airSlate SignNow helps your business efficiently handle all documentation associated with Section 408A Of The Internal Revenue Code. The platform improves operational efficiency, reduces turnaround times for signatures, and enhances compliance efforts. This leads to a more organized approach to managing important financial documents.

-

Is airSlate SignNow secure for handling documents under Section 408A?

Yes, airSlate SignNow prioritizes security and employs advanced encryption technologies to protect documents related to Section 408A Of The Internal Revenue Code. Our platform complies with industry standards to ensure that your sensitive information remains confidential and secure. You can confidence in the privacy of your documents.

Get more for Under Section 408A Of The Internal Revenue Code

Find out other Under Section 408A Of The Internal Revenue Code

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form