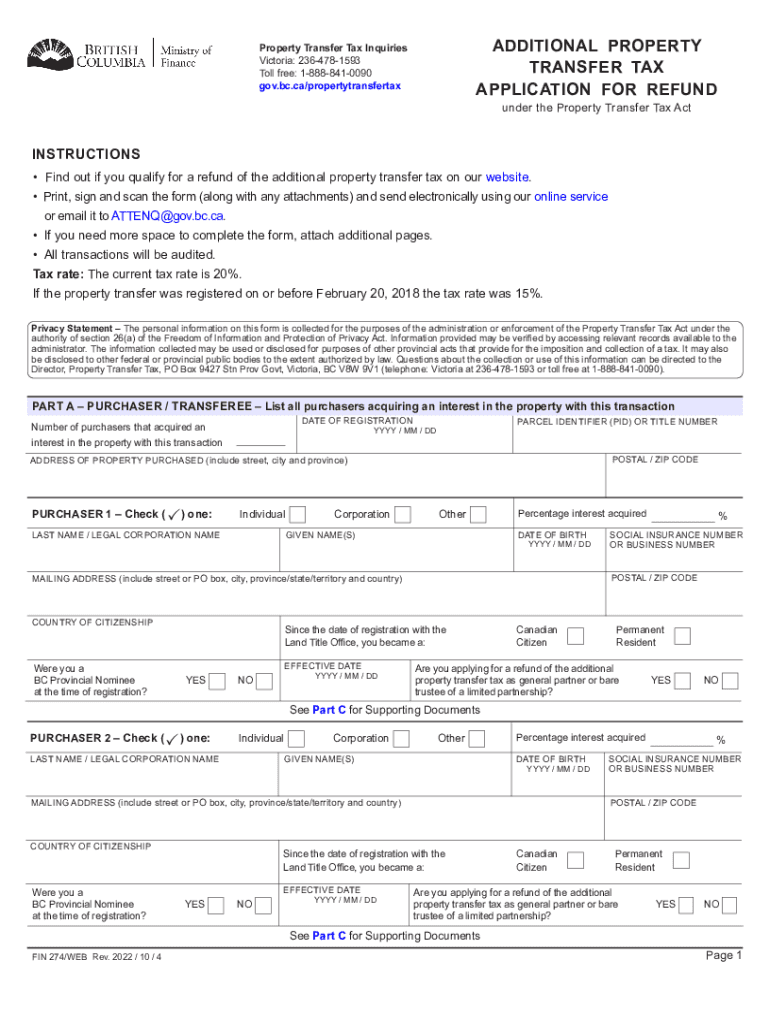

FIN 274, Additional Property Transfer Tax Application for Refund 2022-2026

What is the FIN 274, Additional Property Transfer Tax Application For Refund

The FIN 274, Additional Property Transfer Tax Application For Refund, is a form used by property owners in the United States to request a refund of additional property transfer taxes that may have been incorrectly assessed. This form is essential for individuals or entities who believe they have overpaid taxes during a property transaction. It serves as a formal request to the appropriate tax authority to review the transaction and determine if a refund is warranted.

Steps to complete the FIN 274, Additional Property Transfer Tax Application For Refund

Completing the FIN 274 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information related to the property transfer, including the transaction date, the amount of tax paid, and any relevant property details. Next, fill out the form carefully, providing clear and precise information in each section. Be sure to include your contact information for any follow-up. After completing the form, review it for any errors or omissions before submitting it to the appropriate tax authority.

How to obtain the FIN 274, Additional Property Transfer Tax Application For Refund

The FIN 274 form can typically be obtained from the website of the local tax authority or department of revenue in your state. Many jurisdictions offer downloadable PDF versions of the form that can be printed and filled out by hand. Additionally, some tax offices may provide physical copies of the form upon request. It is important to ensure you are using the most current version of the form to avoid any processing delays.

Legal use of the FIN 274, Additional Property Transfer Tax Application For Refund

The FIN 274 form is legally binding when completed and submitted in accordance with state regulations. To ensure its legal validity, the form must be signed and dated by the applicant. Additionally, it is crucial to comply with any specific state laws regarding the submission of tax refund applications. Failure to adhere to these regulations may result in rejection of the application or delays in processing.

Required Documents

When submitting the FIN 274 form, certain documents may be required to support your request for a refund. These typically include:

- A copy of the original property transfer tax payment receipt.

- Documentation proving the overpayment, such as a closing statement or tax assessment notice.

- Identification information, such as a driver's license or taxpayer identification number.

It is advisable to check with your local tax authority for any additional documentation requirements specific to your jurisdiction.

Form Submission Methods

The FIN 274 form can usually be submitted through various methods, depending on the local tax authority's guidelines. Common submission methods include:

- Online submission through the tax authority's website, if available.

- Mailing the completed form to the designated address provided by the tax authority.

- In-person submission at the local tax office or revenue department.

Each method may have different processing times, so it is beneficial to choose the one that best suits your needs.

Quick guide on how to complete fin 274 additional property transfer tax application for refund

Complete FIN 274, Additional Property Transfer Tax Application For Refund effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle FIN 274, Additional Property Transfer Tax Application For Refund on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign FIN 274, Additional Property Transfer Tax Application For Refund with ease

- Find FIN 274, Additional Property Transfer Tax Application For Refund and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or conceal sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign FIN 274, Additional Property Transfer Tax Application For Refund and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fin 274 additional property transfer tax application for refund

Create this form in 5 minutes!

How to create an eSignature for the fin 274 additional property transfer tax application for refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FIN 274, Additional Property Transfer Tax Application For Refund?

The FIN 274, Additional Property Transfer Tax Application For Refund is a form used by property owners to claim a refund on the additional property transfer tax you may have overpaid. This application allows applicants to clearly delineate their eligibility for receiving a refund, simplifying the overall process.

-

How can airSlate SignNow assist with submitting the FIN 274 application?

airSlate SignNow streamlines the process of submitting the FIN 274, Additional Property Transfer Tax Application For Refund by allowing users to fill out and e-sign the form electronically. This not only saves time but also ensures that your application is submitted accurately and securely.

-

What are the pricing plans for using airSlate SignNow to handle the FIN 274 application?

airSlate SignNow offers various pricing plans that can accommodate different business needs. Users can opt for cost-effective solutions that suit their usage of the FIN 274, Additional Property Transfer Tax Application For Refund, helping them save money while efficiently managing their documentation.

-

Are there any specific benefits of using airSlate SignNow for the FIN 274 application?

Using airSlate SignNow for the FIN 274, Additional Property Transfer Tax Application For Refund offers multiple benefits, including enhanced security, easy document sharing, and rapid e-signature capabilities. These features help ensure that your refund application process is efficient and compliant with legal requirements.

-

What features does airSlate SignNow provide for managing the FIN 274 application?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time document tracking specifically tailored for the FIN 274, Additional Property Transfer Tax Application For Refund. These tools enhance the user experience and improve document management efficiency.

-

Can I integrate airSlate SignNow with other applications while processing the FIN 274 application?

Yes, airSlate SignNow offers seamless integration with various business applications and software platforms. This means you can easily manage your FIN 274, Additional Property Transfer Tax Application For Refund alongside your existing tools, creating a more cohesive workflow.

-

How secure is airSlate SignNow when processing the FIN 274 application?

Security is a top priority for airSlate SignNow. When processing the FIN 274, Additional Property Transfer Tax Application For Refund, your data is protected with advanced encryption and compliance with industry standards, ensuring that your sensitive information remains safe and confidential.

Get more for FIN 274, Additional Property Transfer Tax Application For Refund

- Florida mortgage brokerage fee agreement form

- Cyber security liability application form

- Ssa 3288 fillable form

- Taxable social security worksheet 100006207 form

- Oakvillehydrocompap form

- V112 form 529207651

- Homeowners insurance quote sheet template form

- Notice of intent to use third party inspection agency form

Find out other FIN 274, Additional Property Transfer Tax Application For Refund

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now