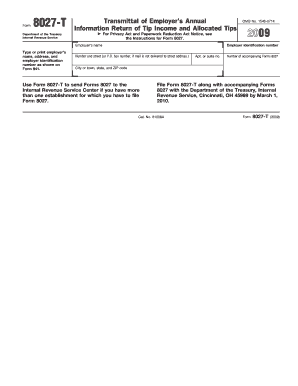

Form 8027 T IRS Video Portal

What is the Form 8027 T IRS Video Portal

The Form 8027 T IRS Video Portal is a specialized tool provided by the IRS to facilitate the submission and management of Form 8027, which is used by certain businesses to report tips received by employees. This portal allows users to access instructional videos and resources that guide them through the process of completing and submitting the form accurately. It is designed to enhance understanding and compliance with IRS regulations regarding tip reporting.

How to use the Form 8027 T IRS Video Portal

To effectively use the Form 8027 T IRS Video Portal, users can navigate through a series of instructional videos that cover various aspects of the form. The portal offers step-by-step guidance on filling out the form, understanding the requirements, and submitting it electronically. Users can pause, rewind, and replay videos to ensure they grasp the material fully. Additionally, the portal may include FAQs and troubleshooting tips for common issues encountered during the submission process.

Steps to complete the Form 8027 T IRS Video Portal

Completing the Form 8027 T IRS Video Portal involves several key steps:

- Access the portal through the IRS website.

- Select the relevant video that addresses your specific needs regarding Form 8027.

- Follow the instructions provided in the video, pausing as necessary to complete each section of the form.

- Gather any required documents or information needed to complete the form accurately.

- Submit the completed form electronically through the portal or follow the instructions for mailing it if necessary.

Key elements of the Form 8027 T IRS Video Portal

The key elements of the Form 8027 T IRS Video Portal include:

- Instructional videos that provide detailed explanations of each section of Form 8027.

- Resources for understanding IRS guidelines related to tip reporting.

- Access to forms and related documents needed for submission.

- Support for users who may have questions or require additional assistance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8027 are crucial for compliance. Businesses must submit the form by the end of February for the previous calendar year if filing by paper, or by the end of March if filing electronically. It is essential to keep track of these dates to avoid penalties and ensure timely reporting of tips received by employees.

Form Submission Methods

The Form 8027 can be submitted through various methods, including:

- Online submission via the IRS Video Portal for those who prefer a digital approach.

- Mailing a paper version of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete form 8027 t irs video portal

Effortlessly Prepare [SKS] on Any Device

Online document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related processes today.

The Simplest Method to Modify and eSign [SKS] Seamlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the specialized tools that airSlate SignNow offers for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign [SKS] while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8027 T IRS Video Portal

Create this form in 5 minutes!

How to create an eSignature for the form 8027 t irs video portal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8027 T IRS Video Portal, and how does it work?

The Form 8027 T IRS Video Portal is an innovative platform that allows users to eSign and submit Form 8027 T to the IRS securely. This user-friendly interface simplifies the submission process, ensuring that all necessary information is accurately captured and instantly transmitted to the IRS.

-

How can I benefit from using the Form 8027 T IRS Video Portal?

Using the Form 8027 T IRS Video Portal can signNowly streamline your business's document management process. It not only saves time but also reduces errors by providing a clear step-by-step guide for completing and submitting Form 8027 T efficiently.

-

What features does the Form 8027 T IRS Video Portal offer?

The Form 8027 T IRS Video Portal includes features such as digital signatures, real-time document tracking, and secure storage. These functionalities make it easier to manage Form 8027 T submissions while enhancing overall data security.

-

Is there a cost associated with using the Form 8027 T IRS Video Portal?

Yes, there is a cost for utilizing the Form 8027 T IRS Video Portal; however, airSlate SignNow offers flexible pricing plans to fit various business needs. Considering the efficiency and time saved, many users find that the investment is well worth it.

-

Can I integrate the Form 8027 T IRS Video Portal with other software?

Absolutely! The Form 8027 T IRS Video Portal can be easily integrated with various third-party applications, enhancing its functionality and allowing for seamless workflow management. This compatibility helps businesses maintain efficient operations while submitting Form 8027 T.

-

How secure is the Form 8027 T IRS Video Portal?

The Form 8027 T IRS Video Portal is designed with top-tier security measures to protect your sensitive information. With SSL encryption and secure cloud storage, you can trust that the data submitted via this portal is safe and secure.

-

What support options are available for users of the Form 8027 T IRS Video Portal?

Users of the Form 8027 T IRS Video Portal can access comprehensive support through various channels, including live chat, email support, and an extensive knowledge base. Our dedicated team is committed to helping you make the most out of your experience.

Get more for Form 8027 T IRS Video Portal

Find out other Form 8027 T IRS Video Portal

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement