Your Projected Total Tax for Form

What is the Your Projected Total Tax For

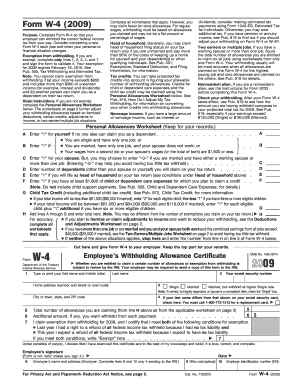

The form "Your Projected Total Tax For" is a crucial document used by taxpayers to estimate their tax liability for the upcoming year. This form helps individuals and businesses calculate their expected tax payments based on projected income, deductions, and credits. By providing a clear overview of anticipated tax obligations, it allows taxpayers to plan their finances more effectively and avoid surprises during tax season.

How to use the Your Projected Total Tax For

To effectively use the "Your Projected Total Tax For" form, begin by gathering all necessary financial information, including income sources, potential deductions, and applicable tax credits. Input your estimated income for the year, factoring in any changes that might affect your earnings. Calculate your deductions and credits based on current tax laws. Once you have all the information, follow the form's instructions to compute your projected tax liability accurately.

Steps to complete the Your Projected Total Tax For

Completing the "Your Projected Total Tax For" involves several steps:

- Collect your financial documents, including pay stubs, investment income statements, and receipts for deductible expenses.

- Estimate your total income for the year, considering any expected changes in employment or additional income sources.

- Identify and calculate your eligible deductions, such as mortgage interest, student loan interest, and charitable contributions.

- Determine your tax credits, which can reduce your overall tax liability.

- Fill out the form by entering your estimated income, deductions, and credits, then calculate your projected total tax.

Key elements of the Your Projected Total Tax For

Several key elements are essential when filling out the "Your Projected Total Tax For." These include:

- Estimated Income: The total income you expect to earn during the tax year.

- Deductions: Expenses that can be subtracted from your total income to reduce taxable income.

- Tax Credits: Direct reductions in the amount of tax owed, which can significantly lower your tax bill.

- Filing Status: Your tax filing status, such as single, married filing jointly, or head of household, which affects tax rates and deductions.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing the "Your Projected Total Tax For." Taxpayers should refer to the IRS website or publications for the most current information regarding tax rates, allowable deductions, and credits. Staying informed about these guidelines ensures that taxpayers can accurately project their tax liabilities and comply with federal tax laws.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial when using the "Your Projected Total Tax For." Generally, taxpayers must submit their completed forms by April fifteenth of the following year. However, if you expect to owe taxes, making estimated payments throughout the year can help avoid penalties. Be aware of any changes in deadlines or requirements, especially if filing for an extension or if you are self-employed.

Quick guide on how to complete your projected total tax for

Complete [SKS] effortlessly on any device

Online document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important parts of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searching, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Your Projected Total Tax For

Create this form in 5 minutes!

How to create an eSignature for the your projected total tax for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Your Projected Total Tax For using airSlate SignNow?

Your Projected Total Tax For can be easily calculated when using airSlate SignNow by integrating our electronic signature solution with your accounting software. This makes it convenient and accurate for businesses to determine their expected tax obligations while managing documents digitally.

-

How does airSlate SignNow help in calculating Your Projected Total Tax For?

airSlate SignNow automates document workflows and streamlines your business processes. This efficiency allows users to focus on core activities, ensuring that financial documentation related to Your Projected Total Tax For is handled swiftly and accurately, reducing potential errors.

-

Are there any additional costs associated with calculating Your Projected Total Tax For?

There are no hidden fees when using airSlate SignNow to manage Your Projected Total Tax For. Our pricing plans are transparent, providing users with a cost-effective solution to eSign documents and manage tax-related paperwork without incurring unexpected expenses.

-

Can I use airSlate SignNow for managing tax documents related to Your Projected Total Tax For?

Absolutely! airSlate SignNow is designed to handle various business documents, including those related to Your Projected Total Tax For. Our platform ensures secure and compliant eSigning of tax documents, making it easier to manage your financial obligations.

-

What features of airSlate SignNow are beneficial for calculating Your Projected Total Tax For?

Key features like automated workflows, templates, and secure storage make airSlate SignNow ideal for managing Your Projected Total Tax For. These tools enhance efficiency and ensure that all necessary documentation is readily accessible and easily processed.

-

Does airSlate SignNow integrate with tax software for Your Projected Total Tax For?

Yes, airSlate SignNow integrates seamlessly with popular tax software to assist in calculating Your Projected Total Tax For. This integration allows users to synchronize their documents and data effortlessly, making the tax filing process smoother and more efficient.

-

What are the benefits of using airSlate SignNow for Your Projected Total Tax For?

Using airSlate SignNow for Your Projected Total Tax For provides numerous benefits, including increased accuracy, reduced paperwork, and time savings. These advantages allow businesses to focus on growth while confidently managing their tax documents digitally.

Get more for Your Projected Total Tax For

Find out other Your Projected Total Tax For

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy