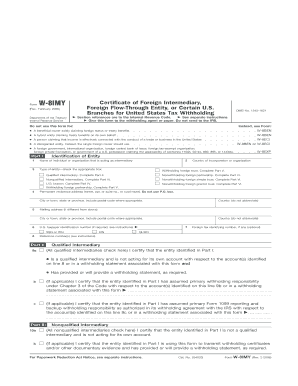

Certificate of Foreign Intermediary, Foreign Flow through Entity, or Certain U Form

What is the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

The Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U is a tax document used by foreign entities to certify their status for U.S. tax purposes. This form helps determine the appropriate withholding tax rates on income received from U.S. sources. It is primarily utilized by foreign intermediaries, flow-through entities, or certain U.S. persons to establish their eligibility for reduced withholding rates under applicable tax treaties. This certification is crucial for compliance with IRS regulations and ensures that the correct amount of tax is withheld from payments made to these entities.

How to use the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

Using the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U involves several steps. First, the entity must complete the form accurately, providing all required information, including its name, address, and tax identification number. Next, the completed form should be submitted to the withholding agent or payer of income. This document serves as proof of the entity's status and eligibility for reduced withholding tax rates. It is important to keep a copy of the submitted form for record-keeping and future reference.

Steps to complete the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

Completing the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including the entity's legal name, address, and tax identification number.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the withholding agent or payer of income.

- Retain a copy of the submitted form for your records.

Legal use of the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

The legal use of the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U is essential for compliance with U.S. tax laws. This form verifies the foreign entity's status and is used to claim benefits under tax treaties. Proper utilization of this certificate helps prevent over-withholding of taxes on income sourced from the U.S. Entities that fail to provide this certification may face higher withholding rates, leading to potential financial losses. It is advisable to consult with a tax professional to ensure compliance and proper usage of the form.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. These guidelines outline the eligibility criteria, required information, and the process for claiming treaty benefits. It is important for entities to familiarize themselves with these guidelines to ensure accurate completion of the form and compliance with tax regulations. The IRS also updates these guidelines periodically, so staying informed about any changes is crucial for maintaining compliance.

Required Documents

To complete the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U, certain documents may be required. These typically include:

- Proof of the entity's foreign status, such as a tax identification number or other identification documents.

- Documentation supporting any claims for reduced withholding rates under applicable tax treaties.

- Any additional information that may be requested by the withholding agent or payer of income.

Quick guide on how to complete certificate of foreign intermediary foreign flow through entity or certain u

Prepare [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents promptly without interruptions. Manage [SKS] using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] seamlessly

- Locate [SKS] and then click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Accentuate important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to preserve your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it onto your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

Create this form in 5 minutes!

How to create an eSignature for the certificate of foreign intermediary foreign flow through entity or certain u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U?

A Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U is a document used by foreign entities to signNow their status for tax purposes. This certificate is crucial for ensuring compliance with U.S. tax regulations. It helps the foreign entity avoid withholding tax on certain U.S. source income. Understanding this certificate is vital for organizations navigating international taxation.

-

How can airSlate SignNow help with obtaining a Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U?

airSlate SignNow simplifies the process of obtaining a Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U by providing an easy-to-use electronic signature solution. You can quickly prepare, sign, and send the necessary documents securely. This streamlines the workflow and ensures that all required documents are completed accurately. Our platform's efficiency can save valuable time in your compliance process.

-

What features does airSlate SignNow offer for managing documents related to the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U?

airSlate SignNow offers a variety of features to manage documents associated with the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. These include customizable templates, real-time tracking of document status, and secure eSigning capabilities. Additionally, users can easily store and retrieve essential documents, ensuring that compliance requirements are met. This comprehensive toolset enhances document management efficiency.

-

Are there any costs associated with using airSlate SignNow for the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U documentation?

Yes, there are costs involved in using airSlate SignNow, but we offer competitive pricing plans designed to fit various business needs. Each plan provides access to necessary features for handling the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U, making it a cost-effective solution. We also offer a free trial to help you evaluate our services without commitment. Investing in our platform can save time and reduce compliance risks.

-

What benefits does airSlate SignNow provide when dealing with the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U?

Using airSlate SignNow for the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U offers numerous benefits, including increased efficiency and reduced turnaround times for document handling. Our platform enhances accuracy by minimizing the risk of errors in the required forms. Furthermore, it provides secure storage and easy access to essential documents, contributing to better organization and compliance management. This convenience helps businesses focus on core operations.

-

Can airSlate SignNow integrate with other tools for managing the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, making it easier to manage documentation related to the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. Integrations with tools like CRM systems, cloud storage services, and accounting software enhance your workflow and centralize document management. These connections facilitate better collaboration across different teams and streamline your operations.

-

Is airSlate SignNow compliant with regulations for the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U?

Absolutely! airSlate SignNow prioritizes compliance with applicable regulations, including those relating to the Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. Our platform adheres to industry standards for security and privacy, ensuring your documents are safe and compliant. This commitment to regulatory compliance is essential for businesses handling sensitive information related to international transactions.

Get more for Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

Find out other Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast