Form 8810 Fill in Capable Corporate Passive Activity Loss and Credit Limitations

Understanding Form 8810

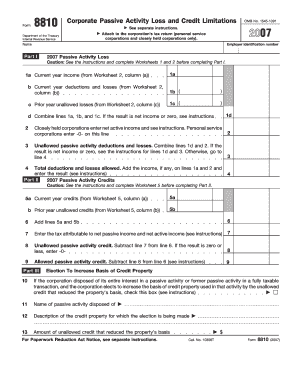

Form 8810, officially known as the Fill In Capable Corporate Passive Activity Loss and Credit Limitations, is a tax form used by corporations to report passive activity losses and credits. This form is essential for businesses that engage in activities where they do not materially participate, allowing them to calculate and claim allowable losses and credits. The IRS established this form to ensure that corporations accurately report their passive income and losses, which can significantly affect their overall tax liability.

Steps to Complete Form 8810

Completing Form 8810 involves several steps to ensure accuracy and compliance with IRS regulations. Start by gathering all necessary financial documents related to passive activities, including income statements and expense reports. Next, follow these steps:

- Enter the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Detail the passive activities in which the corporation is involved, including any income generated and losses incurred.

- Calculate the total passive activity loss and any credits that can be claimed.

- Review the instructions for any specific calculations required for your situation.

- Sign and date the form before submission.

Obtaining Form 8810

Form 8810 is readily available for download from the IRS website. It can also be obtained through various tax preparation software programs, which may offer guided assistance in filling it out. Additionally, tax professionals can provide the form and help ensure it is completed correctly, considering any specific circumstances related to the corporation's activities.

Legal Use of Form 8810

The legal use of Form 8810 is critical for corporations that wish to report passive activity losses and credits accurately. Properly completing and filing this form helps corporations comply with IRS regulations and avoid potential penalties. It is essential for businesses to understand the guidelines surrounding passive activities, as improper reporting can lead to audits or additional tax liabilities.

IRS Guidelines for Form 8810

The IRS provides specific guidelines regarding the use of Form 8810, including eligibility criteria for claiming passive activity losses. Corporations must ensure they meet the requirements outlined in IRS publications, which detail how to classify activities as passive and the limitations on losses and credits. Following these guidelines is crucial for maintaining compliance and maximizing potential tax benefits.

Filing Deadlines for Form 8810

Corporations must adhere to specific filing deadlines for Form 8810 to avoid penalties. Generally, the form is due on the same date as the corporation's income tax return, including extensions. It is important for businesses to keep track of these dates to ensure timely submission and to maintain compliance with IRS regulations.

Quick guide on how to complete form 8810 fill in capable corporate passive activity loss and credit limitations

Prepare [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it digitally. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with special tools that airSlate SignNow offers for this specific task.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Decide how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of missing or lost files, burdensome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from a device of your preference. Modify and eSign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8810 Fill In Capable Corporate Passive Activity Loss And Credit Limitations

Create this form in 5 minutes!

How to create an eSignature for the form 8810 fill in capable corporate passive activity loss and credit limitations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8810 Fill In Capable Corporate Passive Activity Loss And Credit Limitations?

Form 8810 is a crucial tax form that deals with corporate passive activity loss and credit limitations. It helps businesses accurately report their passive activities and ensure compliance with IRS regulations. Understanding this form is essential for corporations to avoid potential tax liabilities.

-

How does airSlate SignNow help with Form 8810?

airSlate SignNow streamlines the process of completing Form 8810 Fill In Capable Corporate Passive Activity Loss And Credit Limitations. Our solution provides templates and automated workflows to ensure that your filings are accurate and timely. This not only saves time but also reduces the risk of errors in submitting the form.

-

What features does airSlate SignNow offer for corporate tax forms?

airSlate SignNow offers a variety of features that assist with corporate tax forms, including e-signature capabilities, document templates, and secure storage. For Form 8810 Fill In Capable Corporate Passive Activity Loss And Credit Limitations, these tools ensure that businesses can efficiently prepare and submit their documents without hassle.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. Our pricing plans are competitive, making it accessible for those who need to manage forms such as the Form 8810 Fill In Capable Corporate Passive Activity Loss And Credit Limitations without straining their budgets.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax preparation software. This allows you to efficiently manage Form 8810 Fill In Capable Corporate Passive Activity Loss And Credit Limitations alongside other financial documents in a centralized platform.

-

What are the benefits of using airSlate SignNow for corporate tax documents?

Using airSlate SignNow for corporate tax documents, including Form 8810 Fill In Capable Corporate Passive Activity Loss And Credit Limitations, provides numerous benefits such as increased efficiency, enhanced security, and simplified collaboration. It allows you to automate workflows, track document status, and keep your sensitive information secure.

-

Does airSlate SignNow provide customer support for using Form 8810?

Yes, our customer support team is readily available to assist you with using Form 8810 Fill In Capable Corporate Passive Activity Loss And Credit Limitations through airSlate SignNow. Whether you have questions about features or need help navigating the platform, we offer extensive resources and dedicated support.

Get more for Form 8810 Fill In Capable Corporate Passive Activity Loss And Credit Limitations

Find out other Form 8810 Fill In Capable Corporate Passive Activity Loss And Credit Limitations

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist