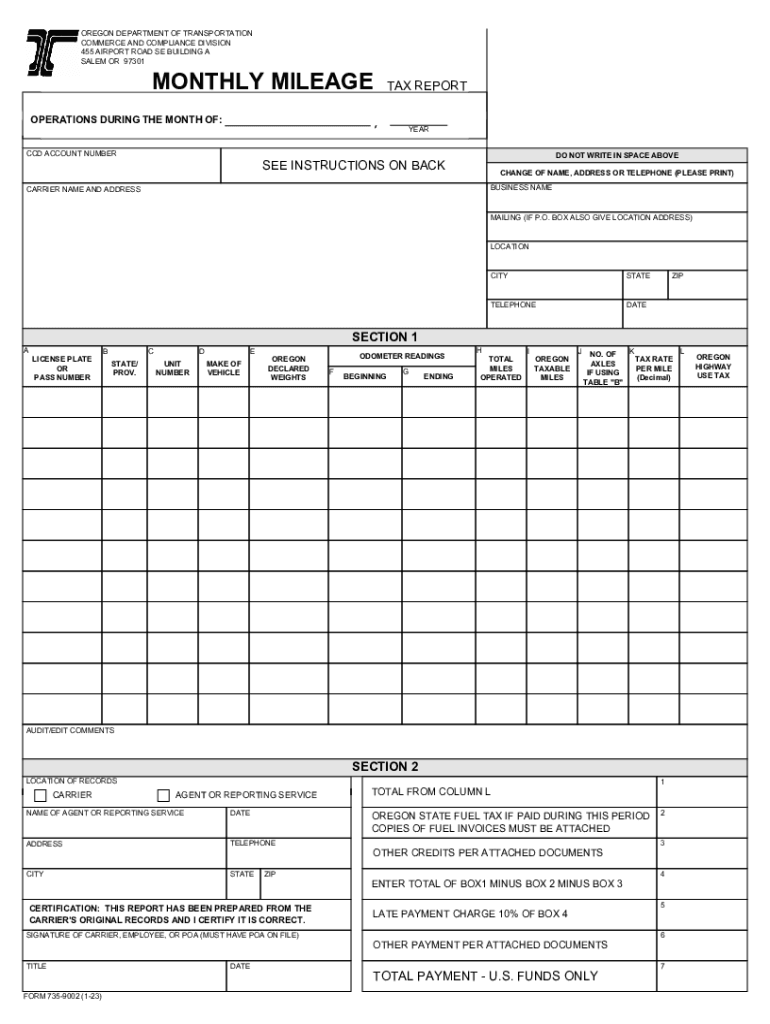

MONTHLY MILEAGE TAX REPORT 2023-2026

What is the monthly mileage tax report?

The monthly mileage tax report is a crucial document for individuals and businesses that track vehicle usage for tax purposes. This form provides a detailed account of miles driven for business-related activities, which can be essential for claiming deductions on tax returns. Understanding the specifics of this report is vital for ensuring compliance with IRS regulations and maximizing potential tax benefits.

Steps to complete the monthly mileage tax report

Completing the monthly mileage tax report involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant data, including the total miles driven for business, personal use, and commuting. Next, categorize the miles according to the purpose of each trip. It is important to maintain a clear record of dates, destinations, and the purpose of each journey. Once all data is compiled, enter the information into the form accurately, ensuring that all calculations are correct. Finally, review the completed report for any errors before submission.

Legal use of the monthly mileage tax report

The monthly mileage tax report serves as a legally recognized document when filed correctly. It is essential to adhere to IRS guidelines regarding the documentation of mileage to substantiate any claims made on tax returns. Properly maintaining and submitting this report can protect taxpayers during audits and ensure that they receive the deductions they are entitled to. Understanding the legal implications of this form reinforces the importance of accuracy and compliance in its completion.

IRS guidelines for the monthly mileage tax report

The IRS provides specific guidelines for completing the monthly mileage tax report, which include maintaining a detailed log of all business-related travel. Taxpayers must differentiate between business and personal miles, as only business miles are deductible. The IRS also recommends using a consistent method for calculating mileage, whether it be the standard mileage rate or actual expenses incurred. Familiarizing oneself with these guidelines is essential for ensuring that the report meets all necessary requirements for tax deductions.

Filing deadlines for the monthly mileage tax report

Filing deadlines for the monthly mileage tax report are essential to keep in mind to avoid penalties. Typically, this report should be submitted along with other tax documentation by the annual tax filing deadline, which is usually April fifteenth in the United States. However, some businesses may have different fiscal year deadlines. It is important to verify specific deadlines based on your business structure and tax obligations to ensure timely submission.

Examples of using the monthly mileage tax report

There are various scenarios in which the monthly mileage tax report can be utilized effectively. For instance, self-employed individuals can use the report to claim deductions for business trips, while employees who use their personal vehicles for work-related tasks may also benefit from documenting their mileage. Additionally, businesses that provide vehicles to employees can use this report to track usage and allocate expenses accurately. These examples highlight the versatility and importance of the monthly mileage tax report in different contexts.

Quick guide on how to complete monthly mileage tax report

Prepare MONTHLY MILEAGE TAX REPORT seamlessly on any device

Online document management has gained popularity among companies and individuals alike. It offers a fantastic eco-friendly substitute to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents promptly without delays. Manage MONTHLY MILEAGE TAX REPORT on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to alter and eSign MONTHLY MILEAGE TAX REPORT effortlessly

- Locate MONTHLY MILEAGE TAX REPORT and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Edit and eSign MONTHLY MILEAGE TAX REPORT and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct monthly mileage tax report

Create this form in 5 minutes!

How to create an eSignature for the monthly mileage tax report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the '2014 or 7359002' plan offered by airSlate SignNow?

The '2014 or 7359002' plan is designed for businesses seeking a comprehensive eSignature solution. This plan offers robust features for document management and electronic signing while ensuring ease of use and affordability. With this plan, users can streamline their workflow signNowly.

-

How does the pricing for the '2014 or 7359002' plan compare to other eSignature solutions?

The '2014 or 7359002' plan is competitively priced, making it one of the most cost-effective options in the market. Users will find that it offers signNow value with its extensive features for document signing and management. Typically, clients save money while gaining efficiency.

-

What features are included in the '2014 or 7359002' plan?

The '2014 or 7359002' plan includes key features such as customizable templates, multi-user support, and enhanced security options. These features empower businesses to manage their eSigning processes seamlessly. Additionally, document tracking and mobile access ensure convenience.

-

What benefits does airSlate SignNow provide with the '2014 or 7359002' plan?

The primary benefit of the '2014 or 7359002' plan is its ability to simplify the document signing process, reducing turnaround time. Furthermore, users can integrate it with various platforms, enhancing workflow efficiency. This results in increased productivity and better customer satisfaction.

-

Can the '2014 or 7359002' plan integrate with other software?

Yes, the '2014 or 7359002' plan supports integrations with numerous software solutions, such as CRM and document management systems. This flexibility allows businesses to incorporate eSigning into their existing processes smoothly. Seamless integration is vital for enhancing overall efficiency.

-

Is there a mobile app for the '2014 or 7359002' plan?

Absolutely, airSlate SignNow offers a mobile app for users on the '2014 or 7359002' plan. The app enables users to manage and eSign documents on the go, ensuring that business operations remain efficient regardless of location. This mobile capability is essential for today's fast-paced work environment.

-

What support options are available for the '2014 or 7359002' users?

Users of the '2014 or 7359002' plan have access to dedicated customer support via various channels, including live chat and email. Additionally, comprehensive resources like FAQs and tutorials are available to assist with any inquiries. This support ensures a smooth user experience.

Get more for MONTHLY MILEAGE TAX REPORT

- State of michigan court forms jc02

- Ho to add parents as joint tenants with full right of survivorship form

- Hmrc sa106 form

- Housing questionnaire form

- Cigna injectables form

- Guide supplement to magazine form

- Employee personal deduction authorization form client sheakley

- Mortgage purchase agreement template form

Find out other MONTHLY MILEAGE TAX REPORT

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online