Form 13614 T Rev January Fill in Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET

What is the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET

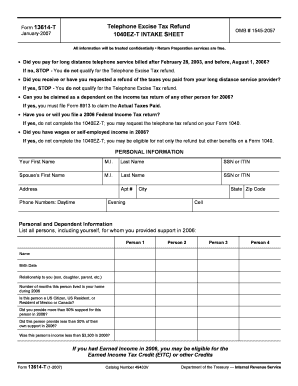

The Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET is a specific document used by taxpayers in the United States to facilitate the process of claiming a telephone excise tax refund. This form is designed to gather essential information about the taxpayer, including personal identification details, income sources, and the specific amounts eligible for refund. It serves as a crucial tool for ensuring accurate and efficient processing of claims related to telephone excise taxes that may have been overpaid in previous years.

How to use the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET

Using the Form 13614 T involves several straightforward steps. First, taxpayers need to download or obtain the form from an authorized source. Once in possession of the form, individuals should carefully fill out all required fields, ensuring that all personal and financial information is accurate. After completing the form, it is important to review the information for any errors before submission. The completed form can then be submitted through the appropriate channels, either online or via mail, depending on the submission guidelines provided by the IRS.

Steps to complete the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET

Completing the Form 13614 T requires careful attention to detail. Here are the steps to follow:

- Start by downloading the form from the IRS website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your income, ensuring to include all relevant sources.

- Calculate the total amount of telephone excise tax you believe you are eligible to refund.

- Double-check all entries for accuracy before signing and dating the form.

- Submit the form according to the IRS guidelines, either electronically or by mail.

Eligibility Criteria

To be eligible for a refund using the Form 13614 T, taxpayers must meet specific criteria set by the IRS. Generally, individuals who paid telephone excise taxes on long-distance calls during the applicable periods are eligible to claim a refund. It is essential to have documentation that supports the claim, such as billing statements or receipts. Additionally, the taxpayer must ensure they have not previously claimed a refund for the same tax amount in prior filings.

Required Documents

When preparing to submit the Form 13614 T, several documents may be required to support the claim. These typically include:

- Copies of telephone bills showing the excise tax charged.

- Proof of payment for the taxes claimed.

- Any prior correspondence with the IRS regarding telephone excise tax issues.

Having these documents ready can help streamline the filing process and ensure that the claim is processed without unnecessary delays.

Form Submission Methods

The Form 13614 T can be submitted through various methods, allowing flexibility for taxpayers. Common submission methods include:

- Online submission via the IRS e-file system, which is often the fastest option.

- Mailing the completed form to the designated IRS address for tax refunds.

- In-person submission at local IRS offices, if applicable.

Each method has its own processing times and requirements, so it is advisable to choose the one that best fits the taxpayer's needs.

Quick guide on how to complete form 13614 t rev january fill in capable telephone excise tax refund 1040ez t intake sheet

Easily Create [SKS] on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

How to Alter and Electronically Sign [SKS] Effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight signNow sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET

Create this form in 5 minutes!

How to create an eSignature for the form 13614 t rev january fill in capable telephone excise tax refund 1040ez t intake sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET?

The Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET is a crucial document for taxpayers looking to claim refunds on telephone excise taxes. This form simplifies the process of providing necessary information for tax preparations. It is specifically designed to facilitate a seamless filing experience for individuals using Form 1040EZ.

-

How can I fill out the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET using airSlate SignNow?

AirSlate SignNow offers an easy-to-use digital platform to fill out the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET. Users can simply upload the form, fill in the required fields electronically, and save their work securely. This not only streamlines the completion process but also ensures your submissions are accurate and timely.

-

Is there any cost associated with using airSlate SignNow for the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET?

AirSlate SignNow provides very competitive pricing options that cater to a variety of users, from individuals to businesses. Users benefit from a free trial to explore features before committing to a subscription plan. Pricing for premium features that support the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET is designed to be cost-effective for everyone.

-

What features does airSlate SignNow offer for the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET?

AirSlate SignNow provides a range of features tailored to enhance the completion of the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET. Users can access templates, electronic signatures, and document management tools. These features promote efficiency and ensure that users can submit their tax forms accurately and without hassle.

-

How does airSlate SignNow ensure the security of my Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and secure cloud storage to protect your Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET and other documents. This commitment to security gives users peace of mind that their sensitive information is safe throughout the document signing process.

-

Can I integrate airSlate SignNow with other software while using the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET?

Yes, airSlate SignNow offers numerous integrations with popular business applications, enabling seamless workflow enhancements. This integration capability allows users to manage their Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET alongside other tools they already use, increasing efficiency and productivity. The platform supports various APIs, making it versatile for diverse business needs.

-

What are the benefits of using airSlate SignNow for filing the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET?

Using airSlate SignNow for the Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET offers numerous benefits, including simplified document handling, faster processing times, and cost savings. The electronic signing feature eliminates the need for printing and scanning, speeding up the submission process. Overall, it enhances accuracy while reducing the stress of tax preparation.

Get more for Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET

Find out other Form 13614 T Rev January Fill In Capable Telephone Excise Tax Refund 1040EZ T INTAKE SHEET

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online