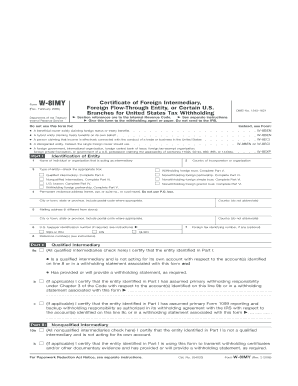

Form W 8IMY Rev February Fill in Capable Certificate of Foreign Intermediary, Foreign Flow through Entity, or Certain U S Branch

Understanding the Form W-8IMY

The Form W-8IMY is a crucial document for foreign intermediaries, foreign flow-through entities, and certain U.S. branches. It serves as a certificate for U.S. tax withholding purposes, ensuring that the correct amount of tax is withheld from payments made to foreign entities. This form is primarily used to claim a reduced rate of withholding under an applicable tax treaty or to certify that the entity is not subject to U.S. taxation. Understanding its purpose is essential for compliance with U.S. tax laws.

How to Complete the Form W-8IMY

Completing the Form W-8IMY requires careful attention to detail. The form consists of several sections that must be filled out accurately to avoid delays or issues with tax withholding. Key sections include identifying information about the foreign entity, the type of entity, and the applicable tax treaty benefits. Each section must be completed based on the specific circumstances of the entity, ensuring that all information is current and correct.

Obtaining the Form W-8IMY

The Form W-8IMY can be obtained directly from the Internal Revenue Service (IRS) website. It is available as a downloadable PDF, which can be printed and filled out manually or completed electronically using compatible software. It is important to ensure that you are using the most current version of the form, as updates may affect the information required for completion.

Key Elements of the Form W-8IMY

Several key elements must be included when completing the Form W-8IMY. These include:

- Entity Information: Name, address, and country of incorporation.

- Type of Entity: Specify whether the entity is a foreign intermediary, foreign flow-through entity, or a certain U.S. branch.

- Tax Treaty Benefits: Information regarding any applicable tax treaties that may reduce withholding rates.

- Certification: Signature of an authorized representative certifying the accuracy of the information provided.

Filing Deadlines for the Form W-8IMY

Filing deadlines for the Form W-8IMY are essential to ensure compliance with U.S. tax regulations. Generally, the form should be submitted before any payments are made to the foreign entity. If there are changes in the entity's status or information, an updated form must be submitted promptly to avoid incorrect withholding. It is advisable to keep track of any relevant deadlines to ensure timely submission.

Penalties for Non-Compliance

Failure to submit the Form W-8IMY or providing inaccurate information can result in significant penalties. The IRS may impose a higher withholding tax rate on payments made to the foreign entity if the form is not filed correctly. Additionally, there may be fines for failing to comply with U.S. tax laws. It is important for entities to understand these risks and ensure that all forms are completed and submitted accurately.

Quick guide on how to complete form w 8imy rev february fill in capable certificate of foreign intermediary foreign flow through entity or certain u s

Complete [SKS] effortlessly on any device

Online document administration has become increasingly favored by both businesses and individuals. It offers a wonderful eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest method to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to save your adjustments.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form W 8IMY Rev February Fill In Capable Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U S Branch

Create this form in 5 minutes!

How to create an eSignature for the form w 8imy rev february fill in capable certificate of foreign intermediary foreign flow through entity or certain u s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Form W 8IMY Rev February Fill In Capable Certificate?

The Form W 8IMY Rev February Fill In Capable Certificate of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U S Branches For United States Tax Withholding is designed to help foreign entities signNow their status for tax withholding purposes. By submitting this form, entities can establish eligibility for reduced withholding rates on U.S. source income, ensuring compliance with IRS regulations.

-

How can airSlate SignNow assist with filling out the Form W 8IMY?

airSlate SignNow offers a user-friendly platform that simplifies the completion of the Form W 8IMY Rev February Fill In Capable Certificate. With easy-to-use tools, businesses can electronically fill in and eSign the form, streamlining the process and reducing errors while ensuring adherence to IRS requirements.

-

Is there a cost associated with using airSlate SignNow for the Form W 8IMY?

Yes, airSlate SignNow provides a cost-effective solution for electronic document management, including the Form W 8IMY Rev February Fill In Capable Certificate. Pricing plans vary based on features and usage, allowing businesses to choose a plan that best fits their needs and budget.

-

What features does airSlate SignNow offer for the Form W 8IMY?

airSlate SignNow includes multiple features tailored for seamless completion and management of the Form W 8IMY Rev February Fill In Capable Certificate. These features include template creation, collaborative editing, secure storage, and tracking capabilities to ensure that documents are completed efficiently and accurately.

-

Can I integrate airSlate SignNow with other applications for managing Form W 8IMY?

Absolutely! airSlate SignNow supports integrations with various applications, enabling efficient workflows for managing the Form W 8IMY Rev February Fill In Capable Certificate. This integration allows businesses to connect their existing systems and streamline the document signing and management process.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents like the Form W 8IMY Rev February Fill In Capable Certificate provides numerous benefits, including increased efficiency, reduced paper waste, and enhanced security. The platform’s compliance with legal standards protects your data while facilitating faster transaction times.

-

How is user data security handled with airSlate SignNow when using Form W 8IMY?

airSlate SignNow prioritizes user data security by employing advanced encryption methods and secure storage solutions. When dealing with sensitive information, such as that on the Form W 8IMY Rev February Fill In Capable Certificate, businesses can trust that their data is protected against unauthorized access.

Get more for Form W 8IMY Rev February Fill In Capable Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U S Branch

Find out other Form W 8IMY Rev February Fill In Capable Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U S Branch

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors