Notice 746 Rev July Information About Your Notice, Penalty and Interest

Understanding Notice 746 Rev July

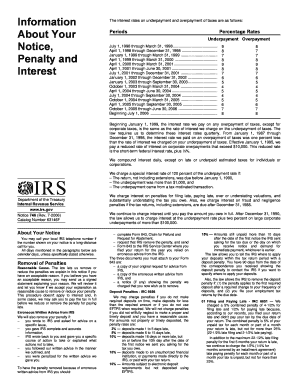

Notice 746 Rev July provides essential information regarding your tax notice, penalties, and interest that may apply to your tax situation. This document is typically issued by the Internal Revenue Service (IRS) and outlines the reasons for any penalties or interest assessed on your account. It serves as a notification for taxpayers, detailing the specific tax periods affected and the amounts due. Understanding this notice is crucial for ensuring compliance with tax obligations and addressing any discrepancies in a timely manner.

How to Utilize Notice 746 Rev July

To effectively use Notice 746 Rev July, carefully review the information contained within the document. Pay attention to the details regarding the penalties and interest, as well as the actions required on your part. If the notice indicates that you owe additional taxes, ensure that you gather all relevant documentation to support your case. This may include previous tax returns, payment records, and any correspondence with the IRS. By organizing your information, you can respond appropriately and resolve any issues efficiently.

Obtaining Notice 746 Rev July

If you have not received Notice 746 Rev July but believe you should have, you can obtain a copy by contacting the IRS directly. It is advisable to have your taxpayer identification number and relevant personal information on hand when making this request. Additionally, you can access your tax records through the IRS website, which may provide the notice in digital format. Ensure that you keep a copy for your records once you receive it.

Key Components of Notice 746 Rev July

Notice 746 Rev July includes several key components that are important for taxpayers to understand:

- Tax Periods: The notice specifies the tax years affected by the penalties or interest.

- Amounts Due: It outlines the total amount owed, including any penalties and interest accrued.

- Reason for Penalties: The notice explains why the penalties were assessed, which may include late payments or underreporting of income.

- Payment Instructions: Clear instructions on how to pay the owed amounts are provided, including acceptable payment methods.

Consequences of Non-Compliance with Notice 746 Rev July

Failing to comply with the requirements outlined in Notice 746 Rev July can lead to further penalties and interest, compounding your tax liability. The IRS may take additional actions, such as placing a lien on your property or garnishing wages, if the amounts owed are not addressed. It is essential to respond promptly to the notice and take the necessary steps to resolve any outstanding issues to avoid these severe consequences.

IRS Guidelines Related to Notice 746 Rev July

The IRS provides specific guidelines regarding how to handle notices like Notice 746 Rev July. Taxpayers are encouraged to review the IRS website for resources that explain their rights and responsibilities. Additionally, the IRS offers guidance on how to dispute any inaccuracies in the notice. Familiarizing yourself with these guidelines can empower you to take informed action regarding your tax situation.

Quick guide on how to complete notice 746 rev july information about your notice penalty and interest

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow offers all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage [SKS] on any platform with the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

How to edit and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and electronically sign [SKS] and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Notice 746 Rev July Information About Your Notice, Penalty And Interest

Create this form in 5 minutes!

How to create an eSignature for the notice 746 rev july information about your notice penalty and interest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Notice 746 Rev July Information About Your Notice, Penalty And Interest?

Notice 746 Rev July Information About Your Notice, Penalty And Interest is a document issued by the IRS that explains your tax situation, including any penalties and interest incurred. It's crucial for understanding the implications of your tax obligations and making informed decisions. This notice helps taxpayers navigate their responsibilities effectively.

-

How can airSlate SignNow help in managing my Notice 746 Rev July?

airSlate SignNow provides an efficient platform to electronically sign and manage your documents related to the Notice 746 Rev July Information About Your Notice, Penalty And Interest. With our solution, you can quickly upload your notice and securely sign documents, ensuring compliance with IRS requirements. This streamlined process saves time and reduces paperwork.

-

Is airSlate SignNow affordable for small businesses dealing with Notice 746 Rev July?

Yes, airSlate SignNow offers competitive pricing plans that are suitable for small businesses facing issues related to Notice 746 Rev July Information About Your Notice, Penalty And Interest. The cost-effective solution is designed to provide value without breaking the budget. We believe in empowering businesses with tools that enhance productivity while being financially feasible.

-

What features does airSlate SignNow offer for tax documents like Notice 746 Rev July?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and advanced eSignature capabilities tailored for tax documents like the Notice 746 Rev July Information About Your Notice, Penalty And Interest. These features ensure that your documents are not only compliant but also easily accessible from anywhere. Efficiency and security are at the forefront of our offering.

-

Can I integrate airSlate SignNow with other software I use for tax management?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, enhancing your ability to manage documents related to Notice 746 Rev July Information About Your Notice, Penalty And Interest. Whether you use accounting software or CRM systems, our integrations allow for a cohesive workflow, making document management easier and more efficient.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow to manage tax-related documents, such as the Notice 746 Rev July Information About Your Notice, Penalty And Interest, offers several benefits including enhanced security, faster turnaround times, and less reliance on physical paperwork. Our platform enables you to track the signing process in real-time and ensures that your documents are securely stored. This simplifies your overall tax management experience.

-

How secure is airSlate SignNow when dealing with sensitive documents like Notice 746 Rev July?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents such as the Notice 746 Rev July Information About Your Notice, Penalty And Interest. We implement advanced security measures including end-to-end encryption and compliance with industry standards. This ensures that your documents remain confidential and are protected throughout the signing process.

Get more for Notice 746 Rev July Information About Your Notice, Penalty And Interest

Find out other Notice 746 Rev July Information About Your Notice, Penalty And Interest

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document