Sbi Car Loan Form Filling

Understanding the SBI Car Loan Form Filling

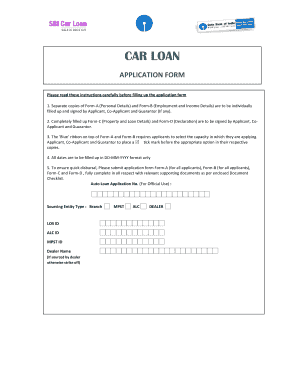

The SBI car loan form is a crucial document for individuals seeking financing to purchase a vehicle. This form captures essential information about the applicant, including personal details, employment status, financial information, and the specifics of the vehicle being financed. Filling out this form accurately is vital, as it determines eligibility for the loan and influences the approval process.

Steps to Complete the SBI Car Loan Form Filling

Completing the SBI car loan form involves several steps to ensure that all necessary information is provided correctly. Start by gathering required documents such as proof of identity, income statements, and vehicle details. Next, fill in personal information, including your name, address, and contact details. Provide financial details, including your monthly income and existing liabilities. Finally, review the form for accuracy before submission. This thorough approach helps streamline the approval process.

Required Documents for the SBI Car Loan Form

When filling out the SBI car loan form, certain documents are required to support your application. These typically include:

- Proof of identity (e.g., driver's license, passport)

- Proof of address (e.g., utility bill, lease agreement)

- Income proof (e.g., salary slips, tax returns)

- Bank statements for the last three to six months

- Details of the vehicle (e.g., make, model, registration number)

Having these documents ready can expedite the loan application process.

Legal Use of the SBI Car Loan Form Filling

The SBI car loan form is legally binding once submitted, provided it is filled out correctly and signed. Electronic signatures are accepted, ensuring that the form meets legal standards for authenticity and security. Compliance with regulations such as the ESIGN Act and UETA is essential for the form to be recognized in legal proceedings. Therefore, using a reliable digital signing solution can enhance the form's validity.

How to Obtain the SBI Car Loan Form Filling

The SBI car loan form can be obtained through various channels. It is available for download from the official SBI website, where applicants can access the latest version of the form in PDF format. Additionally, physical copies can be requested at SBI branches. Using the online option allows for easy access and the convenience of filling out the form digitally.

Digital vs. Paper Version of the SBI Car Loan Form

Both digital and paper versions of the SBI car loan form serve the same purpose, but they differ in terms of convenience and processing speed. The digital form allows for easier editing, electronic submission, and faster processing times. In contrast, the paper version requires physical mailing or in-person submission, which may delay the approval process. Choosing the digital option can enhance efficiency for applicants.

Quick guide on how to complete sbi car loan form filling

Complete Sbi Car Loan Form Filling effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Sbi Car Loan Form Filling on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to modify and eSign Sbi Car Loan Form Filling with ease

- Locate Sbi Car Loan Form Filling and click Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Sbi Car Loan Form Filling and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sbi car loan form filling

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SBI car loan form download process?

To download the SBI car loan form, visit the official SBI website, navigate to the loans section, and select the car loan option. From there, you can easily find and download the required form. Ensure you have the latest version of the form for a smooth application process.

-

Is the SBI car loan form download free?

Yes, the SBI car loan form download is free of charge. You can access and download the form without any fees, making it easy for potential borrowers to begin their car loan application process without additional costs.

-

What documents are required to submit with the SBI car loan form?

Along with the SBI car loan form download, you will need to submit several documents, including proof of identity, income statements, and residence proof. Make sure all documents are current and accurately reflect your information to avoid any processing delays.

-

Can I fill out the SBI car loan form online?

The SBI car loan form is typically downloaded for manual completion; however, some applicants may be able to fill it out digitally depending on SBI's current online services. Always check the SBI website for the latest updates on digital submission options for greater convenience.

-

What is the benefit of using the SBI car loan form download?

The main benefit of the SBI car loan form download is that it provides a quick and easy way to initiate your car loan application. By downloading and completing this form, you can streamline the process and ensure that your application is reviewed promptly.

-

How long does it take to process the SBI car loan form?

Processing times for the SBI car loan form can vary based on several factors, including documentation completeness and loan demand. Typically, once submitted, you may receive an initial response within a few business days, but it's advisable to check with your local SBI branch for specific timelines.

-

What features are included with SBI car loans?

SBI car loans come with various features such as competitive interest rates, flexible repayment options, and the ability to borrow up to a certain percentage of the car's value. Additionally, using the SBI car loan form download is the first step to accessing these benefits quickly and efficiently.

Get more for Sbi Car Loan Form Filling

- Pain management follow up form

- Tibial nail ex inventory form

- Sales action plan form

- Flag football registration form vandyschools org

- Kent county animal shelter dog adoption survey form

- Golf sponsorship registration form additional sponsorships

- Softball tournament sponsorship commitment form

- Hurley foundation grant program hurleyfoundation form

Find out other Sbi Car Loan Form Filling

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile