Form 943A PR Rev June

What is the Form 943A PR Rev June

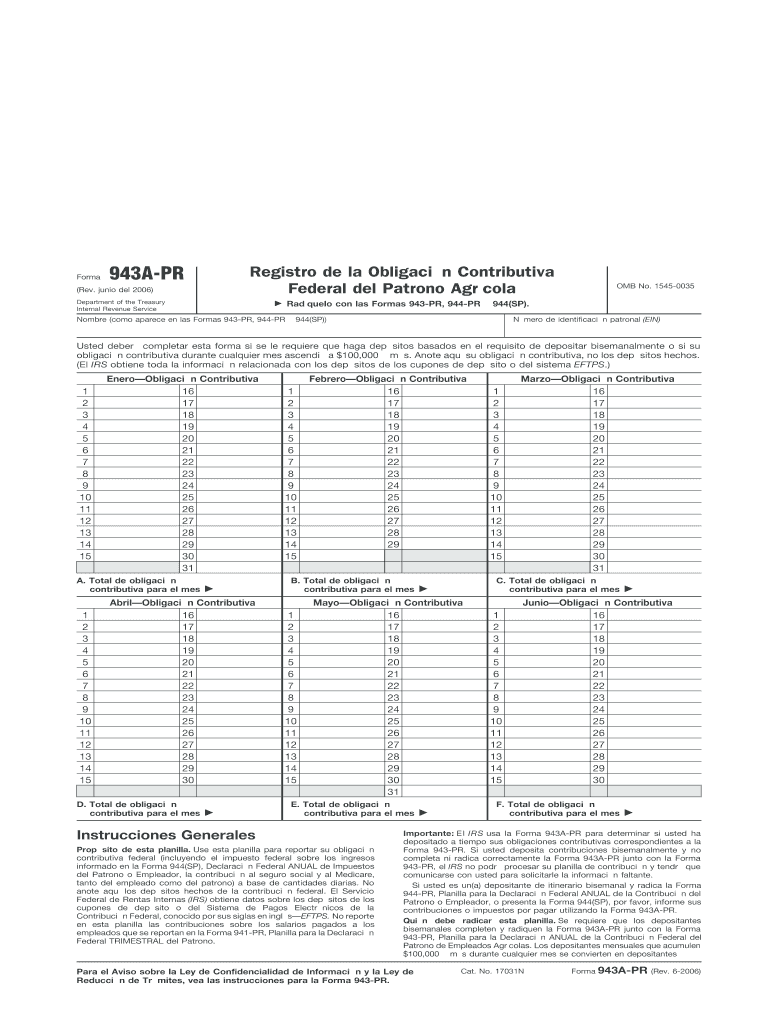

The Form 943A PR Rev June is a specific tax form used by employers in Puerto Rico to report and pay federal income tax withheld from employees' wages. This form is essential for businesses operating in Puerto Rico, as it helps ensure compliance with federal tax regulations. It is particularly relevant for employers who are required to withhold income taxes from their employees and report these amounts to the Internal Revenue Service (IRS).

How to use the Form 943A PR Rev June

To effectively use the Form 943A PR Rev June, employers need to accurately fill out the form with the required information regarding employee wages and the corresponding tax withheld. This includes entering details such as the total wages paid, the amount of federal income tax withheld, and any adjustments necessary for the reporting period. Proper completion of the form ensures that the employer meets their tax obligations and avoids potential penalties.

Steps to complete the Form 943A PR Rev June

Completing the Form 943A PR Rev June involves several key steps:

- Gather necessary information, including employee wage records and tax withholding amounts.

- Fill in the employer's identification information at the top of the form.

- Report total wages paid to employees during the reporting period.

- Calculate and enter the total federal income tax withheld.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Form 943A PR Rev June to avoid penalties. The form is typically due on or before January 31 of the year following the reporting period. It is crucial for employers to stay informed about any changes to these deadlines, as they may vary based on IRS announcements or updates to tax regulations.

Legal use of the Form 943A PR Rev June

The Form 943A PR Rev June is legally mandated for employers in Puerto Rico who withhold federal income tax from their employees' wages. Proper use of this form ensures compliance with federal tax laws and regulations, helping employers avoid legal issues and penalties associated with incorrect or late filings. Understanding the legal requirements surrounding this form is essential for maintaining good standing with tax authorities.

Key elements of the Form 943A PR Rev June

Key elements of the Form 943A PR Rev June include:

- Employer identification information, including the Employer Identification Number (EIN).

- Total wages paid to employees during the reporting period.

- Total federal income tax withheld from employees' wages.

- Signature of the employer or authorized representative, certifying the accuracy of the information provided.

Quick guide on how to complete form 943a pr rev june

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest way to alter and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 943A PR Rev June

Create this form in 5 minutes!

How to create an eSignature for the form 943a pr rev june

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 943A PR Rev June?

Form 943A PR Rev June is a specific form used by employers in Puerto Rico to report and pay federal income tax withholding on agricultural wages. It is essential for businesses to manage their tax obligations effectively. Understanding this form is crucial for compliance with IRS regulations.

-

How can airSlate SignNow assist with Form 943A PR Rev June?

airSlate SignNow provides a seamless platform for businesses to fill, sign, and manage Form 943A PR Rev June digitally. This not only saves time but also reduces the chances of errors that might arise with manual processing. Our solution ensures that your forms are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for Form 943A PR Rev June?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs. The cost of using our platform for Form 943A PR Rev June is competitive and reflects the value of streamlining your document signing and management processes. Additionally, we provide a free trial to help users explore all features.

-

What features does airSlate SignNow offer for handling Form 943A PR Rev June?

airSlate SignNow includes features like customizable templates, automatic reminders, and secure eSignatures tailored for Form 943A PR Rev June. Users can also track document status in real-time, ensuring that important tax documents are processed in a timely manner. This enhances overall workflow efficiency.

-

Can I integrate airSlate SignNow with other applications for managing Form 943A PR Rev June?

Absolutely! airSlate SignNow offers integrations with various applications such as CRM and accounting software, which can streamline the process of managing Form 943A PR Rev June. This helps ensure all relevant data is centralized and easily accessible, improving your document management process.

-

What are the benefits of eSigning Form 943A PR Rev June through airSlate SignNow?

ESigning Form 943A PR Rev June through airSlate SignNow ensures a faster turnaround time and enhances security. With our platform, you can also reduce paper waste and administrative burden, allowing your team to focus on more strategic tasks. It's a modern solution for efficient document handling.

-

How secure is airSlate SignNow when submitting Form 943A PR Rev June?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive forms like Form 943A PR Rev June. We employ advanced encryption and security protocols to protect your data at every step of the process. Compliance with industry standards ensures that your information remains confidential and secure.

Get more for Form 943A PR Rev June

Find out other Form 943A PR Rev June

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple