Schedule J Form 1041 Accumulation Distribution for Certain Complex Trusts 2024-2026

What is the Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts

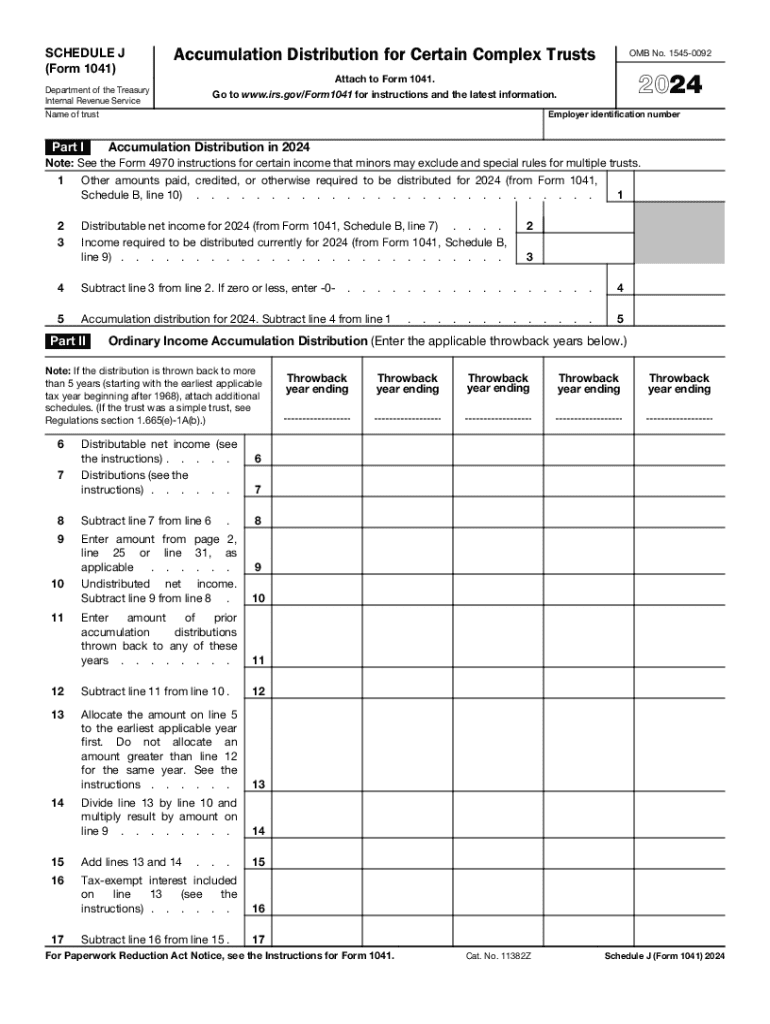

The Schedule J Form 1041 is a tax form used by certain complex trusts in the United States to report accumulation distributions. This form is essential for trusts that have accumulated income rather than distributing it to beneficiaries during the tax year. The form helps determine the tax implications of these distributions, ensuring compliance with IRS regulations. It allows trustees to calculate the amount of income that beneficiaries will be taxed on when distributions are made in future years.

How to use the Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts

Using the Schedule J Form 1041 involves several steps. First, trustees must gather all relevant financial information regarding the trust's income and distributions. The form requires detailed reporting of the trust's income, deductions, and distributions to beneficiaries. It is important to accurately complete the form to reflect the trust's financial activities. Once completed, the form should be attached to the Form 1041, which is the main tax return for estates and trusts, and submitted to the IRS.

Steps to complete the Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts

Completing the Schedule J Form 1041 involves a systematic approach:

- Collect all necessary financial documents related to the trust's income and distributions.

- Fill out the form by entering the total income of the trust and any deductions that apply.

- Calculate the amount of accumulated income that will be distributed to beneficiaries.

- Ensure that all figures are accurate and reflect the trust's financial situation.

- Attach the completed Schedule J to the Form 1041 and submit it to the IRS by the deadline.

Key elements of the Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts

The Schedule J Form 1041 includes several key elements that are crucial for accurate reporting. These elements consist of:

- Income Reporting: The form requires a detailed account of the trust's income sources.

- Deductions: Trustees must list any applicable deductions that can reduce the taxable income of the trust.

- Distribution Information: The form must clearly indicate how much income is being accumulated versus distributed to beneficiaries.

- Tax Implications: It is important to understand the tax consequences of accumulated distributions for both the trust and the beneficiaries.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule J Form 1041. These guidelines outline the necessary information that must be reported, including the definitions of accumulation distributions and the tax treatment of such distributions. Trustees should refer to the IRS instructions for the Schedule J to ensure compliance with all reporting requirements. Understanding these guidelines is essential for accurate tax reporting and avoiding potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule J Form 1041 are aligned with the general filing deadlines for Form 1041. Typically, the due date for the Form 1041 is the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this means the form is due by April fifteenth. It is crucial for trustees to be aware of these deadlines to avoid late fees and penalties associated with late submissions.

Create this form in 5 minutes or less

Find and fill out the correct schedule j form 1041 accumulation distribution for certain complex trusts

Create this form in 5 minutes!

How to create an eSignature for the schedule j form 1041 accumulation distribution for certain complex trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts?

The Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts is a tax form used to report distributions made by complex trusts. It helps in calculating the income tax owed on accumulated income that is distributed to beneficiaries. Understanding this form is crucial for trustees to ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with the Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts?

airSlate SignNow provides a streamlined platform for preparing and eSigning the Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts. Our solution simplifies document management, allowing users to easily fill out, sign, and send forms securely. This efficiency helps ensure timely compliance with tax obligations.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling the Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts. Our plans are cost-effective, providing access to essential features without breaking the bank. You can choose from monthly or annual subscriptions based on your usage requirements.

-

What features does airSlate SignNow offer for managing tax documents?

With airSlate SignNow, users can enjoy features such as customizable templates, secure eSigning, and document tracking. These tools are particularly beneficial for managing the Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts, ensuring that all necessary steps are completed efficiently. Additionally, our platform supports collaboration among team members for enhanced productivity.

-

Is airSlate SignNow compliant with legal standards for tax documents?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures and document management. This compliance is crucial when dealing with sensitive forms like the Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts. Our platform adheres to industry regulations, ensuring that your documents are legally binding and secure.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax preparation software. This capability allows users to efficiently manage the Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts alongside their existing tools, streamlining the entire tax preparation process.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform reduces the risk of errors and ensures that documents are processed quickly. This efficiency allows businesses to focus on their core operations while staying compliant with tax regulations.

Get more for Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts

- Employment application spudnik equipment company spudnik form

- Ri affidavit 28 33 form

- Beneficiary designation for a motor vehicle form

- Spider are not insects as many people believe form

- Application for canpass remote area border ntier form

- The illinois state treasurers office connects people with their cash icash illinois form

- Dr zegarelli form

- Partnership declaration form

Find out other Schedule J Form 1041 Accumulation Distribution For Certain Complex Trusts

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure