Form 8804 W Worksheet Fill in Version

What is the Form 8804 W Worksheet Fill In Version

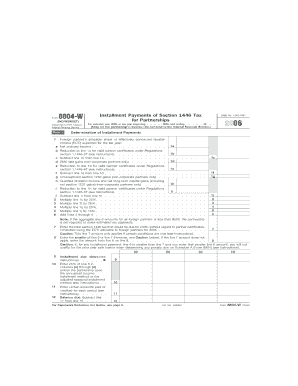

The Form 8804 W Worksheet Fill In Version is a tax document used by partnerships to calculate their withholding tax obligations on effectively connected income allocable to foreign partners. This form assists in determining the amount of tax required to be withheld and reported to the IRS. It is specifically designed for partnerships that are required to file Form 8804, which reports the partnership's withholding tax liability.

How to use the Form 8804 W Worksheet Fill In Version

To effectively use the Form 8804 W Worksheet Fill In Version, partnerships should first gather all necessary financial information regarding income and distributions to foreign partners. The worksheet guides users through calculations needed to determine the withholding tax amount. Each section of the form corresponds to specific income types and deductions, ensuring accurate reporting. Users should carefully follow the instructions provided on the form to ensure compliance with IRS requirements.

Steps to complete the Form 8804 W Worksheet Fill In Version

Completing the Form 8804 W Worksheet Fill In Version involves several key steps:

- Gather all relevant financial documents, including partnership income statements and details of distributions to foreign partners.

- Fill in the partnership's identifying information, such as name, address, and Employer Identification Number (EIN).

- Calculate the total effectively connected income and any applicable deductions.

- Determine the appropriate withholding tax rate based on the type of income and the residency status of the partners.

- Complete the worksheet by entering the calculated amounts in the designated fields.

- Review all entries for accuracy before finalizing the form.

Filing Deadlines / Important Dates

Partnerships must adhere to specific deadlines when filing the Form 8804 W Worksheet Fill In Version. Generally, the form should be filed on or before the due date of the partnership's tax return, which is typically March 15 for calendar-year partnerships. If the partnership is granted an extension, the filing deadline may be extended accordingly. It is crucial to stay informed about any changes to tax deadlines to avoid penalties.

Key elements of the Form 8804 W Worksheet Fill In Version

The Form 8804 W Worksheet Fill In Version includes several key elements that are essential for accurate tax reporting:

- Partnership Information: Includes the name, address, and EIN of the partnership.

- Income Calculation: Sections for reporting effectively connected income and deductions.

- Withholding Tax Rate: Information on applicable rates based on partner residency status.

- Final Tax Amount: The total withholding tax amount calculated based on the provided information.

Legal use of the Form 8804 W Worksheet Fill In Version

The Form 8804 W Worksheet Fill In Version is legally required for partnerships that have foreign partners and need to comply with U.S. tax withholding regulations. Failure to accurately complete and file this form can result in penalties and interest on unpaid taxes. It is important for partnerships to understand their obligations under U.S. tax law and to use the worksheet as a tool for ensuring compliance.

Quick guide on how to complete form 8804 w worksheet fill in version

Complete [SKS] effortlessly on any device

Online document management has gained traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your paperwork quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign [SKS] with minimal effort

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from whichever device you prefer. Edit and eSign [SKS] and ensure effective communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8804 W Worksheet Fill In Version

Create this form in 5 minutes!

How to create an eSignature for the form 8804 w worksheet fill in version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8804 W Worksheet Fill In Version?

The Form 8804 W Worksheet Fill In Version is a tool designed to help taxpayers calculate the estimated tax liabilities for their foreign partners. This version allows for easy data entry and ensures that all necessary calculations are performed efficiently. By utilizing the Form 8804 W Worksheet Fill In Version, users can streamline their tax preparation process.

-

How does the Form 8804 W Worksheet Fill In Version work?

The Form 8804 W Worksheet Fill In Version works by providing users with a structured framework for inputting data related to foreign partners. Once the required information is entered, the tool automatically calculates the estimated tax amounts owed. This user-friendly format minimizes the risk of errors and saves time during tax preparation.

-

Can I integrate the Form 8804 W Worksheet Fill In Version with other software?

Yes, the Form 8804 W Worksheet Fill In Version can be integrated with various accounting and tax software platforms. This integration facilitates smoother data transfers and ensures that your tax calculations align with other financial records. Businesses can leverage this feature for a more cohesive financial management experience.

-

What are the pricing options for the Form 8804 W Worksheet Fill In Version?

The pricing for the Form 8804 W Worksheet Fill In Version is competitive and designed to fit various business needs. You can choose from different subscription plans based on your usage and features required. This flexibility ensures that companies of all sizes can take advantage of this essential tax preparation tool without breaking the bank.

-

What benefits does the Form 8804 W Worksheet Fill In Version offer?

The Form 8804 W Worksheet Fill In Version provides numerous benefits, including time savings and accuracy in tax calculations. Users can complete their tax returns more efficiently, which increases productivity. Additionally, the tool is optimized to reduce errors, which can lead to fewer audits and penalties from tax authorities.

-

Is the Form 8804 W Worksheet Fill In Version user-friendly?

Absolutely! The Form 8804 W Worksheet Fill In Version is designed with user experience in mind. Its intuitive interface allows users of all skill levels, including those new to tax preparation, to navigate and complete their worksheets with ease.

-

What types of businesses can benefit from the Form 8804 W Worksheet Fill In Version?

All types of businesses that have foreign partners can benefit from the Form 8804 W Worksheet Fill In Version. Whether you’re a small business or a large corporation, this tool simplifies the complexities of tax calculations. It’s particularly useful for firms that frequently deal with international partners and need to stay compliant with tax regulations.

Get more for Form 8804 W Worksheet Fill In Version

Find out other Form 8804 W Worksheet Fill In Version

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF