Form 8876 Rev December Fill in Capable Excise Tax on Structured Settlement Factoring Transactions

Understanding Form 8876 and Its Purpose

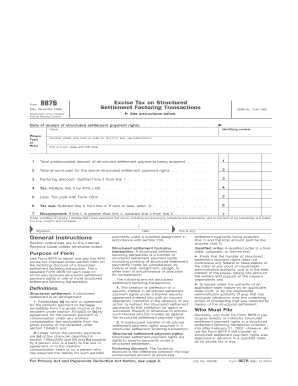

The Form 8876, officially known as the Excise Tax on Structured Settlement Factoring Transactions, is a tax form used in the United States. It is specifically designed for individuals or entities involved in structured settlement transactions. This form is crucial for reporting the excise tax that applies to the sale or transfer of structured settlement payment rights. The IRS requires this form to ensure compliance with tax regulations surrounding structured settlements, which are often used in personal injury cases or other legal settlements.

How to Obtain Form 8876

Obtaining Form 8876 is straightforward. The form can be downloaded directly from the IRS website or requested through the IRS forms hotline. Additionally, tax preparation software often includes this form, making it accessible for users who prefer digital filing. It is essential to ensure that you are using the most recent version of the form to comply with current tax laws.

Steps to Complete Form 8876

Completing Form 8876 involves several key steps:

- Begin by entering your name, address, and taxpayer identification number at the top of the form.

- Provide details about the structured settlement transaction, including the date of the transaction and the total amount involved.

- Calculate the excise tax owed based on the applicable rate and enter this amount in the designated section.

- Sign and date the form, ensuring that all information is accurate and complete before submission.

Legal Use of Form 8876

The legal use of Form 8876 is primarily for compliance with IRS regulations regarding structured settlement transactions. Failure to file this form or inaccuracies in reporting can lead to penalties. It is important for taxpayers to understand their obligations under the law and to use this form correctly to avoid potential legal issues.

Filing Deadlines for Form 8876

Filing deadlines for Form 8876 typically align with the tax year in which the structured settlement transaction occurred. Generally, the form must be filed by the due date of the tax return for the year in which the transaction took place. It is advisable to keep track of these deadlines to ensure timely compliance and avoid late fees or penalties.

Penalties for Non-Compliance

Non-compliance with the requirements of Form 8876 can result in significant penalties. The IRS may impose fines for failing to file the form or for inaccuracies in the reported information. It is crucial for individuals and businesses involved in structured settlement transactions to adhere to the filing requirements to mitigate the risk of incurring these penalties.

Quick guide on how to complete form 8876

Prepare form 8876 effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage form 8876 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign 8876 form effortlessly

- Obtain form 8876 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), an invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that require new document prints. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign 8876 form to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 8876

Create this form in 5 minutes!

How to create an eSignature for the 8876 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 8876 form

-

What is form 8876 and why do I need it?

Form 8876 is used to claim the credit for increasing research activities. Businesses that qualify for this credit must file this form to benefit from potential tax savings. By understanding and utilizing form 8876, businesses can enhance their financial efficiency.

-

How can airSlate SignNow help with completing form 8876?

airSlate SignNow provides an intuitive platform for filling out form 8876 electronically. With its eSignature feature, you can easily sign and send the form securely, ensuring it is completed and submitted correctly. This streamlines the process and minimizes paper waste.

-

Is there a cost associated with using airSlate SignNow to fill out form 8876?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective. The pricing plans cater to different business needs, ensuring you can access tools to efficiently complete form 8876 without breaking the bank. Investing in this solution can lead to time savings and reduce errors.

-

What features does airSlate SignNow offer for managing form 8876?

airSlate SignNow includes features like customizable templates, secure sharing, and robust tracking to manage form 8876 effectively. These tools allow users to streamline the completion process and ensure compliance with tax regulations. Furthermore, its user-friendly interface makes it accessible for all business types.

-

Can I integrate airSlate SignNow with other software to streamline form 8876 submissions?

Yes, airSlate SignNow offers integration capabilities with a variety of software solutions like CRM and accounting tools. This allows you to efficiently gather data needed for form 8876 from various sources. These integrations help create a seamless workflow, enhancing productivity and accuracy.

-

What are the benefits of using airSlate SignNow for form 8876?

Using airSlate SignNow for form 8876 offers numerous benefits, including time savings, enhanced security, and reduced paper usage. The electronic signature feature ensures a faster turnaround time for approvals. Additionally, you can access your documents anytime, anywhere, which improves overall convenience.

-

How secure is airSlate SignNow when handling form 8876?

airSlate SignNow prioritizes security, ensuring that your data while filling out form 8876 is protected through encryption and secure servers. The platform complies with industry standards, safeguarding sensitive information. You can have peace of mind knowing your documents are secure during the signing process.

Get more for form 8876

Find out other 8876 form

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online