Form 9452 Fill in Capable

What is the Form 9452 Fill In Capable

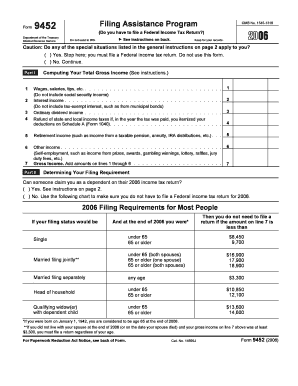

The Form 9452 is a document used by taxpayers to request a waiver for the estimated tax penalty. This form is particularly relevant for individuals who may not have met their estimated tax payment obligations due to unusual circumstances. Understanding its purpose is essential for ensuring compliance with IRS regulations while avoiding unnecessary penalties.

How to use the Form 9452 Fill In Capable

To effectively use the Form 9452, taxpayers need to fill it out accurately, providing all required information. This includes personal identification details, the reason for the penalty waiver request, and any supporting documentation that substantiates the claim. Once completed, the form should be submitted to the IRS according to the specified instructions.

Steps to complete the Form 9452 Fill In Capable

Completing the Form 9452 involves several key steps:

- Gather necessary information, including your taxpayer identification number and details about your estimated tax payments.

- Clearly state the reason for your request for a penalty waiver.

- Attach any relevant documentation that supports your request.

- Review the form for accuracy before submission.

- Submit the form to the appropriate IRS address as indicated in the instructions.

Legal use of the Form 9452 Fill In Capable

The Form 9452 is legally recognized by the IRS as a valid request for a penalty waiver. Taxpayers must ensure that their use of the form complies with IRS guidelines to avoid complications. Misuse or inaccurate information can lead to denial of the waiver request and potential penalties.

Eligibility Criteria

To qualify for a penalty waiver using the Form 9452, taxpayers must meet specific eligibility criteria set by the IRS. This typically includes having a reasonable cause for failing to make estimated tax payments, such as a serious illness or natural disaster. It is essential to provide sufficient evidence to support the claim.

Form Submission Methods

The Form 9452 can be submitted to the IRS through various methods, including:

- Mailing the completed form to the designated IRS address.

- Submitting the form electronically if eligible, following the IRS guidelines for electronic submissions.

- In-person submission at local IRS offices, if necessary.

Filing Deadlines / Important Dates

Timeliness is crucial when submitting the Form 9452. Taxpayers should be aware of relevant deadlines, such as the due dates for estimated tax payments and the timeline for filing the form to request a penalty waiver. Missing these dates can result in the denial of the request and additional penalties.

Quick guide on how to complete form 9452 fill in capable

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to Edit and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 9452 Fill In Capable

Create this form in 5 minutes!

How to create an eSignature for the form 9452 fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 9452 Fill In Capable and how does it work?

Form 9452 Fill In Capable is a feature provided by airSlate SignNow that allows users to easily fill out and sign the IRS Form 9452 digitally. This functionality streamlines the documentation process, enabling businesses to complete necessary forms efficiently and securely within the airSlate platform. With this feature, you can ensure that your documents are compliant and professionally completed.

-

Can I customize Form 9452 Fill In Capable templates?

Yes, airSlate SignNow enables users to customize templates for the Form 9452 Fill In Capable to suit their specific needs. This flexibility allows businesses to incorporate their branding and personalize fields, making the forms more relevant for their unique processes. Customization is key to improving user engagement and ensuring accuracy.

-

Is there a mobile app for filling out Form 9452 Fill In Capable?

Absolutely! airSlate SignNow offers a mobile app that supports Form 9452 Fill In Capable, allowing users to fill out and sign documents on the go. The app is designed to provide a seamless experience, ensuring you can manage your forms anytime and anywhere. This capability can greatly enhance productivity and convenience for businesses.

-

What are the pricing options for using Form 9452 Fill In Capable?

airSlate SignNow provides various pricing plans to accommodate different business needs when utilizing the Form 9452 Fill In Capable feature. The plans are designed to be cost-effective and cater to both small businesses and larger enterprises. You can choose a plan that best fits your usage requirements and budget.

-

How does airSlate SignNow ensure the security of Form 9452 Fill In Capable?

Security is a priority with airSlate SignNow when handling Form 9452 Fill In Capable. The platform employs advanced encryption protocols and compliance measures to protect sensitive information. This ensures that your documents remain confidential and secure throughout the signing and filling process.

-

What integrations are available with Form 9452 Fill In Capable?

airSlate SignNow offers various integrations that work seamlessly with Form 9452 Fill In Capable, allowing businesses to streamline workflows. It connects with popular tools like Google Drive, Dropbox, and CRM systems. These integrations enhance efficiency and help eliminate redundant tasks in document management.

-

Can multiple users collaborate on the Form 9452 Fill In Capable?

Yes, airSlate SignNow supports collaboration on the Form 9452 Fill In Capable, allowing multiple users to work together in real time. This feature is especially beneficial for teams in managing and completing forms collaboratively. Enhanced collaboration leads to quicker turnaround times and improved accuracy.

Get more for Form 9452 Fill In Capable

Find out other Form 9452 Fill In Capable

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document