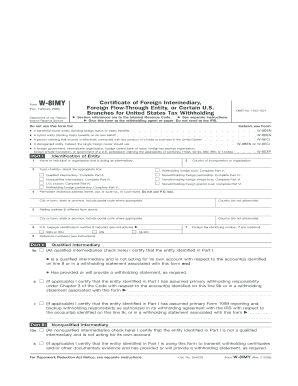

1545 1621 Department of the Treasury Internal Revenue Service Do Not Use This Form for a Beneficial Owner Solely Claiming Foreig

What is the Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming

The form, issued by the Department of the Treasury Internal Revenue Service (IRS), is specifically designed for certain tax-related purposes. This form is not intended for use by beneficial owners solely claiming foreign status or treaty benefits, nor for hybrid entities claiming such benefits. It serves as a declaration of eligibility for tax treaty benefits and is essential for entities that may have complex tax situations. Understanding its purpose is crucial for compliance with U.S. tax laws.

How to use the Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming

Using the form requires careful consideration of the specific circumstances under which it is applicable. It is vital to ensure that you are not a beneficial owner solely claiming foreign status or treaty benefits. If your situation aligns with the form's intended use, you will need to accurately complete the required fields, providing all necessary information related to your tax status and entity type. This form can be filled out digitally, ensuring ease of access and submission.

Steps to complete the Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming

Completing the form involves several key steps:

- Gather necessary information regarding your entity type and tax status.

- Access the form through the IRS website or a reliable document management platform.

- Fill in all required fields accurately, ensuring that you do not claim foreign status or treaty benefits if not applicable.

- Review the completed form for accuracy and completeness.

- Submit the form as directed, either electronically or via mail.

Key elements of the Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming

Key elements of the form include:

- Identification of the entity type, such as corporation or partnership.

- Details regarding the tax status of the entity.

- Specific declarations regarding eligibility for treaty benefits.

- Signature of an authorized representative, affirming the accuracy of the information provided.

Legal use of the Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming

The legal use of the form is strictly regulated. It is essential that only entities that meet the specific criteria outlined by the IRS utilize this form. Misuse can lead to penalties or complications with tax compliance. Therefore, it is advisable to consult with a tax professional if there is any uncertainty regarding eligibility or the proper use of this form.

Filing Deadlines / Important Dates

Filing deadlines for the form vary based on the entity type and the specific tax year. Generally, entities should submit the form along with their tax returns by the established deadlines to avoid penalties. Keeping track of these dates is essential for maintaining compliance with IRS regulations.

Quick guide on how to complete 1545 1621 department of the treasury internal revenue service do not use this form for a beneficial owner solely claiming

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents swiftly and without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest way to alter and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and guarantee excellent communication throughout every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1545 1621 Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreig

Create this form in 5 minutes!

How to create an eSignature for the 1545 1621 department of the treasury internal revenue service do not use this form for a beneficial owner solely claiming

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 1545 1621 Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming?

The 1545 1621 Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming is designed to guide entities in reporting their foreign status and treaty benefits accurately. It ensures compliance with IRS regulations and helps avoid unnecessary penalties by providing a clear framework for beneficial ownership.

-

How does airSlate SignNow help with the 1545 1621 form?

airSlate SignNow simplifies the documentation process by allowing users to eSign and manage the 1545 1621 Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming efficiently. With customizable templates and easy document sharing, users can ensure they meet IRS requirements while reducing processing time.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs, making it accessible for small to large organizations. Pricing includes various features that facilitate eSigning and document management, related to the 1545 1621 Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming, ensuring great value for users.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes several robust features such as real-time collaboration, customizable templates, and automated workflows. These features streamline the process of handling documents associated with the 1545 1621 Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming, enhancing overall efficiency for your business.

-

Can airSlate SignNow integrate with other software I use?

Yes, airSlate SignNow integrates seamlessly with popular software applications like Salesforce, Google Drive, and Microsoft Office. This compatibility allows users to manage documents related to the 1545 1621 Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming efficiently within their existing workflows.

-

How secure is airSlate SignNow for handling sensitive documents?

airSlate SignNow employs state-of-the-art security measures, including encryption and secure cloud storage, to protect your sensitive documents. This ensures that your information related to the 1545 1621 Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming is safeguarded against unauthorized access.

-

Is airSlate SignNow user-friendly for those unfamiliar with technology?

Absolutely! airSlate SignNow is designed with user experience in mind, featuring an intuitive interface that simplifies the eSigning process. This user-friendly approach ensures that anyone, regardless of their tech-savviness, can handle documents like the 1545 1621 Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreign Status Or Treaty Benefits A Hybrid Entity Claiming with ease.

Get more for 1545 1621 Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreig

Find out other 1545 1621 Department Of The Treasury Internal Revenue Service Do Not Use This Form For A Beneficial Owner Solely Claiming Foreig

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement