Form 943 PR Fill in Capable Employer's Annual Tax Return for Agricultural Employees Puerto Rican Version

Understanding the Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version

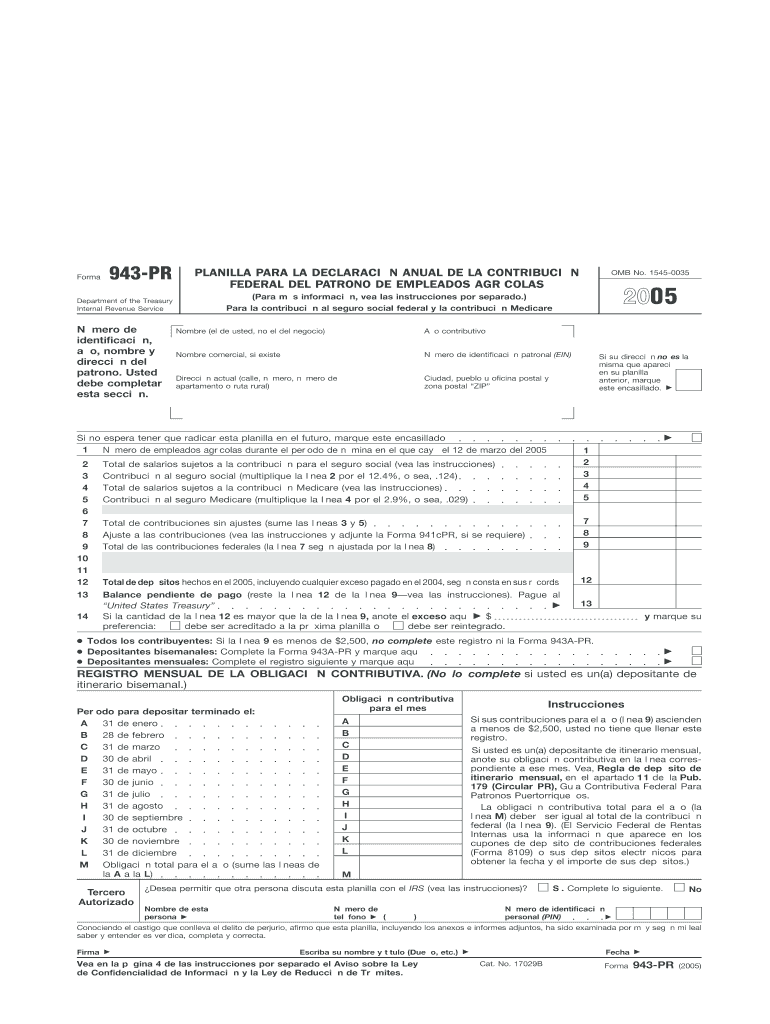

The Form 943 PR is a crucial tax document specifically designed for employers in Puerto Rico who hire agricultural employees. This form allows employers to report wages paid and taxes withheld for agricultural workers throughout the year. It is tailored to meet the unique tax obligations of agricultural businesses operating in Puerto Rico, ensuring compliance with local and federal regulations.

Employers must accurately complete this form to avoid penalties and ensure that their employees receive proper credit for their earnings, which can affect their future benefits. Understanding the specific requirements and sections of the form is essential for accurate reporting.

Steps to Complete the Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version

Completing the Form 943 PR involves several key steps. First, gather all necessary information, including employee details, wages paid, and taxes withheld. Next, fill out the form by providing accurate data in each section, ensuring that all calculations are correct. Pay special attention to the sections that require reporting of total wages and tax liabilities.

After filling out the form, review it thoroughly for any errors or omissions. It is advisable to keep a copy of the completed form for your records. Once confirmed, submit the form to the appropriate tax authority by the specified deadline.

Legal Use of the Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version

The Form 943 PR serves a legal purpose in the tax reporting process for agricultural employers in Puerto Rico. It is mandated by the Internal Revenue Service (IRS) and local tax authorities to ensure that employers fulfill their tax obligations accurately. Failure to file this form can result in penalties, interest on unpaid taxes, and potential legal issues.

Employers must understand the legal implications of the information reported on this form, as it affects both their tax liabilities and their employees' tax records. Compliance with the guidelines outlined by the IRS and local authorities is essential for maintaining good standing as an employer.

Key Elements of the Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version

Several key elements must be included when completing the Form 943 PR. These elements typically consist of employer identification details, employee information, total wages paid, and the amount of taxes withheld. Additionally, the form may require information about any adjustments or corrections from previous filings.

Understanding these key components is crucial for accurate completion. Each section of the form has specific requirements, and missing or incorrect information can lead to delays in processing or additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 943 PR are critical for employers to adhere to in order to avoid penalties. Typically, the form must be submitted by January 31 of the following year for the tax year being reported. Employers should also be aware of any changes in deadlines that may occur due to federal or local regulations.

Staying informed about these important dates ensures timely compliance and helps maintain a good standing with tax authorities. Employers are encouraged to mark these deadlines on their calendars to avoid last-minute filing issues.

Form Submission Methods (Online / Mail / In-Person)

The Form 943 PR can be submitted through various methods, providing flexibility for employers. It can be filed online through authorized tax software, mailed directly to the appropriate tax authority, or submitted in person at designated offices. Each method has its own advantages, such as immediate confirmation of receipt for online submissions.

Employers should choose the submission method that best fits their needs, considering factors like convenience, security, and processing times. Regardless of the method chosen, ensuring that the form is submitted accurately and on time is essential for compliance.

Quick guide on how to complete form 943 pr fill in capable employers annual tax return for agricultural employees puerto rican version

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the proper format and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify your documentation tasks today.

The easiest method to modify and electronically sign [SKS] seamlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or conceal confidential information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version

Create this form in 5 minutes!

How to create an eSignature for the form 943 pr fill in capable employers annual tax return for agricultural employees puerto rican version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version?

The Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version is specifically designed for agricultural employers in Puerto Rico to report income tax withheld from their employees. This form simplifies tax reporting and ensures compliance with local tax laws, making it easier for businesses to manage their payroll.

-

How can airSlate SignNow help with the Form 943 PR Fill In Capable Employer's Annual Tax Return?

airSlate SignNow streamlines the process of filling out and submitting the Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version. It offers user-friendly features that allow businesses to fill in and e-sign the form quickly, reducing processing time and enhancing accuracy in submissions.

-

Are there any pricing options available for using airSlate SignNow to complete Form 943 PR?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans are designed to provide cost-effective solutions for completing the Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version, ensuring that both small and large businesses can find a suitable option.

-

What are the key features of airSlate SignNow for the Form 943 PR?

Key features of airSlate SignNow for the Form 943 PR Fill In Capable Employer's Annual Tax Return include document templates, electronic signatures, and automated workflows. These features help businesses efficiently manage their tax-related documents while maintaining compliance with regulations.

-

How does airSlate SignNow ensure the security of the Form 943 PR submissions?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption techniques and secure servers. When completing the Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version, you can trust that your information is protected and compliant with industry standards.

-

Can airSlate SignNow integrate with other payroll systems for Form 943 PR submission?

Yes, airSlate SignNow integrates seamlessly with various payroll systems, enhancing the efficiency of managing your Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version. These integrations allow for easy data transfer and accurate reporting, simplifying the overall tax filing process.

-

What benefits does using airSlate SignNow provide for companies filling out the Form 943 PR?

Using airSlate SignNow for the Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version offers numerous benefits, such as improved efficiency, reduced errors, and easier compliance with tax regulations. These advantages enable businesses to focus on their core operations while ensuring timely and accurate tax submissions.

Get more for Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version

Find out other Form 943 PR Fill In Capable Employer's Annual Tax Return For Agricultural Employees Puerto Rican Version

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document