Form 990 or 990 EZ Schedule a Fill in Capable Organization Exempt under Section 501c3

Understanding the Form 990 or 990 EZ Schedule A for 501(c)(3) Organizations

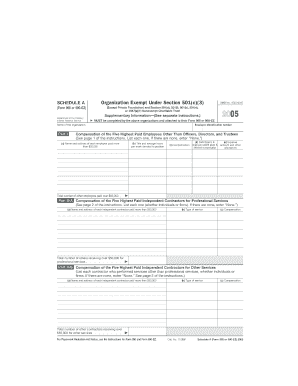

The Form 990 or 990 EZ Schedule A is a critical document for organizations exempt under Section 501(c)(3) of the Internal Revenue Code. This form provides the IRS with essential information about the organization's mission, programs, and financial activities. It is specifically designed for non-profit entities to report their income, expenses, and activities, ensuring transparency and accountability in their operations. By completing this form, organizations demonstrate their compliance with federal regulations, which is vital for maintaining their tax-exempt status.

Steps to Complete the Form 990 or 990 EZ Schedule A

Completing the Form 990 or 990 EZ Schedule A involves several key steps. First, organizations need to gather necessary financial records, including income statements and expense reports. Next, they should review the IRS instructions for the form to ensure they understand each section's requirements. After filling out the form, organizations must double-check their entries for accuracy before submitting it to the IRS. It is also advisable to keep a copy of the completed form for their records, as this can be useful for future reference or audits.

Key Elements of the Form 990 or 990 EZ Schedule A

The Form 990 or 990 EZ Schedule A includes several important sections that organizations must complete. These sections typically cover the organization's mission statement, a summary of its programs, and detailed financial information. Additionally, organizations must disclose their governance structure, including board members and key staff. Understanding these key elements is essential for ensuring that the form is filled out correctly and complies with IRS requirements, which can help avoid penalties for non-compliance.

Legal Use of the Form 990 or 990 EZ Schedule A

Organizations must use the Form 990 or 990 EZ Schedule A in accordance with IRS regulations. This means that the information provided must be accurate and truthful, as any misrepresentation can lead to legal consequences, including the loss of tax-exempt status. It is crucial for organizations to adhere to the legal standards set forth by the IRS when completing this form, as it serves as a public record of their financial health and operational activities.

Filing Deadlines for the Form 990 or 990 EZ Schedule A

Organizations are required to file the Form 990 or 990 EZ Schedule A annually, with the deadline typically falling on the fifteenth day of the fifth month after the end of their fiscal year. For example, if an organization operates on a calendar year, the form would be due by May fifteenth. It is important for organizations to keep track of these deadlines to avoid late fees and ensure compliance with IRS regulations.

Obtaining the Form 990 or 990 EZ Schedule A

The Form 990 or 990 EZ Schedule A can be obtained directly from the IRS website. Organizations can download the form in PDF format, which can be filled out digitally or printed for manual completion. Additionally, organizations may seek assistance from tax professionals or use software solutions that facilitate the completion and filing of the form, ensuring that all required information is accurately reported.

Quick guide on how to complete form 990 or 990 ez schedule a fill in capable organization exempt under section 501c3

Effortlessly Prepare [SKS] on Any Device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The easiest method to alter and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, painstaking form searches, or errors that necessitate reprinting new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee excellent communication at all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 Or 990 EZ Schedule A Fill In Capable Organization Exempt Under Section 501c3

Create this form in 5 minutes!

How to create an eSignature for the form 990 or 990 ez schedule a fill in capable organization exempt under section 501c3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 990 Or 990 EZ Schedule A Fill In Capable Organization Exempt Under Section 501c3?

The Form 990 Or 990 EZ Schedule A Fill In Capable Organization Exempt Under Section 501c3 is a required tax return for charities and nonprofit organizations. It helps organizations provide the IRS with information about their activities, governance, and financials. Using the right tools to fill in this form can streamline the process signNowly.

-

How can airSlate SignNow assist with the Form 990 Or 990 EZ Schedule A?

airSlate SignNow offers an intuitive platform that simplifies the eSigning process for the Form 990 Or 990 EZ Schedule A Fill In Capable Organization Exempt Under Section 501c3. Our solution enables organizations to send documents for signature seamlessly, reducing the time it takes to complete the filing. With easy access and tracking features, you can manage your documents effectively.

-

What are the pricing options for using airSlate SignNow for nonprofit organizations?

airSlate SignNow provides flexible pricing plans tailored for nonprofit organizations needing to file the Form 990 Or 990 EZ Schedule A Fill In Capable Organization Exempt Under Section 501c3. Our plans allow you to choose functionalities that best fit your needs. Additionally, we often have discounts available for 501c3 organizations.

-

Are there any specific features in airSlate SignNow for 501c3 organizations?

Yes, airSlate SignNow offers specific features that cater to the needs of 501c3 organizations preparing the Form 990 Or 990 EZ Schedule A. Features include document templates, secure storage, and customization options to ensure your forms are completed accurately and efficiently. These tools help to enhance compliance and organization.

-

What benefits does airSlate SignNow provide for filing the Form 990 Or 990 EZ Schedule A?

Using airSlate SignNow to file the Form 990 Or 990 EZ Schedule A Fill In Capable Organization Exempt Under Section 501c3 offers numerous benefits. The platform's user-friendly interface allows for fast and secure signatures, reducing the turnaround time for document approval. Plus, it helps maintain compliance and keeps records organized in one place.

-

Can I integrate airSlate SignNow with other tools for my 501c3 organization?

Absolutely! airSlate SignNow integrates with various tools that 501c3 organizations typically use, streamlining your workflow for the Form 990 Or 990 EZ Schedule A. This helps to manage document flow and synchronize data across platforms. Popular integrations include cloud storage services, CRM systems, and project management tools.

-

Is it secure to use airSlate SignNow for sensitive documents like the Form 990 Or 990 EZ Schedule A?

Yes, airSlate SignNow prioritizes security, making it a reliable option for handling sensitive documents like the Form 990 Or 990 EZ Schedule A Fill In Capable Organization Exempt Under Section 501c3. We implement advanced encryption and security protocols to protect your data throughout the eSigning process. You can trust that your information remains confidential and secure.

Get more for Form 990 Or 990 EZ Schedule A Fill In Capable Organization Exempt Under Section 501c3

- Imgurl hqgd9mg m9zfls2aaaaa w 198 h 256 c 7 o 5 pid 1 7 form

- Model acknowledgement of conditions for mitigation of form

- Formulir permohonan visa malaysia

- Spa membership form

- Course evaluation form physical therapy private practice

- Florida department of health intern registration application form

- Echocardiogram report pdf sound form

- Communicable disease guideline chart for child care centers form

Find out other Form 990 Or 990 EZ Schedule A Fill In Capable Organization Exempt Under Section 501c3

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document