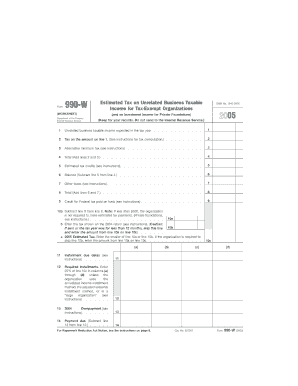

Form 990 W Estimated Tax on Unrelated Business Taxable Income for Tax Exempt Organizations and on Investment Income for Private

Understanding Form 990 W

The Form 990 W is specifically designed for tax-exempt organizations to report estimated taxes on unrelated business taxable income (UBTI) and on investment income for private foundations. This form is crucial for organizations that engage in activities not directly related to their exempt purpose, as it helps ensure compliance with IRS regulations. By accurately completing this form, organizations can avoid potential penalties and maintain their tax-exempt status.

How to Obtain Form 990 W

To obtain Form 990 W, tax-exempt organizations can visit the IRS website or contact the IRS directly. The form is available for download in PDF format, allowing organizations to print and fill it out manually. Additionally, organizations may find the form through various tax preparation software that supports IRS forms, ensuring they have the most current version for their filing needs.

Steps to Complete Form 990 W

Completing Form 990 W involves several key steps:

- Gather necessary financial information, including income from unrelated business activities and investment income.

- Calculate the estimated tax liability based on the applicable tax rates for UBTI and investment income.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays.

- Review the form for accuracy before submission, checking for any discrepancies in reported income or calculations.

Key Elements of Form 990 W

Form 990 W includes several important elements that organizations must understand:

- Identification Information: This section requires the organization's name, address, and Employer Identification Number (EIN).

- Estimated Tax Calculation: Organizations must provide details on their estimated tax based on UBTI and investment income.

- Payment Information: Instructions for making estimated tax payments are included, detailing how and when to submit payments.

Filing Deadlines for Form 990 W

Organizations must be aware of the filing deadlines associated with Form 990 W. Generally, the form is due quarterly, with specific due dates for each quarter. It is essential for organizations to mark these dates on their calendars to ensure timely submissions and avoid penalties for late filings.

Penalties for Non-Compliance

Failure to file Form 990 W or inaccuracies in the form can lead to significant penalties. The IRS may impose fines based on the amount of unpaid tax, and organizations risk losing their tax-exempt status if they consistently fail to comply with filing requirements. Understanding these penalties underscores the importance of accurate and timely submissions.

Quick guide on how to complete form 990 w estimated tax on unrelated business taxable income for tax exempt organizations and on investment income for private

Easily Prepare [SKS] on Any Device

Digital document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork since you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of your documents or conceal sensitive information with the specialized tools that airSlate SignNow offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and electronically sign [SKS] and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 W Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations and On Investment Income For Private

Create this form in 5 minutes!

How to create an eSignature for the form 990 w estimated tax on unrelated business taxable income for tax exempt organizations and on investment income for private

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Form 990 W Estimated Tax?

Form 990 W Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations and On Investment Income For Private Foundations Keep For Your Records is used by tax-exempt organizations to report and pay estimated taxes on income that is taxable. This form helps ensure compliance and prevents signNow tax liabilities from unexpected income fluctuation.

-

How does airSlate SignNow assist with signing Form 990 W?

With airSlate SignNow, you can easily upload, send, and eSign Form 990 W Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations and On Investment Income For Private Foundations Keep For Your Records. Our platform streamlines the signing process, allowing your organization to finalize documents quickly while maintaining legal compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to meet different organizational needs, including a basic plan for small organizations and more comprehensive packages for larger ones. Regardless of the plan you choose, you'll have the tools needed to manage documents like Form 990 W Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations and On Investment Income For Private Foundations Keep For Your Records efficiently.

-

What features does airSlate SignNow provide for tax documentation?

airSlate SignNow includes features such as document templates, bulk sending, and secure eSigning that make managing tax documentation seamless. You can easily track the status of your Form 990 W Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations and On Investment Income For Private Foundations Keep For Your Records, ensuring that all necessary steps are completed on time.

-

Is airSlate SignNow compatible with other software?

Yes, airSlate SignNow integrates seamlessly with various popular software platforms like Google Drive, Salesforce, and Dropbox. This allows you to store and manage your Form 990 W Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations and On Investment Income For Private Foundations Keep For Your Records alongside other key documents effortlessly.

-

What are the benefits of using airSlate SignNow for tax-exempt organizations?

For tax-exempt organizations, using airSlate SignNow means saving time, reducing paper usage, and ensuring that important documents like Form 990 W Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations and On Investment Income For Private Foundations Keep For Your Records are securely handled. The platform's user-friendly interface also enhances collaboration among team members.

-

Can I access my signed documents anytime with airSlate SignNow?

Absolutely! airSlate SignNow provides a cloud-based storage solution, allowing you to access your signed documents, including the Form 990 W Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations and On Investment Income For Private Foundations Keep For Your Records, anytime and from anywhere. This ensures that you have the necessary records at your fingertips whenever needed.

Get more for Form 990 W Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations and On Investment Income For Private

Find out other Form 990 W Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations and On Investment Income For Private

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement