Form 1041 Schedule D Fill in Capable Capital Gains and Losses

Understanding Form 1041 Schedule D for Capital Gains and Losses

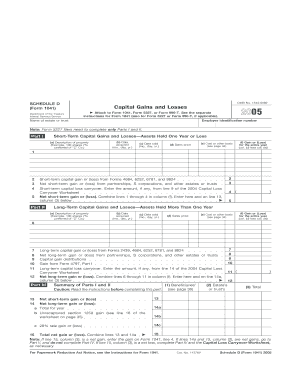

Form 1041 Schedule D is specifically designed for reporting capital gains and losses for estates and trusts. This form is essential for fiduciaries to accurately report the sale of capital assets, such as stocks, bonds, and real estate. It allows for the calculation of gains or losses incurred during the tax year, which impacts the overall tax liability of the estate or trust. Understanding how to correctly fill out this form is crucial for compliance with IRS regulations and for ensuring that beneficiaries receive their appropriate distributions.

Steps to Complete Form 1041 Schedule D

Completing Form 1041 Schedule D involves several key steps:

- Gather all necessary documentation regarding capital transactions, including purchase and sale records.

- Calculate the total capital gains and losses by determining the difference between the selling price and the basis (original purchase price) of each asset.

- Complete the form by entering the calculated gains and losses in the appropriate sections, ensuring accuracy to avoid penalties.

- Transfer the net capital gain or loss to Form 1041, where it will be included in the overall tax calculation for the estate or trust.

Obtaining Form 1041 Schedule D

Form 1041 Schedule D can be obtained directly from the IRS website or through tax preparation software. It is also available at various tax assistance offices. Ensure that you are using the most current version of the form to comply with the latest tax regulations. If you prefer a physical copy, you can request one by contacting the IRS or visiting a local IRS office.

Legal Use of Form 1041 Schedule D

Form 1041 Schedule D is legally required for estates and trusts that have capital gains or losses during the tax year. The fiduciary must ensure that the form is completed accurately and submitted alongside Form 1041. Failure to file this form when required can result in penalties and interest on any unpaid taxes. It is advisable to consult with a tax professional to ensure compliance with all legal requirements surrounding the use of this form.

IRS Guidelines for Form 1041 Schedule D

The IRS provides specific guidelines regarding the completion and submission of Form 1041 Schedule D. These guidelines include detailed instructions on how to report various types of capital gains and losses, including short-term and long-term transactions. It is important to refer to the IRS instructions for the most accurate and up-to-date information, as these guidelines can change annually based on tax law updates.

Filing Deadlines for Form 1041 Schedule D

The deadline for filing Form 1041, including Schedule D, is typically the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Timely filing is essential to avoid penalties and ensure that the estate or trust remains in good standing with the IRS.

Quick guide on how to complete form 1041 schedule d fill in capable capital gains and losses

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to swiftly create, amend, and eSign your documents without any holdups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 Schedule D Fill In Capable Capital Gains And Losses

Create this form in 5 minutes!

How to create an eSignature for the form 1041 schedule d fill in capable capital gains and losses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1041 Schedule D Fill In Capable Capital Gains And Losses?

Form 1041 Schedule D Fill In Capable Capital Gains And Losses is a tax form used to report capital gains and losses for estates and trusts. This form allows you to accurately calculate and report your capital transactions, ensuring compliance with tax regulations. Utilizing airSlate SignNow makes the process of filling out this form simple and efficient.

-

How can airSlate SignNow help with Form 1041 Schedule D Fill In Capable Capital Gains And Losses?

airSlate SignNow streamlines the process of filling out Form 1041 Schedule D Fill In Capable Capital Gains And Losses by providing an easy-to-use digital platform. With features like templates and e-signature capabilities, you can fill in and send these forms quickly. This ensures that your submissions are accurate and timely, alleviating potential tax issues.

-

Is there a cost associated with using airSlate SignNow for Form 1041 Schedule D Fill In Capable Capital Gains And Losses?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost is competitive, providing you with a cost-effective solution to eSign and manage your documents for Form 1041 Schedule D Fill In Capable Capital Gains And Losses. You can select a plan based on your usage and requirements.

-

What features does airSlate SignNow offer for managing Form 1041 Schedule D Fill In Capable Capital Gains And Losses?

airSlate SignNow offers a range of features ideal for managing Form 1041 Schedule D Fill In Capable Capital Gains And Losses, including customizable templates, secure e-signature functionality, and real-time collaboration tools. These features enhance your workflow by allowing you to prepare, edit, and sign documents seamlessly. The platform also provides cloud storage for easy access.

-

Can I integrate airSlate SignNow with other software for handling Form 1041 Schedule D Fill In Capable Capital Gains And Losses?

Absolutely! airSlate SignNow supports integration with various software solutions, making it easy to manage your Form 1041 Schedule D Fill In Capable Capital Gains And Losses in conjunction with your existing tools. This integration streamlines your workflow, allowing for a more cohesive approach to document management and tax filing.

-

Is airSlate SignNow secure for handling sensitive documents like Form 1041 Schedule D Fill In Capable Capital Gains And Losses?

Yes, airSlate SignNow prioritizes security and employs robust measures to protect your sensitive documents, including Form 1041 Schedule D Fill In Capable Capital Gains And Losses. The platform is designed with encryption and compliance standards to ensure that your data remains confidential and secure during the eSigning process.

-

What are the benefits of using airSlate SignNow for Form 1041 Schedule D Fill In Capable Capital Gains And Losses?

Using airSlate SignNow for Form 1041 Schedule D Fill In Capable Capital Gains And Losses offers numerous benefits, including time savings, increased accuracy, and enhanced accessibility. The platform simplifies document handling, allowing for quick edits and e-signatures, which can signNowly reduce the time spent on tax preparations. This efficiency can lead to fewer mistakes and quicker submissions.

Get more for Form 1041 Schedule D Fill In Capable Capital Gains And Losses

- Certificate of capacity nsw 343973529 form

- When mandated reporters in california must report form

- Childrens ministry volunteer application form template 10 church volunteer application form templates in pdfdoc10 church

- Purchase and sale contract for lots and vacant land form

- Fax request form

- Form 1092

- Writing that works by dr steven m gerson johnson county community college form

- Solving multi step equations notes pdf form

Find out other Form 1041 Schedule D Fill In Capable Capital Gains And Losses

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement