Form 1065 U

What is the Form 1065 U

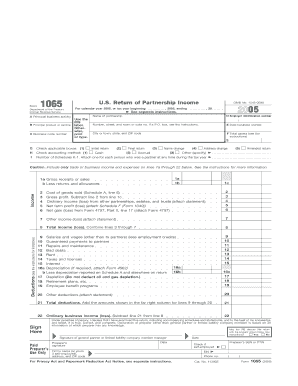

The Form 1065 U is a tax document used by partnerships to report income, deductions, gains, losses, and other important financial information to the Internal Revenue Service (IRS). This form is essential for partnerships as it helps in the accurate reporting of the business's financial activities. Unlike individual tax returns, the Form 1065 U does not impose a tax on the partnership itself; instead, it passes through income to the partners, who then report it on their personal tax returns.

How to use the Form 1065 U

To utilize the Form 1065 U effectively, partnerships must gather all necessary financial data, including income earned, expenses incurred, and any deductions applicable to the partnership. Each partner's share of income, deductions, and credits must be reported accurately on the form. Once completed, the form should be filed with the IRS and provided to each partner for their records. It is important to ensure that all information is accurate to avoid any potential issues with the IRS.

Steps to complete the Form 1065 U

Completing the Form 1065 U involves several key steps:

- Gather all financial records for the partnership, including income statements and expense reports.

- Fill out the basic information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report total income and deductions on the appropriate lines of the form.

- Calculate the partnership's total income or loss and allocate each partner's share accordingly.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

The Form 1065 U must be filed by the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this typically means a deadline of March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Partnerships may also request an extension to file, but this does not extend the time to pay any taxes owed.

Required Documents

Before completing the Form 1065 U, partnerships should gather several important documents:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received and expenses paid during the tax year.

- Partner agreements outlining each partner's ownership percentage and profit-sharing arrangements.

- Any supporting documentation for deductions claimed on the form.

Penalties for Non-Compliance

Failing to file the Form 1065 U on time or providing inaccurate information can lead to significant penalties. The IRS may impose a penalty for each month the form is late, which can accumulate quickly. Additionally, inaccuracies may result in audits or further scrutiny, leading to potential fines or additional tax liabilities. It is crucial for partnerships to ensure compliance with all filing requirements to avoid these consequences.

Quick guide on how to complete form 1065 u

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without any delays. Handle [SKS] on any device using the airSlate SignNow apps available for Android or iOS, and simplify any document-driven process today.

The easiest method to modify and electronically sign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Alter and electronically sign [SKS] while ensuring effective communication throughout the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1065 U

Create this form in 5 minutes!

How to create an eSignature for the form 1065 u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1065 U and how does airSlate SignNow assist with it?

Form 1065 U is a partnership tax return used to report income, deductions, and credits. airSlate SignNow simplifies the process of sending and signing this document electronically, ensuring that all parties can complete it efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for Form 1065 U?

Yes, airSlate SignNow offers competitive pricing plans tailored to different business needs. By utilizing our platform for Form 1065 U, you can save time and resources while ensuring compliance, making it an affordable choice for your business.

-

What features does airSlate SignNow offer for managing Form 1065 U?

airSlate SignNow provides a variety of features tailored for Form 1065 U, including customizable templates, real-time document tracking, and cloud storage. This ensures that you can manage your forms efficiently and securely from anywhere.

-

How does airSlate SignNow enhance the eSigning process for Form 1065 U?

With airSlate SignNow, the eSigning process for Form 1065 U is streamlined. Users can sign documents digitally without the hassle of printing, scanning, or mailing, making the submission process faster and more efficient.

-

Can I integrate airSlate SignNow with other software for handling Form 1065 U?

Absolutely! airSlate SignNow offers integrations with popular software solutions, allowing you to connect your existing accounting tools with our platform for a smoother workflow when dealing with Form 1065 U.

-

What benefits can businesses expect when using airSlate SignNow for Form 1065 U?

Businesses can expect signNow time savings, improved collaboration, and reduced errors when using airSlate SignNow for Form 1065 U. Our intuitive interface and powerful tools make managing tax documents easier than ever.

-

Is it secure to use airSlate SignNow for submitting Form 1065 U?

Yes, security is a top priority at airSlate SignNow. Our platform employs advanced encryption protocols and complies with industry standards to ensure that your Form 1065 U and other sensitive documents are protected.

Get more for Form 1065 U

Find out other Form 1065 U

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation