Form 1065 Schedule D Fill in Capable Capital Gains and Losses

Understanding Form 1065 Schedule D for Capital Gains and Losses

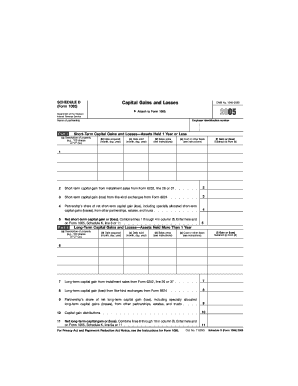

Form 1065 Schedule D is a crucial document for partnerships in the United States to report capital gains and losses. This form is used to detail the sale of capital assets, such as stocks, bonds, and real estate. It helps determine the tax implications of these transactions, ensuring that partners accurately report their share of gains or losses on their individual tax returns. Understanding this form is essential for compliance with IRS regulations and for accurate financial reporting.

Steps to Complete Form 1065 Schedule D

Completing Form 1065 Schedule D involves several steps:

- Gather necessary financial records, including details of all capital asset transactions.

- Identify the type of gains or losses—long-term or short-term—based on the holding period of the assets.

- Fill in the required information, including the description of each asset, date acquired, date sold, and the proceeds from the sale.

- Calculate the total capital gains and losses and report them in the appropriate sections of the form.

- Review the completed form for accuracy before submission.

Legal Use of Form 1065 Schedule D

The legal use of Form 1065 Schedule D is primarily for reporting capital gains and losses by partnerships to the IRS. Accurate reporting is necessary to comply with federal tax laws. Failure to report correctly can lead to penalties or audits. It is important for partnerships to maintain thorough records of all transactions and ensure that the information reported on Schedule D aligns with their overall tax filings.

Obtaining Form 1065 Schedule D

Form 1065 Schedule D can be obtained directly from the IRS website or through tax preparation software. It is available in a downloadable format, allowing users to print and fill it out manually. Additionally, tax professionals can provide guidance and assistance in obtaining and completing this form, ensuring compliance with all necessary regulations.

IRS Guidelines for Form 1065 Schedule D

The IRS provides specific guidelines regarding the completion and submission of Form 1065 Schedule D. These guidelines include instructions on what constitutes a capital gain or loss, how to categorize these gains or losses, and the required documentation to support the reported figures. It is essential to follow these guidelines closely to avoid errors that could result in penalties.

Filing Deadlines for Form 1065 Schedule D

Partnerships must file Form 1065 Schedule D by the due date of their partnership return, which is typically the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. Extensions may be available, but it is important to understand the implications of filing late.

Quick guide on how to complete form 1065 schedule d fill in capable capital gains and losses

Effortlessly prepare [SKS] on any device

The management of documents online has gained popularity among businesses and individuals. It offers a perfect environmentally friendly substitute to conventional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate issues of lost or misfiled documents, time-consuming form searching, or errors requiring new printouts. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1065 Schedule D Fill In Capable Capital Gains And Losses

Create this form in 5 minutes!

How to create an eSignature for the form 1065 schedule d fill in capable capital gains and losses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1065 Schedule D, and why is it important?

Form 1065 Schedule D is a critical tax form used by partnerships to report capital gains and losses. It helps ensure accurate tax reporting and compliance for partnerships, making it essential for tax preparation. Understanding how to fill in Form 1065 Schedule D Capable Capital Gains And Losses can save businesses time and reduce the risk of errors during the tax-filing process.

-

How does airSlate SignNow simplify the process of filling out Form 1065 Schedule D?

airSlate SignNow streamlines the completion of Form 1065 Schedule D Fill In Capable Capital Gains And Losses by providing user-friendly templates and eSigning capabilities. Our platform ensures that all necessary information is captured accurately, minimizing manual work. This efficiency allows users to focus on more important aspects of their business, especially during tax season.

-

Are there any costs associated with using airSlate SignNow for Form 1065 Schedule D?

Yes, airSlate SignNow offers flexible pricing plans to cater to different business needs. Our pricing is competitive, and we ensure that you get value for your investment when managing documents like Form 1065 Schedule D Fill In Capable Capital Gains And Losses. We also provide a free trial, allowing you to explore our features without any commitment.

-

Can I integrate airSlate SignNow with other accounting software for better efficiency?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your ability to manage Form 1065 Schedule D Fill In Capable Capital Gains And Losses efficiently. These integrations help automate data transfer and reduce manual entry, allowing for more streamlined workflows and fewer errors.

-

What features does airSlate SignNow offer for helping with tax forms?

airSlate SignNow offers a range of features designed to assist with tax forms, including reusable templates, collaboration tools, and secure eSigning. These features simplify how you fill in Form 1065 Schedule D Capable Capital Gains And Losses, making document management straightforward and error-free. With a focus on user experience, we ensure you spend less time on paperwork.

-

Is airSlate SignNow secure for managing sensitive data like tax information?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and secure access methods to protect your sensitive data, including information related to Form 1065 Schedule D Fill In Capable Capital Gains And Losses. You can trust that your documents are safe while utilizing our platform.

-

How does airSlate SignNow enhance collaboration on Form 1065 Schedule D?

With airSlate SignNow, collaboration on Form 1065 Schedule D Fill In Capable Capital Gains And Losses becomes much easier. Teams can comment, share, and edit documents in real-time, ensuring that everyone involved is on the same page and that the necessary data is captured accurately. This collaborative environment reduces errors and promotes efficient tax preparation.

Get more for Form 1065 Schedule D Fill In Capable Capital Gains And Losses

Find out other Form 1065 Schedule D Fill In Capable Capital Gains And Losses

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself