Form 1065 B Use the IRS Label

What is the Form 1065 B Use The IRS Label

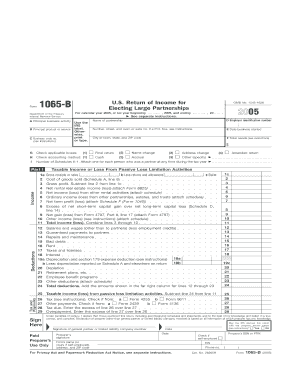

The Form 1065 B is a tax form used by partnerships to report income, deductions, gains, and losses to the Internal Revenue Service (IRS). This particular form is designed for electing large partnerships that meet specific criteria set by the IRS. The "Use The IRS Label" refers to the requirement that these partnerships must include specific information on the form to ensure compliance with IRS regulations. This includes details about the partnership's income, expenses, and other financial activities during the tax year.

How to use the Form 1065 B Use The IRS Label

Using the Form 1065 B involves several steps to ensure accurate reporting. First, partnerships must gather all necessary financial documents, including income statements and expense records. Next, the form must be filled out accurately, ensuring that all required fields are completed. It is essential to use the IRS label correctly, which includes providing the partnership's name, address, and taxpayer identification number. After completing the form, partnerships should review it for accuracy before submission.

Steps to complete the Form 1065 B Use The IRS Label

Completing the Form 1065 B involves a systematic approach:

- Gather all necessary financial documents, including income and expense reports.

- Fill out the partnership's name, address, and taxpayer identification number in the designated areas.

- Report income, deductions, and other financial information accurately in the appropriate sections.

- Double-check all entries for accuracy and completeness.

- Sign and date the form, ensuring that it is submitted by the filing deadline.

Filing Deadlines / Important Dates

The filing deadline for Form 1065 B typically falls on the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is crucial for partnerships to be aware of these deadlines to avoid penalties.

Legal use of the Form 1065 B Use The IRS Label

The legal use of Form 1065 B is essential for compliance with federal tax laws. Partnerships must file this form to report their financial activities accurately. Failure to file or incorrect filing can lead to penalties, including fines and interest on unpaid taxes. The IRS requires that partnerships maintain accurate records and submit the form in accordance with the established guidelines to avoid legal repercussions.

Required Documents

To complete the Form 1065 B, partnerships must have several key documents on hand:

- Financial statements, including profit and loss statements.

- Records of all income received during the tax year.

- Documentation of all deductions and expenses incurred.

- Previous year’s tax returns, if applicable.

Having these documents ready will facilitate a smoother completion process and ensure compliance with IRS requirements.

Quick guide on how to complete form 1065 b use the irs label

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based procedure today.

How to Alter and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or mask sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1065 B Use The IRS Label

Create this form in 5 minutes!

How to create an eSignature for the form 1065 b use the irs label

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1065 B Use The IRS Label?

Form 1065 B Use The IRS Label is a tax form for partnerships to report income, deductions, and other tax-related information. It's essential for ensuring compliance with IRS regulations and helps in accurately filing partnership tax returns.

-

How can airSlate SignNow help with Form 1065 B Use The IRS Label?

airSlate SignNow streamlines the process of completing and eSigning Form 1065 B Use The IRS Label. Our platform allows you to upload the document, fill it out electronically, and send it for signatures quickly, making tax season more efficient.

-

Is there a cost associated with using airSlate SignNow for Form 1065 B Use The IRS Label?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that best suits your requirements, ensuring you have the right features to manage Form 1065 B Use The IRS Label efficiently.

-

What features does airSlate SignNow offer for managing Form 1065 B Use The IRS Label?

With airSlate SignNow, you can easily create, edit, and send Form 1065 B Use The IRS Label for eSignature. Our features include document templates, secure cloud storage, and real-time tracking to ensure that your documents are handled seamlessly.

-

Are integrations available with airSlate SignNow for Form 1065 B Use The IRS Label?

Yes, airSlate SignNow integrates with various applications and systems to enhance your workflow for Form 1065 B Use The IRS Label. Popular integrations include CRM software, cloud storage solutions, and accounting platforms to ensure a smooth process.

-

What benefits does airSlate SignNow provide when handling Form 1065 B Use The IRS Label?

Using airSlate SignNow for Form 1065 B Use The IRS Label offers numerous benefits, including time savings, reduced paper usage, and enhanced document security. Our platform ensures you can focus on your business while we handle the paperwork.

-

Can I customize forms with airSlate SignNow when using Form 1065 B Use The IRS Label?

Absolutely! airSlate SignNow allows you to customize Form 1065 B Use The IRS Label according to your business preferences. You can add logos, modify fields, and specify signature requirements to ensure the form meets your needs.

Get more for Form 1065 B Use The IRS Label

Find out other Form 1065 B Use The IRS Label

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo