Form 1120, Fill in Capable U S Corporation Income Tax Return

What is the Form 1120, Fill In Capable U S Corporation Income Tax Return

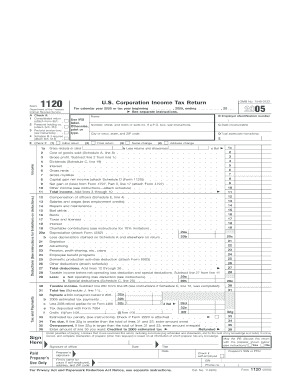

The Form 1120 is the U.S. Corporation Income Tax Return used by C corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their tax liability and ensure compliance with federal tax regulations. It is specifically designed for corporations operating in the United States and must be filed annually with the Internal Revenue Service (IRS). The form collects detailed financial information, including revenue, expenses, and tax payments, allowing corporations to fulfill their tax obligations accurately.

Steps to complete the Form 1120, Fill In Capable U S Corporation Income Tax Return

Completing Form 1120 involves several key steps:

- Gather financial documents: Collect all necessary financial records, including income statements, balance sheets, and previous tax returns.

- Fill out basic information: Enter the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report income: Complete the income section by listing all sources of revenue, including sales and interest income.

- Deduct expenses: Fill in the deductions section to account for business expenses, such as salaries, rent, and utilities.

- Calculate tax: Use the information provided to determine the corporation's taxable income and calculate the tax owed.

- Sign and date: Ensure that an authorized officer of the corporation signs and dates the form before submission.

How to obtain the Form 1120, Fill In Capable U S Corporation Income Tax Return

The Form 1120 can be obtained directly from the IRS website or through tax preparation software. Corporations may also request a physical copy by contacting the IRS or visiting a local IRS office. It is advisable to use the most current version of the form to ensure compliance with any recent tax law changes. Additionally, many tax professionals can provide the form as part of their services.

Filing Deadlines / Important Dates

Corporations must file Form 1120 by the 15th day of the fourth month after the end of their tax year. For most corporations operating on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can request a six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Key elements of the Form 1120, Fill In Capable U S Corporation Income Tax Return

Form 1120 contains several key sections that are crucial for accurate reporting:

- Income Section: This section requires detailed reporting of all income sources, including gross receipts and other income.

- Deductions Section: Corporations must list all allowable deductions, which can significantly affect taxable income.

- Tax Calculation: This part includes the computation of tax based on the taxable income reported.

- Signatures: An authorized officer must sign the form, affirming the accuracy of the information provided.

Legal use of the Form 1120, Fill In Capable U S Corporation Income Tax Return

Form 1120 is legally required for C corporations to report their income and pay taxes to the IRS. Failure to file the form accurately and on time can result in penalties, including fines and interest on unpaid taxes. It is essential for corporations to maintain accurate records and ensure that the form is completed in compliance with IRS regulations. Legal advisers often recommend consulting a tax professional to navigate complex tax laws and ensure proper filing.

Quick guide on how to complete form 1120 fill in capable u s corporation income tax return

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it digitally. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents rapidly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign [SKS] without hassle

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication throughout every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120, Fill In Capable U S Corporation Income Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 1120 fill in capable u s corporation income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120, Fill In Capable U S Corporation Income Tax Return?

Form 1120, Fill In Capable U S Corporation Income Tax Return, is a tax form that U.S. corporations use to report their income, gains, losses, deductions, and credits. This form is essential for corporations to compute their federal income tax liability. Filling it out accurately ensures compliance with IRS regulations and helps in avoiding penalties.

-

How does airSlate SignNow help with Form 1120, Fill In Capable U S Corporation Income Tax Return?

airSlate SignNow simplifies the process of filling out Form 1120, Fill In Capable U S Corporation Income Tax Return by providing an intuitive interface for document management. With features like eSignature capability and form templates, businesses can efficiently complete and submit their tax returns while ensuring all necessary details are accurately captured.

-

What are the pricing options for using airSlate SignNow with Form 1120?

airSlate SignNow offers various pricing plans designed to meet the needs of different businesses, whether small or large. These plans include features that support the efficient completion of Form 1120, Fill In Capable U S Corporation Income Tax Return, making it a cost-effective solution for all your document signing and management needs. Visit our pricing page for detailed options.

-

What features does airSlate SignNow offer for filling Form 1120?

airSlate SignNow provides a range of features that enhance the process of filling out Form 1120, Fill In Capable U S Corporation Income Tax Return. Key features include customizable templates, eSignatures, real-time collaboration, and secure cloud storage, allowing businesses to streamline their workflow and keep all tax documents organized.

-

Can airSlate SignNow integrate with accounting software for Form 1120?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage Form 1120, Fill In Capable U S Corporation Income Tax Return. These integrations allow for better data syncing, ensuring that all financial information is accurately represented on the tax form and reducing the chances of errors.

-

What are the benefits of using airSlate SignNow for Form 1120?

Using airSlate SignNow for Form 1120, Fill In Capable U S Corporation Income Tax Return, presents several benefits including time savings, improved accuracy, and enhanced security. The platform automates many tasks involved in document preparation, allowing users to focus on other important aspects of their business while ensuring compliance and protecting sensitive information.

-

Is airSlate SignNow secure for processing Form 1120?

Absolutely, airSlate SignNow adheres to strict security protocols to ensure that all documents, including Form 1120, Fill In Capable U S Corporation Income Tax Return, are processed securely. With encryption, secure access controls, and data compliance standards, businesses can confidently use airSlate SignNow for their sensitive tax filing needs.

Get more for Form 1120, Fill In Capable U S Corporation Income Tax Return

- Application for emergency detention form

- Neurologist job applications forms

- For the kidz registration and waiver form

- Jeremiahs italian ice employment application form

- Sensory checklist for adults pdf form

- Opt ft 1004 prize form

- Data exchange check casher ms l120 form

- Medical release form www allergy table

Find out other Form 1120, Fill In Capable U S Corporation Income Tax Return

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form