Form 872 Department of the Treasury Internal Revenue Service in Reply Refer to Taxpayer Identification Number Rev

What is the Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev

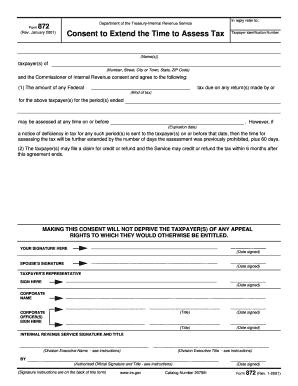

The Form 872 is a document issued by the Department of the Treasury Internal Revenue Service (IRS) that serves as a consent form for extending the time to assess tax. This form is particularly relevant for taxpayers who may be under audit or investigation. It allows the IRS to extend the statute of limitations for tax assessments, enabling them to review and finalize any tax liabilities. The reference to the Taxpayer Identification Number (TIN) ensures that the form is accurately associated with the correct taxpayer, safeguarding personal and financial information.

How to use the Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev

Using Form 872 involves a straightforward process. Taxpayers must fill out the form with their personal information, including their Taxpayer Identification Number. After completing the form, it should be signed and dated. Once signed, the form is submitted to the IRS as part of the correspondence regarding the tax assessment. It is essential to ensure that all information is accurate to avoid delays in processing or potential issues with the IRS.

Steps to complete the Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev

Completing Form 872 requires careful attention to detail. Here are the steps to follow:

- Begin by entering your name and address in the designated fields.

- Provide your Taxpayer Identification Number accurately to ensure proper identification.

- Indicate the tax year or years for which you are granting the extension.

- Sign and date the form to validate your consent.

- Review the completed form for any errors before submission.

Legal use of the Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev

The legal use of Form 872 is crucial for both taxpayers and the IRS. By signing this form, taxpayers consent to extend the time for the IRS to assess taxes, which can be beneficial during audits or disputes. It is legally binding, meaning that once signed, the taxpayer cannot withdraw consent without the IRS's approval. Understanding the implications of this form is essential for compliance and to avoid any legal complications.

Key elements of the Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev

Key elements of Form 872 include:

- Taxpayer Information: Essential details such as name, address, and TIN.

- Tax Year: Specification of the tax year(s) for which the extension applies.

- Signature: The taxpayer's signature is required to validate the form.

- Date: The date of signing is important for the timeline of the extension.

Form Submission Methods

Form 872 can be submitted to the IRS through various methods, ensuring flexibility for taxpayers. The primary submission methods include:

- Mail: Taxpayers can print the completed form and send it to the appropriate IRS address.

- In-Person: Some taxpayers may choose to deliver the form directly to their local IRS office.

Quick guide on how to complete form 872 department of the treasury internal revenue service in reply refer to taxpayer identification number rev

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed papers, allowing you to find the correct form and securely keep it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents quickly and without delays. Handle [SKS] on any platform using airSlate SignNow’s Android or iOS applications and streamline your document processes today.

The simplest way to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the features we provide to complete your form.

- Highlight essential sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, laborious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Edit and eSign [SKS] to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev

Create this form in 5 minutes!

How to create an eSignature for the form 872 department of the treasury internal revenue service in reply refer to taxpayer identification number rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev.?

Form 872 is a consent form provided by the Department of the Treasury and the Internal Revenue Service. It allows taxpayers to extend the statute of limitations on tax assessments. This is crucial for individuals and businesses to manage their tax obligations effectively.

-

How can airSlate SignNow help with signing Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev.?

airSlate SignNow offers a convenient platform for electronically signing Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev. You can upload the form, add signatures, and send it to recipients seamlessly, ensuring compliance and reducing paperwork.

-

What are the pricing options for using airSlate SignNow for Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev.?

airSlate SignNow provides various pricing plans tailored to meet business needs. Each plan includes features that allow for easy signing and handling of important documents like Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev. Check our website for the latest pricing details.

-

Are there any special features in airSlate SignNow for handling tax forms like Form 872?

Yes, airSlate SignNow includes specific features designed for tax forms, including customizable templates, document tracking, and automated reminders. These features enhance the efficiency of managing Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev. and improve overall compliance.

-

Can I integrate airSlate SignNow with other software for managing Form 872?

Absolutely! airSlate SignNow supports integrations with various applications, including CRM systems and document management software. This allows you to streamline your workflow and handle Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev. efficiently alongside your other business processes.

-

What benefits can I expect by using airSlate SignNow for Form 872?

By using airSlate SignNow for Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev., you benefit from increased efficiency, reduced processing time, and the ability to manage documents from anywhere. Additionally, electronic signature solutions help ensure that your forms are securely signed and stored.

-

Is airSlate SignNow legally compliant for signing tax forms like Form 872?

Yes, airSlate SignNow complies with e-signature laws such as ESIGN and UETA, making it legally acceptable for signing documents like Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev. This compliance ensures that your electronically signed forms hold up in legal scenarios.

Get more for Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev

- Service particulars format 100295595

- Chapter 8 quadratic graphs and their attributes features answer key form

- Authorized relative certification form

- Beih20 form

- La serenissima rond veneziano spartito pdf form

- Frankfort beautification award form

- Prescription referral form

- Ktrs change of address form kentucky teachersamp39 retirement ktrs ky

Find out other Form 872 Department Of The Treasury Internal Revenue Service In Reply Refer To Taxpayer Identification Number Rev

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free