Schedule a Form 990 or 990 EZ

What is the Schedule A Form 990 or 990 EZ

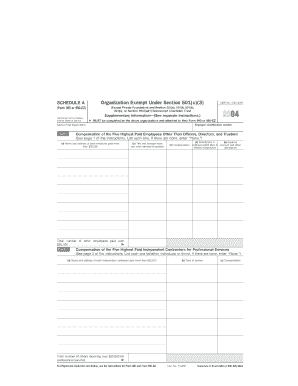

The Schedule A Form 990 or 990 EZ is a crucial document used by tax-exempt organizations in the United States to provide detailed information about their public charity status. This form is part of the Internal Revenue Service (IRS) Form 990 series, which organizations must file annually to maintain their tax-exempt status. The Schedule A helps the IRS and the public understand how an organization qualifies as a public charity, detailing aspects such as its sources of revenue and the types of activities it engages in. Nonprofits use this form to report their financial activities, ensuring transparency and accountability in their operations.

How to Use the Schedule A Form 990 or 990 EZ

Using the Schedule A Form 990 or 990 EZ involves several steps. Organizations must first determine if they are required to file this schedule based on their public charity status. Once confirmed, they should gather necessary financial information, including revenue sources and program expenses. The form requires organizations to disclose their public support test results, which assess whether they meet the IRS's criteria for public charity status. After completing the form, organizations must file it along with their main Form 990 or 990 EZ, ensuring all information is accurate and comprehensive to avoid penalties.

Steps to Complete the Schedule A Form 990 or 990 EZ

Completing the Schedule A Form 990 or 990 EZ involves a systematic approach:

- Gather financial documents: Collect all relevant financial records, including income statements and balance sheets.

- Determine public support: Calculate the total support received from contributions, grants, and other sources.

- Complete the form: Fill out the required sections, including the public support test and revenue sources.

- Review for accuracy: Double-check all entries for correctness and completeness.

- File the form: Submit the completed Schedule A along with the main Form 990 or 990 EZ by the deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule A Form 990 or 990 EZ align with the deadlines for the main Form 990. Generally, organizations must file their forms by the 15th day of the fifth month after the end of their tax year. For example, if an organization operates on a calendar year, the filing deadline would be May 15. Organizations can apply for a six-month extension, but they must file Form 8868 to request this extension. It is essential to adhere to these deadlines to avoid penalties and maintain compliance with IRS regulations.

Key Elements of the Schedule A Form 990 or 990 EZ

Several key elements are integral to the Schedule A Form 990 or 990 EZ:

- Public support test: This section evaluates the organization's public support to determine if it qualifies as a public charity.

- Revenue sources: Organizations must disclose their income sources, including contributions, grants, and program service revenue.

- Exempt activities: The form requires details about the exempt activities the organization conducts to further its charitable purposes.

- Financial statements: Organizations must provide financial statements that reflect their overall financial health and operations.

Legal Use of the Schedule A Form 990 or 990 EZ

The Schedule A Form 990 or 990 EZ serves a legal purpose by ensuring compliance with federal tax laws governing tax-exempt organizations. By accurately completing and filing this form, organizations demonstrate their adherence to IRS regulations, which is essential for maintaining their tax-exempt status. Failure to file or inaccuracies in the form can lead to penalties, loss of tax-exempt status, or increased scrutiny from the IRS. Therefore, it is vital for organizations to understand the legal implications of this form and to ensure that all information provided is truthful and complete.

Quick guide on how to complete schedule a form 990 or 990 ez

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents promptly without any holdups. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Alter and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule A Form 990 Or 990 EZ

Create this form in 5 minutes!

How to create an eSignature for the schedule a form 990 or 990 ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Schedule A Form 990 Or 990 EZ using airSlate SignNow?

To Schedule A Form 990 Or 990 EZ with airSlate SignNow, you simply need to upload your document, add the required signatures and fields, and send it for eSignature. Our intuitive interface assists you through each step, ensuring compliance with IRS requirements. Additionally, our platform allows you to track the status of your forms in real-time.

-

What features does airSlate SignNow offer for scheduling Form 990 Or 990 EZ?

airSlate SignNow provides a range of features for scheduling Form 990 Or 990 EZ, including customizable templates, automated reminders, and seamless integrations with various accounting software. Our platform also supports bulk sending, enabling you to manage multiple filings efficiently. With cloud storage, you can access your documents anytime, anywhere.

-

How can I ensure compliance while Scheduling A Form 990 Or 990 EZ?

To ensure compliance when Scheduling A Form 990 Or 990 EZ, airSlate SignNow offers built-in compliance features that adhere to IRS guidelines. We provide tips and resources on correctly filling out forms and maintaining digital signatures' legality. Our platform also logs every action taken, giving you a clear audit trail.

-

What is the pricing structure for using airSlate SignNow to Schedule A Form 990 Or 990 EZ?

airSlate SignNow offers flexible pricing plans tailored for different business needs, including plans specifically designed for nonprofits. You can choose a plan that best fits your volume of forms needed to schedule A Form 990 Or 990 EZ, and all plans come with a free trial. This empowers you to test our features without commitment.

-

Can I integrate airSlate SignNow with other accounting software for Form 990 Or 990 EZ scheduling?

Yes, airSlate SignNow seamlessly integrates with various accounting software like QuickBooks, Xero, and others, which simplifies the process of scheduling A Form 990 Or 990 EZ. These integrations allow you to pull data directly from your accounting systems, reducing the need for manual entry. This enhances accuracy and saves time.

-

What are the benefits of using airSlate SignNow to Schedule A Form 990 Or 990 EZ?

Using airSlate SignNow to Schedule A Form 990 Or 990 EZ offers numerous benefits, including reducing processing time and paper waste. Our electronic signature solution is swift and secure, ensuring that your documents are signed and delivered efficiently. Plus, our easy-to-use platform allows you to manage and track your forms hassle-free.

-

Is there customer support available for assistance with Scheduling A Form 990 Or 990 EZ?

Absolutely! airSlate SignNow provides comprehensive customer support for users needing assistance with Scheduling A Form 990 Or 990 EZ. Our support team is available via chat, email, and phone to guide you through any challenges you may encounter. Additionally, our online resources include tutorials and FAQs for quick help.

Get more for Schedule A Form 990 Or 990 EZ

- Wellcare eft form

- Employee requisition form

- Northeast ohio communicable disease reporting form

- Fishing tournament registration form 25511422

- 470 3826 request for fip beyond 60 months iowa department of dhs iowa form

- Naptosa online application form

- Smouldering charcoal book pdf no no download needed needed form

- Xnx x form

Find out other Schedule A Form 990 Or 990 EZ

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template