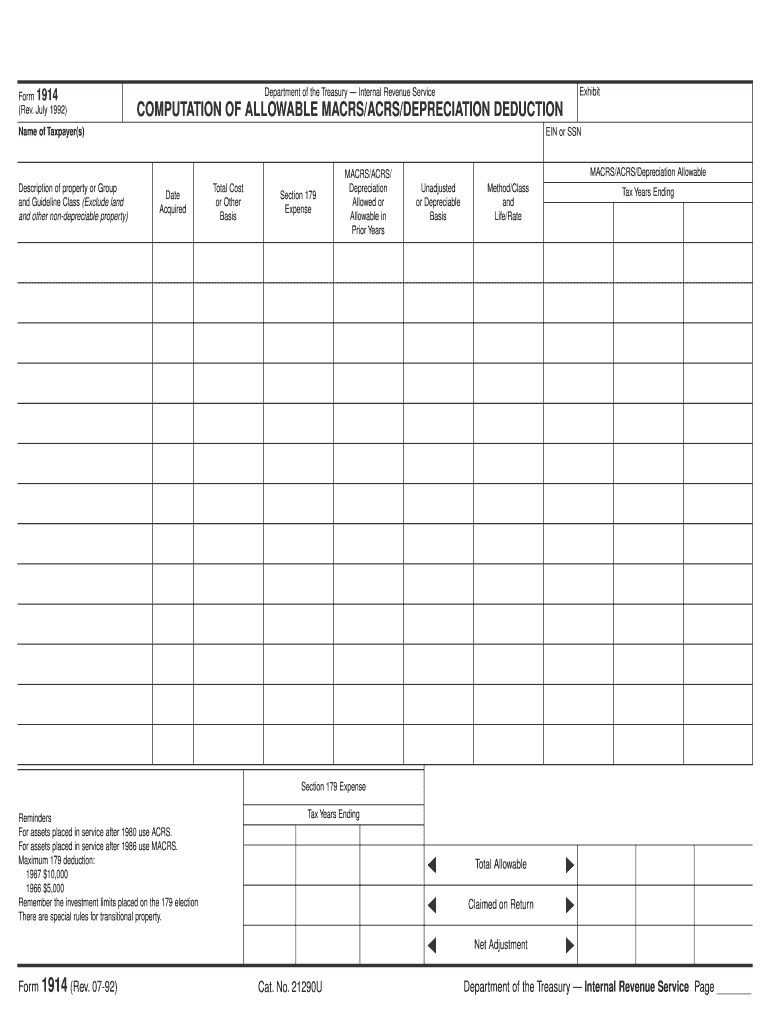

July Name of Taxpayers Department of the Treasury Internal Revenue Service Exhibit COMPUTATION of ALLOWABLE MACRSACRSDEPRECIATIO Form

Understanding the July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit

The July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit is a crucial document for taxpayers seeking to compute allowable MACRS (Modified Accelerated Cost Recovery System) or ACRS (Accelerated Cost Recovery System) depreciation deductions. This form provides detailed guidelines on how to accurately report depreciation for tax purposes, ensuring compliance with IRS regulations. It is particularly important for businesses and individuals who have made significant capital investments in property or equipment.

Steps to Complete the Computation of Allowable Depreciation Deduction

Completing the computation of allowable MACRS or ACRS depreciation deduction involves several key steps:

- Gather all relevant financial documents, including purchase invoices and prior year tax returns.

- Determine the type of property being depreciated and its classification under IRS guidelines.

- Calculate the depreciation for the current year based on the applicable MACRS or ACRS method.

- Document any depreciation deductions claimed in prior years to ensure accurate reporting.

- Fill out the form with the calculated depreciation amounts and any required identification information, such as EIN or SSN.

Legal Use of the Depreciation Deduction Exhibit

The legal use of the July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit is essential for ensuring compliance with federal tax laws. Taxpayers must use this form to substantiate their claims for depreciation deductions on their tax returns. Proper documentation and adherence to IRS guidelines can help prevent audits and potential penalties for non-compliance.

Key Elements of the Depreciation Deduction Exhibit

Several key elements are essential for understanding the July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit:

- Identification Information: Taxpayers must provide their EIN or SSN to associate the deductions with their tax records.

- Property Classification: The form requires taxpayers to classify their property correctly to apply the correct depreciation method.

- Prior Year Deductions: Taxpayers need to report any depreciation deductions claimed in previous years to maintain accurate records.

Examples of Using the Depreciation Deduction Exhibit

Examples of using the July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit include:

- A small business purchasing new equipment can use this form to calculate and claim depreciation on their taxes.

- An individual taxpayer who has made improvements to rental property can report depreciation using this exhibit.

- Corporations with significant capital assets can utilize the form to ensure they maximize their allowable depreciation deductions.

Filing Deadlines and Important Dates

It is critical to be aware of filing deadlines associated with the July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit. Typically, taxpayers must submit their depreciation calculations along with their annual tax returns. Missing these deadlines can result in penalties or loss of deductions, so keeping track of important dates is essential for compliance.

Quick guide on how to complete july name of taxpayers department of the treasury internal revenue service exhibit computation of allowable

Complete [SKS] effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, adjust, and eSign your documents swiftly without delays. Handle [SKS] on any system with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to alter and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details, then click on the Done button to save your changes.

- Choose how you wish to send your form: by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device of your liking. Modify and eSign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the july name of taxpayers department of the treasury internal revenue service exhibit computation of allowable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit COMPUTATION OF ALLOWABLE MACRSACRSDEPRECIATION DEDUCTION EIN Or SSN MACRSACRS Depreciation Allowed Or Allowable In Prior Years?

airSlate SignNow is a user-friendly eSigning solution that streamlines document signing and management. It serves businesses needing to efficiently process documents while also ensuring compliance with requirements like those outlined in the July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit COMPUTATION OF ALLOWABLE MACRSACRSDEPRECIATION DEDUCTION EIN Or SSN MACRSACRS Depreciation Allowed Or Allowable In Prior Years.

-

Can airSlate SignNow help with tax document management?

Yes, airSlate SignNow is designed to help businesses manage their tax documents efficiently. Utilizing our platform ensures that crucial tax-related documents, including those referencing the July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit COMPUTATION OF ALLOWABLE MACRSACRSDEPRECIATION DEDUCTION EIN Or SSN MACRSACRS Depreciation Allowed Or Allowable In Prior Years, are signed securely and stored in compliance with regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet different business needs. Our pricing structures can accommodate various requirements, including those for managing documents associated with the July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit COMPUTATION OF ALLOWABLE MACRSACRSDEPRECIATION DEDUCTION EIN Or SSN MACRSACRS Depreciation Allowed Or Allowable In Prior Years.

-

What features does airSlate SignNow provide for document security?

airSlate SignNow prioritizes document security with advanced encryption protocols that keep your documents safe. This is particularly important when managing sensitive tax documents outlined in the July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit COMPUTATION OF ALLOWABLE MACRSACRSDEPRECIATION DEDUCTION EIN Or SSN MACRSACRS Depreciation Allowed Or Allowable In Prior Years.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with various popular software applications, helping streamline your workflow. These integrations can assist in managing approvals and documents related to the July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit COMPUTATION OF ALLOWABLE MACRSACRSDEPRECIATION DEDUCTION EIN Or SSN MACRSACRS Depreciation Allowed Or Allowable In Prior Years.

-

How does airSlate SignNow enhance productivity for businesses?

airSlate SignNow enhances productivity by automating document workflows and facilitating quick eSigning. This efficiency is crucial for handling tax documents that fall under the July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit COMPUTATION OF ALLOWABLE MACRSACRSDEPRECIATION DEDUCTION EIN Or SSN MACRSACRS Depreciation Allowed Or Allowable In Prior Years.

-

Is airSlate SignNow suitable for both small and large businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes. Whether you're a small startup or a large corporation handling extensive tax filings related to the July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit COMPUTATION OF ALLOWABLE MACRSACRSDEPRECIATION DEDUCTION EIN Or SSN MACRSACRS Depreciation Allowed Or Allowable In Prior Years, our solution can adapt to your needs.

Get more for July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit COMPUTATION OF ALLOWABLE MACRSACRSDEPRECIATIO

- Kisumu county bursary form kisumu county bursary form a3c bestbooks

- Vsf z 08 03 abs 1 form

- Eviction notice oregon form

- Cms signature log template 421242136 form

- Quartz prior authorization list form

- 16 rental form for scuba diving equipment divers training

- Macomb county friend of the court form

- Aw 501 form

Find out other July Name Of Taxpayers Department Of The Treasury Internal Revenue Service Exhibit COMPUTATION OF ALLOWABLE MACRSACRSDEPRECIATIO

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation