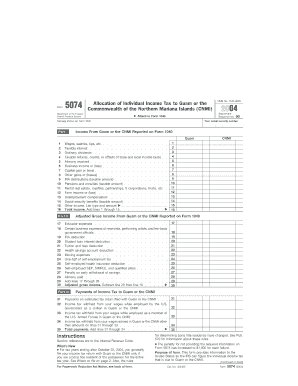

Form 5074 Allocation of Individual Income Tax to Guam or the Commonwealth of the Northern Mariana Islands CNMI Attach to Form 10

Understanding Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI

Form 5074 is a critical document for U.S. taxpayers who have income sourced from Guam or the Commonwealth of the Northern Mariana Islands (CNMI). This form is used to allocate individual income tax to these territories when filing your federal income tax return using Form 1040. It ensures that the correct amount of tax is attributed to income earned in these areas, which may have different tax rates and regulations compared to the mainland United States.

Steps to Complete Form 5074

Completing Form 5074 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and any previous tax returns. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. You will also need to detail your income earned in Guam or CNMI, as well as any taxes paid to these territories. Finally, review your entries for accuracy before attaching the completed form to your Form 1040 when filing your federal tax return.

Obtaining Form 5074

Form 5074 can be obtained directly from the Internal Revenue Service (IRS) website or through tax preparation software that includes this form. It is essential to ensure you have the most current version of the form to avoid any issues during filing. If you prefer a physical copy, you can also request it by mail from the IRS or visit a local IRS office for assistance.

Legal Use of Form 5074

The legal use of Form 5074 is essential for taxpayers who earn income in Guam or CNMI. It is required to accurately report and allocate income tax to these territories, ensuring compliance with both federal and local tax laws. Failure to use this form correctly may result in penalties or incorrect tax assessments. It is advisable to consult with a tax professional if you have questions about your specific situation.

Key Elements of Form 5074

Form 5074 includes several key elements that taxpayers must complete. These elements typically consist of personal identification information, income details from Guam or CNMI, and the calculation of taxes owed. Additionally, it requires taxpayers to provide information on any credits or deductions that may apply to their situation. Understanding these components is crucial for accurate tax reporting.

Filing Deadlines for Form 5074

Taxpayers must adhere to specific filing deadlines when submitting Form 5074. Generally, this form should be filed along with your Form 1040 by the standard tax filing deadline, which is typically April 15. However, if you are unable to meet this deadline, you may request an extension. It is important to be aware of any changes to deadlines, especially for taxpayers in Guam or CNMI, as local regulations may differ.

Quick guide on how to complete form 5074 allocation of individual income tax to guam or the commonwealth of the northern mariana islands cnmi attach to form

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an optimal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delay. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize important sections of the documents or conceal sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information carefully and click on the Done button to save your changes.

- Choose how you wish to share your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiring form searches, or errors that necessitate reprinting document copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Modify and eSign [SKS] to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI Attach To Form 10

Create this form in 5 minutes!

How to create an eSignature for the form 5074 allocation of individual income tax to guam or the commonwealth of the northern mariana islands cnmi attach to form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI?

Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI is a tax form used by individuals who want to allocate their income tax between Guam or CNMI and the United States. This form should be attached to Form 1040 when filing your federal income tax return to ensure proper allocation of tax liabilities.

-

How can airSlate SignNow help with completing Form 5074?

airSlate SignNow streamlines the process of completing Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI Attach To Form 1040. With its intuitive interface and document templates, users can easily manage their tax forms and ensure all needed sections are filled out accurately.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features like eSigning, document sharing, and customized templates, which can simplify the management of Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI Attach To Form 1040. These tools help ensure that tax documents are properly filled, signed, and sent promptly.

-

Is airSlate SignNow cost-effective for businesses dealing with tax forms?

Yes, airSlate SignNow provides an affordable solution for businesses needing to handle various tax forms, including Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI Attach To Form 1040. The competitive pricing plans allow businesses of all sizes to benefit from eSigning and document management services.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and document management software, making it easy to incorporate Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI Attach To Form 1040 into your existing workflows. This integration ensures that all your documentation stays organized and accessible.

-

What are the benefits of using airSlate SignNow for tax form management?

Using airSlate SignNow for managing your tax forms, such as Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI Attach To Form 1040, offers numerous benefits. These include increased efficiency, enhanced security, and the ability to track document progress, which helps avoid delays in your tax submissions.

-

Are there any specific instructions for filling out Form 5074?

Yes, there are specific instructions for completing Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI Attach To Form 1040. Ensure you carefully read the guidelines provided by the IRS to allocate your income taxes accurately between the jurisdictions involved, and consider using airSlate SignNow for ease and accuracy.

Get more for Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI Attach To Form 10

Find out other Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI Attach To Form 10

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later