Form 8716 Rev March

What is the Form 8716 Rev March

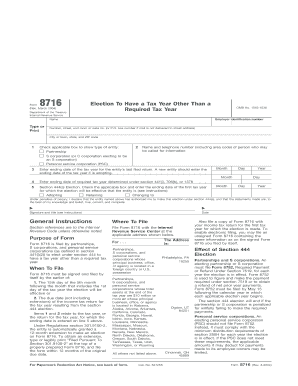

The Form 8716 Rev March is an IRS document primarily used by corporations to make an election under section 1362 of the Internal Revenue Code. This election allows a corporation to be treated as an S corporation, which can provide tax benefits, including the avoidance of double taxation on corporate income. The form must be completed accurately to ensure compliance with IRS regulations and to secure the desired tax treatment.

How to use the Form 8716 Rev March

To use the Form 8716 Rev March effectively, a corporation must first determine its eligibility to elect S corporation status. Once eligibility is confirmed, the corporation should fill out the form with accurate information regarding its name, address, and tax identification number. The completed form must then be submitted to the IRS by the specified deadline to ensure the election is valid for the current tax year.

Steps to complete the Form 8716 Rev March

Completing the Form 8716 Rev March involves several key steps:

- Gather necessary information, including the corporation's name, address, and tax identification number.

- Review the eligibility criteria for S corporation status to ensure compliance.

- Fill out the form, ensuring all sections are completed accurately.

- Sign and date the form, confirming the information is correct.

- Submit the form to the IRS by the designated deadline, either electronically or via mail.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8716 Rev March are crucial for maintaining S corporation status. Typically, the form must be filed by the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. Missing this deadline can result in the loss of S corporation status for that tax year.

Key elements of the Form 8716 Rev March

The Form 8716 Rev March includes several important elements that must be completed accurately:

- Corporation Information: Name, address, and tax identification number.

- Election Statement: A clear declaration of the corporation's intention to elect S corporation status.

- Signature: An authorized officer must sign the form to validate the election.

- Tax Year: Indicate the tax year for which the election is being made.

Legal use of the Form 8716 Rev March

The legal use of the Form 8716 Rev March is governed by IRS regulations. Corporations must ensure that they meet all eligibility requirements and file the form within the specified timeframe. Failure to comply with these regulations can lead to penalties, including the denial of S corporation status, which may result in unfavorable tax consequences.

Quick guide on how to complete form 8716 rev march

Manage [SKS] with ease on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely keep them online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The simplest method to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the stress of lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8716 Rev March

Create this form in 5 minutes!

How to create an eSignature for the form 8716 rev march

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8716 Rev March and why is it important?

Form 8716 Rev March is a request for an extension of time to file specific tax returns. Understanding this form is crucial for businesses who need to manage their tax obligations efficiently. Using tools like airSlate SignNow can simplify the signing and submission process for this important document.

-

How does airSlate SignNow assist with Form 8716 Rev March?

airSlate SignNow provides an easy-to-use platform to electronically sign Form 8716 Rev March. This service streamlines the process, ensuring that the form is securely signed and sent, reducing the risk of errors or delays in submission.

-

What features does airSlate SignNow offer for managing Form 8716 Rev March?

AirSlate SignNow offers features like templates, document tracking, and automatic reminders, which are essential for managing Form 8716 Rev March effectively. These features help ensure that users can fill out, sign, and submit the form without hassles.

-

Is airSlate SignNow affordable for small businesses needing Form 8716 Rev March?

Yes, airSlate SignNow offers cost-effective pricing plans, making it accessible for small businesses to manage documents like Form 8716 Rev March. The flexible pricing structure allows businesses to choose a plan that best fits their needs and budget.

-

Can I integrate airSlate SignNow with other tools to manage Form 8716 Rev March more effectively?

Absolutely! airSlate SignNow offers integrations with various applications, enabling seamless management of Form 8716 Rev March alongside other business tools. This flexibility enhances workflow efficiency and document management.

-

What are the benefits of using airSlate SignNow for Form 8716 Rev March?

Using airSlate SignNow for Form 8716 Rev March offers numerous benefits, including enhanced security, faster turnaround times, and easy access from any device. These advantages make the document signing process more efficient and reliable for businesses.

-

How secure is the electronic signing process for Form 8716 Rev March with airSlate SignNow?

AirSlate SignNow ensures that the electronic signing process for Form 8716 Rev March is secure and compliant with legal standards. The platform uses advanced encryption and authentication protocols to protect sensitive information throughout the process.

Get more for Form 8716 Rev March

Find out other Form 8716 Rev March

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure