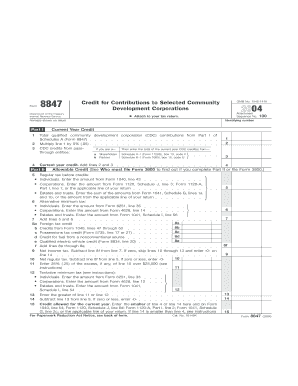

Form 8847 Credit for Contributions to Selected Community Development Corporations Attach to Your Tax Return

What is the Form 8847 Credit For Contributions To Selected Community Development Corporations Attach To Your Tax Return

The Form 8847 is a tax form used by individuals and businesses to claim a credit for contributions made to selected community development corporations (CDCs). This credit is designed to encourage donations that support community development initiatives, particularly in low-income areas. By completing and attaching this form to your tax return, taxpayers can reduce their overall tax liability, making it a valuable tool for those who wish to support their communities while benefiting financially.

How to use the Form 8847 Credit For Contributions To Selected Community Development Corporations Attach To Your Tax Return

Using Form 8847 involves several steps. First, you must gather documentation of your contributions to eligible community development corporations. Next, complete the form by providing details such as the amount contributed and the name of the CDC. After filling out the form, it must be attached to your tax return when you file. Ensure that all information is accurate to avoid delays in processing your credit.

Steps to complete the Form 8847 Credit For Contributions To Selected Community Development Corporations Attach To Your Tax Return

Completing Form 8847 requires careful attention to detail. Follow these steps:

- Collect all receipts and documentation related to your contributions to selected CDCs.

- Fill in your personal information, including your name, address, and Social Security number.

- Enter the total amount of contributions made during the tax year.

- Indicate the name and address of each community development corporation you contributed to.

- Review the completed form for accuracy and completeness.

- Attach the form to your tax return before submission.

Eligibility Criteria

To qualify for the credit on Form 8847, taxpayers must meet specific eligibility criteria. Contributions must be made to a qualified community development corporation recognized by the IRS. Additionally, the contributions must be cash or property donations made during the tax year for which the credit is being claimed. It is essential to verify that the CDC is eligible to ensure that your contributions qualify for the credit.

Required Documents

When filing Form 8847, certain documents are necessary to substantiate your claims. These include:

- Receipts or acknowledgments from the community development corporations for the contributions made.

- Your tax return, as the form must be attached when filing.

- Any additional documentation that supports the eligibility of the CDC.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with Form 8847. Generally, the form must be submitted alongside your annual tax return, which is typically due on April 15 of each year. If you are unable to meet this deadline, you may request an extension, but ensure that the form is still submitted by the extended deadline to avoid penalties.

Quick guide on how to complete form 8847 credit for contributions to selected community development corporations attach to your tax return

Complete [SKS] effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to craft, modify, and eSign your documents promptly without complications. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to initiate the process.

- Make use of the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that function.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8847 credit for contributions to selected community development corporations attach to your tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8847 Credit For Contributions To Selected Community Development Corporations?

The Form 8847 Credit For Contributions To Selected Community Development Corporations is a tax credit that incentivizes contributions to qualifying community development corporations. Businesses and individuals can claim this credit when they attach it to their tax return, helping to support initiatives that promote economic growth in underserved areas.

-

How can airSlate SignNow help with Form 8847 submissions?

airSlate SignNow offers a streamlined platform for electronically signing and submitting documents, including the Form 8847 Credit For Contributions To Selected Community Development Corporations Attach To Your Tax Return. Our user-friendly interface ensures that you can prepare and send documents quickly and efficiently, making the process hassle-free.

-

What are the key benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your tax-related documents, including the Form 8847 Credit For Contributions To Selected Community Development Corporations Attach To Your Tax Return, provides numerous benefits. These include increased efficiency, reduced paperwork, and enhanced security, ensuring that your sensitive tax information is handled with care.

-

Are there any costs associated with using airSlate SignNow for filing Form 8847?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. These plans are cost-effective, allowing you to manage all your document signing needs, including the Form 8847 Credit For Contributions To Selected Community Development Corporations Attach To Your Tax Return, without breaking the bank.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow offers robust features like customizable templates, in-app notifications, and secure cloud storage for your documents. These features help streamline the process of managing tax-related documents such as the Form 8847 Credit For Contributions To Selected Community Development Corporations Attach To Your Tax Return and enhance overall productivity.

-

Can airSlate SignNow integrate with other platforms for filing taxes?

Yes, airSlate SignNow can seamlessly integrate with various accounting and tax software platforms. This means that you can directly enhance your workflow when handling documents relevant to the Form 8847 Credit For Contributions To Selected Community Development Corporations Attach To Your Tax Return, making tax filing more efficient.

-

Is airSlate SignNow secure for submitting sensitive tax information?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that your sensitive tax information, including the Form 8847 Credit For Contributions To Selected Community Development Corporations Attach To Your Tax Return, is kept safe during storage and transmission.

Get more for Form 8847 Credit For Contributions To Selected Community Development Corporations Attach To Your Tax Return

- Surat pengesahan majikan pdf form

- Research grant application example form

- No download needed ept camla form

- High school athletic booster club membership form

- Checks and balances worksheet form

- Baseball player information sheet

- Usda home loan prequalification worksheet online form

- Pdf fillable capa form

Find out other Form 8847 Credit For Contributions To Selected Community Development Corporations Attach To Your Tax Return

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template