Usda Home Loan Prequalification Worksheet Online Form

What is the USDA Home Loan Prequalification Worksheet Online Form

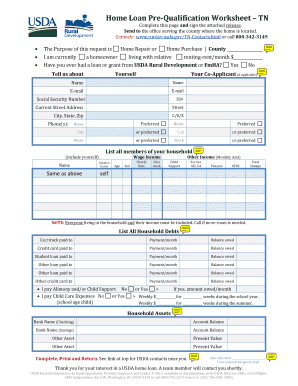

The USDA Home Loan Prequalification Worksheet Online Form is a digital document designed for individuals seeking to determine their eligibility for USDA home loans. This form collects essential financial information, helping potential borrowers assess their qualifications for rural development loans backed by the United States Department of Agriculture. By completing this online form, applicants can streamline the prequalification process, making it easier to understand their borrowing capacity and the types of properties they may be eligible to purchase.

How to Use the USDA Home Loan Prequalification Worksheet Online Form

Using the USDA Home Loan Prequalification Worksheet Online Form involves several straightforward steps. First, access the form through a secure digital platform. Next, input required personal and financial information, such as income, debts, and credit history. After completing the form, review all entries for accuracy. Finally, submit the form electronically. This process ensures that your information is securely transmitted and can be quickly reviewed by lenders, expediting your prequalification.

Key Elements of the USDA Home Loan Prequalification Worksheet Online Form

Several key elements must be included in the USDA Home Loan Prequalification Worksheet Online Form to ensure a comprehensive evaluation. These elements typically consist of:

- Personal Information: Name, address, and contact details.

- Income Details: Monthly income from all sources, including employment and any additional income streams.

- Debt Obligations: A list of current debts, such as credit cards, student loans, and mortgages.

- Credit History: Information regarding your credit score and any past financial issues.

Providing accurate information in these sections is crucial for an effective prequalification assessment.

Steps to Complete the USDA Home Loan Prequalification Worksheet Online Form

Completing the USDA Home Loan Prequalification Worksheet Online Form involves a series of steps to ensure thoroughness and accuracy:

- Access the online form through a secure website.

- Enter your personal information accurately, including your full name and address.

- Provide details about your income, ensuring all sources are included.

- List your current debt obligations to give a complete picture of your financial situation.

- Review the information for any errors or omissions.

- Submit the completed form securely.

Following these steps will help facilitate a smooth prequalification process.

Legal Use of the USDA Home Loan Prequalification Worksheet Online Form

The USDA Home Loan Prequalification Worksheet Online Form is legally recognized as a valid document when completed and submitted according to established guidelines. For the form to be considered legally binding, it must adhere to the requirements set forth by relevant eSignature laws, such as ESIGN and UETA. This ensures that the digital submission is treated with the same legal standing as a paper document, provided that the necessary security measures are in place.

Eligibility Criteria for the USDA Home Loan Prequalification Worksheet Online Form

To qualify for a USDA home loan, applicants must meet specific eligibility criteria outlined in the USDA guidelines. These criteria typically include:

- Location: The property must be situated in a designated rural area.

- Income Limits: The applicant's income must not exceed the maximum limits set for their household size.

- Creditworthiness: A satisfactory credit history, usually a minimum credit score, is required.

- Citizenship: Applicants must be U.S. citizens or have eligible non-citizen status.

Meeting these criteria is essential for successful prequalification and loan approval.

Quick guide on how to complete usda home loan prequalification worksheet online form

Complete Usda Home Loan Prequalification Worksheet Online Form effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct document and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without interruptions. Manage Usda Home Loan Prequalification Worksheet Online Form on any gadget using the airSlate SignNow applications for Android or iOS and optimize your document-related tasks today.

How to modify and electronically sign Usda Home Loan Prequalification Worksheet Online Form with ease

- Locate Usda Home Loan Prequalification Worksheet Online Form and click Get Form to begin.

- Use the resources we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature utilizing the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Usda Home Loan Prequalification Worksheet Online Form and guarantee outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the usda home loan prequalification worksheet online form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the USDA Home Loan Prequalification Worksheet Online Form?

The USDA Home Loan Prequalification Worksheet Online Form is a user-friendly document designed to help potential borrowers assess their eligibility for USDA loans. By completing this form, you can easily gather the necessary information needed to determine if you qualify for a USDA home loan.

-

How do I access the USDA Home Loan Prequalification Worksheet Online Form?

You can access the USDA Home Loan Prequalification Worksheet Online Form directly through our airSlate SignNow platform. Simply sign in, navigate to the forms section, and you will find the worksheet ready for you to complete at your convenience.

-

Is the USDA Home Loan Prequalification Worksheet Online Form free to use?

Yes, accessing and using the USDA Home Loan Prequalification Worksheet Online Form is completely free. Our goal is to provide a cost-effective solution that helps you understand your loan eligibility without any financial commitment.

-

What information do I need to fill out the USDA Home Loan Prequalification Worksheet Online Form?

The USDA Home Loan Prequalification Worksheet Online Form requires basic information such as your income, debts, and credit history. It is essential to have accurate financial details on hand to get an accurate assessment of your eligibility.

-

Can I use the USDA Home Loan Prequalification Worksheet Online Form on mobile devices?

Absolutely! The USDA Home Loan Prequalification Worksheet Online Form is optimized for mobile use, allowing you to complete it anytime, anywhere. This flexibility ensures you can easily assess your loan eligibility on the go.

-

How does the USDA Home Loan Prequalification Worksheet Online Form benefit me?

Using the USDA Home Loan Prequalification Worksheet Online Form provides clarity on your loan options and helps you understand your financial standing. This prequalification can streamline the home buying process by preparing you for what to expect and aligning your goals with USDA loan requirements.

-

What happens after I submit the USDA Home Loan Prequalification Worksheet Online Form?

Once you submit the USDA Home Loan Prequalification Worksheet Online Form, you will receive feedback based on the information provided. This will help guide your next steps in the home loan process, including any potential approval and suggestions for moving forward.

Get more for Usda Home Loan Prequalification Worksheet Online Form

Find out other Usda Home Loan Prequalification Worksheet Online Form

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now