Form 8849 Schedule 3 Rev January Gasohol Blending

What is the Form 8849 Schedule 3 Rev January Gasohol Blending

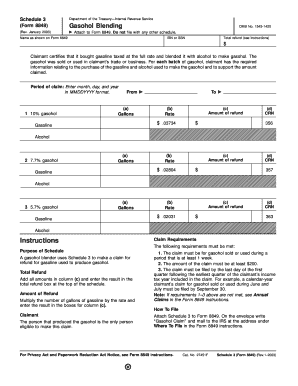

The Form 8849 Schedule 3 Rev January Gasohol Blending is a tax form used by businesses in the United States to claim a refund of excise taxes paid on gasoline that has been blended with alcohol, specifically gasohol. This form is part of the Internal Revenue Service (IRS) process that allows eligible taxpayers to recover certain fuel taxes. The form is essential for those involved in the production or blending of gasohol, as it ensures compliance with federal tax regulations while facilitating the recovery of overpaid taxes.

Steps to complete the Form 8849 Schedule 3 Rev January Gasohol Blending

Completing the Form 8849 Schedule 3 involves several key steps:

- Gather necessary documentation, including records of fuel purchases and blending activities.

- Fill out the taxpayer information section, ensuring accuracy in the name and identification number.

- Detail the gallons of gasohol blended and the corresponding excise taxes paid.

- Calculate the total refund amount by following the instructions provided on the form.

- Review the completed form for any errors or omissions before submission.

How to obtain the Form 8849 Schedule 3 Rev January Gasohol Blending

The Form 8849 Schedule 3 can be obtained directly from the IRS website or through authorized tax preparation services. It is available in a downloadable PDF format, which can be printed and filled out by hand or completed electronically. Ensure that you are using the most recent version of the form to comply with current tax laws and regulations.

Legal use of the Form 8849 Schedule 3 Rev January Gasohol Blending

The legal use of the Form 8849 Schedule 3 is governed by IRS regulations regarding excise taxes on fuel. Businesses must ensure they meet eligibility criteria to file this form, including maintaining accurate records of gasohol blending activities. Proper use of this form allows taxpayers to reclaim taxes legally paid on fuel, thus promoting compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8849 Schedule 3 are crucial for taxpayers seeking refunds. Generally, the form must be submitted within three years of the date the tax was paid or the due date of the return for the period in which the tax was paid. It is important to stay informed about specific deadlines to avoid penalties or delays in processing refund requests.

Examples of using the Form 8849 Schedule 3 Rev January Gasohol Blending

Examples of using the Form 8849 Schedule 3 include businesses that blend gasoline with ethanol to produce gasohol for sale. For instance, a fuel distributor that blends ten thousand gallons of gasohol and pays the corresponding excise tax can use this form to claim a refund for the taxes associated with that fuel. Another example is a manufacturer who produces gasohol for retail sale and seeks to recover taxes paid on fuel used in production.

Quick guide on how to complete form 8849 schedule 3 rev january gasohol blending

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The Easiest Way to Modify and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form—via email, SMS, or invite link—or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and eSign [SKS] to maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8849 Schedule 3 Rev January Gasohol Blending

Create this form in 5 minutes!

How to create an eSignature for the form 8849 schedule 3 rev january gasohol blending

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8849 Schedule 3 Rev January Gasohol Blending?

Form 8849 Schedule 3 Rev January Gasohol Blending is a tax form used by businesses to claim a refund on excise taxes related to gasohol blending. This form provides a structured way for entities to report their fuel activities and seek refunds for eligible blends. Understanding how to properly fill out this form is crucial for businesses involved in this sector.

-

How can airSlate SignNow help with Form 8849 Schedule 3 Rev January Gasohol Blending?

airSlate SignNow offers an intuitive platform that streamlines the process of preparing and signing Form 8849 Schedule 3 Rev January Gasohol Blending. Our solution integrates electronic signatures and document management, making it easy to handle this tax form efficiently. This eliminates the hassle of manual processing and reduces the risk of errors.

-

Is airSlate SignNow cost-effective for managing tax forms like Form 8849 Schedule 3 Rev January Gasohol Blending?

Yes, airSlate SignNow provides a cost-effective solution for managing tax forms, including Form 8849 Schedule 3 Rev January Gasohol Blending. By reducing paper usage and the time spent on document management, our platform ultimately saves you money. Additionally, our pricing models are designed to cater to various business sizes and needs.

-

What features does airSlate SignNow offer for Form 8849 Schedule 3 Rev January Gasohol Blending?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and collaboration tools tailored for Form 8849 Schedule 3 Rev January Gasohol Blending. These features enable you to manage your tax forms seamlessly and with full compliance. Furthermore, you can track document status and ensure timely submissions.

-

Does airSlate SignNow integrate with other accounting software for handling Form 8849 Schedule 3 Rev January Gasohol Blending?

Indeed, airSlate SignNow offers seamless integrations with various accounting software platforms, making it easier to manage Form 8849 Schedule 3 Rev January Gasohol Blending. This integration allows for streamlined data transfer and efficient processing of tax-related documents. You can connect with your existing systems to enhance your workflow.

-

What benefits can I expect when using airSlate SignNow for tax forms like Form 8849 Schedule 3 Rev January Gasohol Blending?

Using airSlate SignNow to manage tax forms like Form 8849 Schedule 3 Rev January Gasohol Blending provides numerous benefits, including increased efficiency, enhanced security, and reduced paper costs. The platform ensures that documents are securely signed and stored, minimizing the risk of loss. Additionally, it simplifies the signing process for all involved parties.

-

Can I track the status of my Form 8849 Schedule 3 Rev January Gasohol Blending submissions with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Form 8849 Schedule 3 Rev January Gasohol Blending submissions in real-time. You will receive updates when documents are signed, viewed, or completed. This feature enhances accountability and keeps you informed throughout the submission process.

Get more for Form 8849 Schedule 3 Rev January Gasohol Blending

Find out other Form 8849 Schedule 3 Rev January Gasohol Blending

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF