Form 8849 Schedule 6 Rev January Other Claims

Understanding Form 8849 Schedule 6

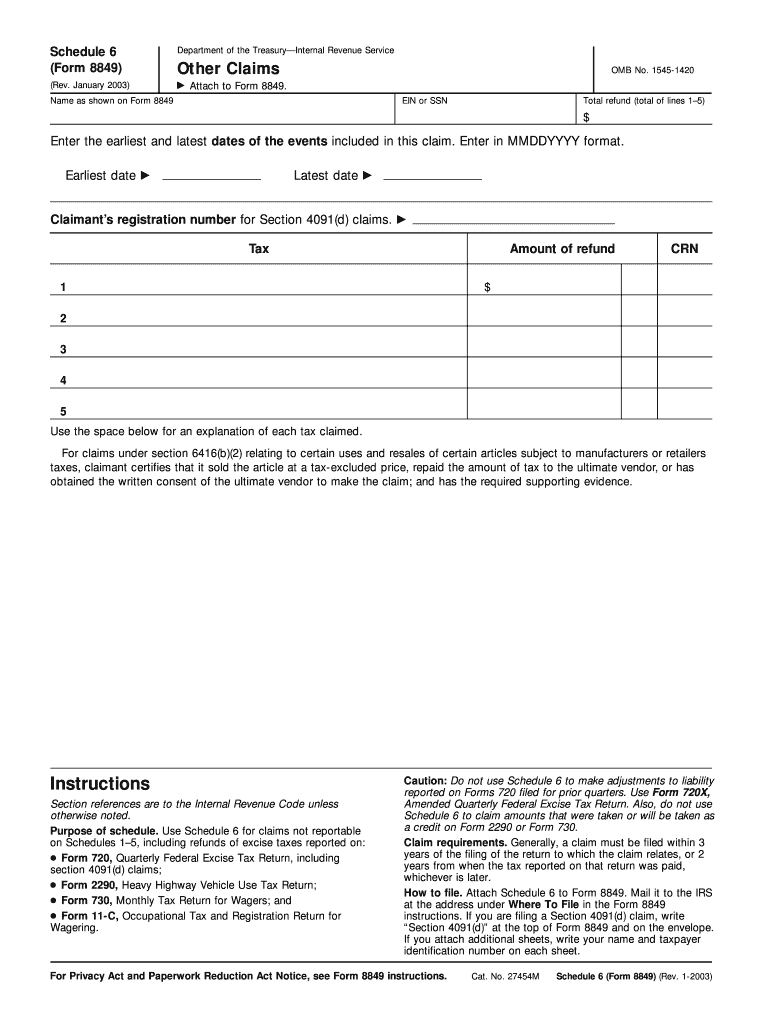

Form 8849 Schedule 6, also known as "Other Claims," is a tax form used by businesses and individuals to claim refunds for certain excise taxes. This form is primarily utilized to report claims for refunds of excise taxes that are not covered by other schedules of Form 8849. It is essential for taxpayers who have overpaid on specific excise taxes related to fuel, environmental taxes, and other applicable areas.

By accurately completing this form, taxpayers can reclaim funds that they are entitled to receive, ensuring compliance with IRS regulations. Understanding the specific claims that can be made on this form is crucial for maximizing potential refunds.

Steps to Complete Form 8849 Schedule 6

Completing Form 8849 Schedule 6 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to the excise taxes you are claiming. This may include receipts, invoices, and any relevant tax records.

Next, fill out the form with your personal or business information, including your Employer Identification Number (EIN) or Social Security Number (SSN). Clearly indicate the type of claim you are making and provide detailed information about the excise taxes you are seeking to refund. Double-check all entries for accuracy before submission.

Once completed, you can file the form either electronically or by mail, depending on your preference and the IRS guidelines. Ensure that you keep a copy of the submitted form for your records.

Key Elements of Form 8849 Schedule 6

Form 8849 Schedule 6 includes several critical components that must be carefully filled out. Key elements include:

- Taxpayer Information: This section requires your name, address, and identification number.

- Claim Type: Specify the type of excise tax refund you are claiming, such as fuel taxes or other applicable claims.

- Refund Amount: Clearly state the amount you are requesting to be refunded.

- Supporting Documentation: Attach any necessary documents that substantiate your claim.

Each of these elements is crucial for the IRS to process your claim efficiently and accurately. Incomplete or incorrect information may delay your refund or result in denial of your claim.

Filing Deadlines for Form 8849 Schedule 6

Timeliness is vital when submitting Form 8849 Schedule 6. The IRS generally requires that claims for refunds be filed within three years from the date the tax was paid. However, specific deadlines may vary based on the type of excise tax and the circumstances surrounding your claim.

It is important to check the IRS guidelines for any updates or changes to filing deadlines. Staying informed about these dates can help ensure that you do not miss the opportunity to reclaim funds that are rightfully yours.

Eligibility Criteria for Form 8849 Schedule 6

To be eligible to file Form 8849 Schedule 6, taxpayers must meet specific criteria. Generally, you must have paid excise taxes on certain products or services and have documentation to support your claim. This form is typically used by businesses involved in activities that incur excise taxes, such as fuel sales or environmental fees.

Additionally, it is crucial to ensure that your claims fall under the categories specified by the IRS for this form. Familiarizing yourself with the eligibility requirements can help streamline the filing process and increase the likelihood of a successful refund claim.

Obtaining Form 8849 Schedule 6

Form 8849 Schedule 6 can be obtained directly from the IRS website or through various tax preparation software. The form is available in a printable format, allowing you to fill it out by hand or electronically. For those who prefer digital options, many tax software programs include this form as part of their services, making it easier to complete and file your claims.

It is advisable to ensure that you are using the most current version of the form to avoid any compliance issues. Regularly checking the IRS website for updates can help you stay informed about any changes to the form or its requirements.

Quick guide on how to complete form 8849 schedule 6

Prepare form 8849 schedule 6 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage form 8849 schedule 6 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign form 8849 schedule 6 with ease

- Locate form 8849 schedule 6 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant portions of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred delivery method for the form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Modify and eSign form 8849 schedule 6 while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 8849 schedule 6

Create this form in 5 minutes!

How to create an eSignature for the form 8849 schedule 6

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 8849 schedule 6

-

What is form 8849 schedule 6?

Form 8849 Schedule 6 is used by taxpayers to claim a credit for certain fuel used in off-highway business activities. It helps you recover excise taxes on fuels used for non-highway purposes, ensuring you can effectively manage your fuel tax obligations.

-

How can airSlate SignNow help me with form 8849 schedule 6?

With airSlate SignNow, you can easily prepare, send, and eSign form 8849 schedule 6 electronically. This streamlines the process, reduces paperwork, and helps ensure that your forms are submitted efficiently and securely.

-

What are the benefits of using airSlate SignNow for form 8849 schedule 6?

Using airSlate SignNow for form 8849 schedule 6 offers several benefits, including time savings, improved accuracy, and a more organized way to manage your forms. Our platform allows for real-time collaboration and tracking, enhancing your document management experience.

-

Is airSlate SignNow cost-effective for filing form 8849 schedule 6?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes looking to file form 8849 schedule 6. With flexible pricing plans, you can find an option that fits your budget while still gaining access to all necessary features.

-

Are there specific features in airSlate SignNow related to form 8849 schedule 6?

Yes, airSlate SignNow provides specific features tailored for form 8849 schedule 6, such as template creation, document sharing, and secure eSignatures. These features make the entire process of completing and submitting the form seamless and user-friendly.

-

Can I integrate airSlate SignNow with other tools for form 8849 schedule 6?

Definitely! airSlate SignNow supports various integrations with popular accounting software and application platforms that can assist in managing form 8849 schedule 6. This means you can synchronize your documents across tools, making it easier to keep track of all your filings.

-

Is it easy to track the status of my form 8849 schedule 6 using airSlate SignNow?

Yes, tracking the status of your form 8849 schedule 6 is straightforward with airSlate SignNow. The platform allows you to monitor the progress of document reviews and approvals, ensuring you stay updated on the filing process.

Get more for form 8849 schedule 6

Find out other form 8849 schedule 6

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application