Form 8889 OMB No

What is Form 8889?

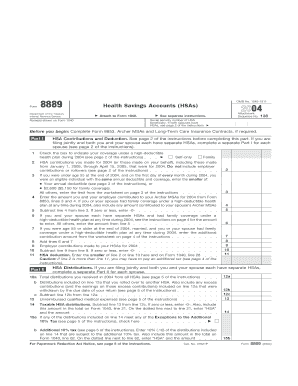

Form 8889 is a tax form used by individuals in the United States to report Health Savings Account (HSA) contributions and distributions. This form is essential for taxpayers who have established an HSA, allowing them to track their contributions, withdrawals, and any tax implications associated with these transactions. The form is part of the IRS tax filing process and must be submitted along with your annual tax return.

Key Elements of Form 8889

Form 8889 consists of several key sections that taxpayers must complete. These include:

- Part I: Reporting contributions made to the HSA during the tax year.

- Part II: Detailing distributions taken from the HSA, including any qualified medical expenses.

- Part III: Calculating any additional taxes or penalties associated with non-qualified distributions.

Each section requires accurate reporting to ensure compliance with IRS regulations and to maximize potential tax benefits associated with HSAs.

Steps to Complete Form 8889

Completing Form 8889 involves several steps:

- Gather necessary documentation, including Form 5498-SA, which reports HSA contributions.

- Fill out Part I by entering total contributions made to your HSA for the tax year.

- Complete Part II by reporting any distributions taken from your HSA, along with the purpose of those distributions.

- In Part III, calculate any additional taxes for non-qualified distributions, if applicable.

- Review the form for accuracy and completeness before submitting it with your tax return.

Filing Deadlines for Form 8889

Form 8889 must be filed by the tax return deadline, which is typically April 15 of the following year. If you file for an extension, you may have until October 15 to submit your tax return, including Form 8889. It is important to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Who Issues Form 8889?

The Internal Revenue Service (IRS) issues Form 8889. It is part of the IRS's efforts to regulate Health Savings Accounts and ensure that taxpayers accurately report their contributions and distributions. The form is available on the IRS website and can be filled out manually or electronically using tax preparation software.

Eligibility Criteria for Using Form 8889

To use Form 8889, taxpayers must meet specific eligibility criteria:

- Must be enrolled in a qualified High Deductible Health Plan (HDHP).

- Must have established a Health Savings Account (HSA).

- Must not be enrolled in Medicare or claimed as a dependent on someone else's tax return.

Meeting these criteria is essential for properly utilizing the benefits associated with HSAs and ensuring compliance with tax regulations.

Quick guide on how to complete what is form 8889

Effortlessly prepare what is form 8889 on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without any holdups. Handle what is form 8889 across any platform using airSlate SignNow's Android or iOS apps and enhance any document-centric procedure today.

Steps to edit and electronically sign what is tax form 8889 effortlessly

- Locate what is form 8889 and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign what is tax form 8889 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to what is form 8889

Create this form in 5 minutes!

How to create an eSignature for the what is tax form 8889

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask what is tax form 8889

-

What is Form 8889?

Form 8889 is a tax form used by taxpayers to report health savings account (HSA) contributions, distributions, and deductions. Understanding what is Form 8889 is crucial for individuals who want to maximize their HSA benefits and ensure compliance with tax regulations.

-

How do I fill out Form 8889?

Filling out Form 8889 requires you to provide information about your HSA contributions and distributions. Clearly understanding what is Form 8889 can simplify this process, as it guides you through reporting your contributions, as well as any withdrawals made for qualified medical expenses.

-

Who needs to file Form 8889?

You must file Form 8889 if you or your employer contributed to an HSA, or if you used funds from an HSA during the tax year. Knowing what is Form 8889 helps determine your filing requirements and ensures you adhere to IRS rules surrounding HSAs.

-

What are the deadlines for submitting Form 8889?

The deadline for submitting Form 8889 coincides with the standard tax filing deadline, usually April 15th, unless otherwise stated. It's essential to know what is Form 8889 and its deadlines to avoid penalties and ensure accurate reporting of your HSA information.

-

Can I eFile Form 8889 with airSlate SignNow?

Yes, you can use airSlate SignNow to eFile Form 8889 efficiently. By leveraging our document management features, you can easily prepare, sign, and send Form 8889 electronically, making the eFiling process straightforward and time-saving.

-

What features does airSlate SignNow offer for managing tax forms like Form 8889?

airSlate SignNow provides features such as electronic signatures, template creations, and secure document storage to manage tax forms effectively. Understanding what is Form 8889 can enhance how you utilize these features, ensuring accurate and timely submission.

-

Is there a cost associated with using airSlate SignNow for Form 8889?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, making it a cost-effective solution for managing forms like Form 8889. Evaluating these options can help you choose the best plan for your specific needs while understanding what is Form 8889.

Get more for what is form 8889

Find out other what is tax form 8889

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe