12 4 Tax Position of Beneficiariesincome of the 2024-2026

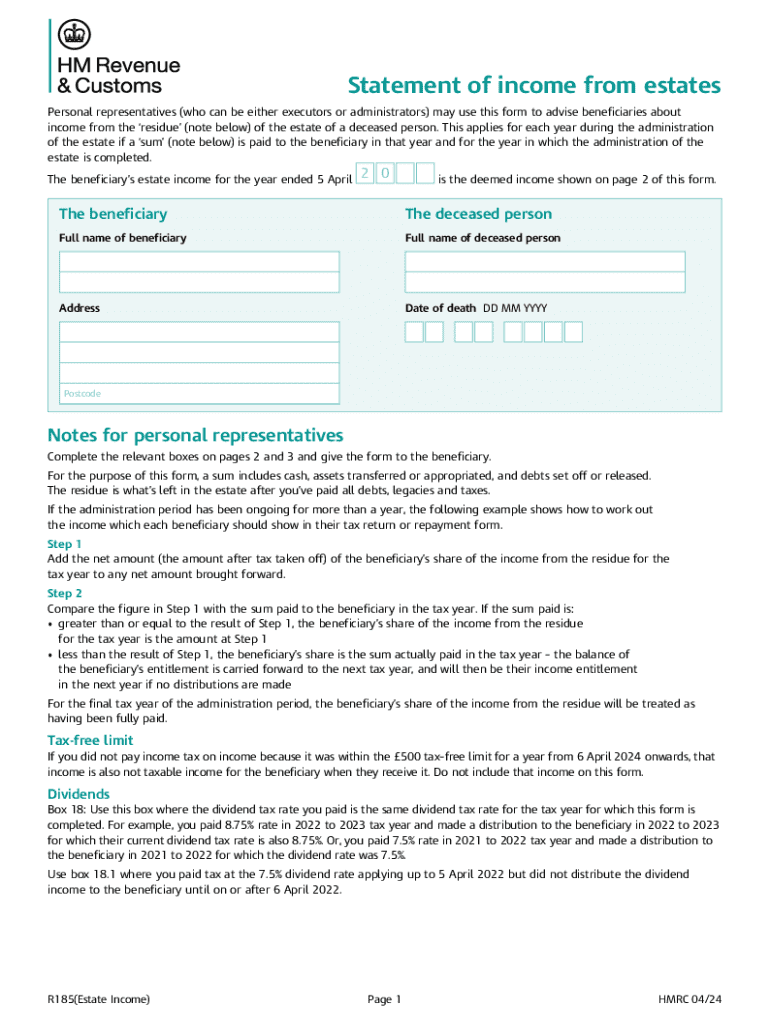

What is the R185 form?

The R185 form is a tax document used in the United Kingdom, specifically for reporting income from estates. It is essential for beneficiaries who receive income from a trust or estate, allowing them to declare this income on their tax returns. The form provides a detailed statement of income received, which is crucial for accurate tax reporting and compliance with tax regulations.

How to use the R185 form

To effectively use the R185 form, beneficiaries must first ensure they have received the form from the estate or trust administrator. The form will detail the income they have received, and beneficiaries should carefully review this information. Once verified, they can use the details from the R185 form to complete their tax returns, ensuring that all reported income aligns with the amounts stated on the form.

Steps to complete the R185 form

Completing the R185 form involves several key steps:

- Gather all necessary information regarding the income received from the estate.

- Fill out the form accurately, ensuring all income sources are reported.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate tax authority, either online or via mail.

Legal use of the R185 form

The R185 form serves a legal purpose by documenting income received from estates. It is important for beneficiaries to use this form correctly to ensure compliance with tax laws. Failure to report income accurately can lead to penalties or legal issues, making it crucial to understand the form's requirements and implications.

IRS Guidelines

Required Documents

When filling out the R185 form, beneficiaries may need to provide additional documentation, including:

- Proof of identity, such as a Social Security number or taxpayer identification number.

- Documentation of income received from the estate, such as bank statements or trust statements.

- Any previous tax returns that may provide context for the reported income.

Form Submission Methods

The R185 form can typically be submitted through various methods. Beneficiaries may choose to file the form online using the appropriate tax authority's website, or they can opt for traditional mail. In-person submissions may also be available at designated tax offices, depending on local regulations.

Create this form in 5 minutes or less

Find and fill out the correct 12 4 tax position of beneficiariesincome of the

Create this form in 5 minutes!

How to create an eSignature for the 12 4 tax position of beneficiariesincome of the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an r185 form and why is it important?

The r185 form is a tax document used in the UK to report income from investments. It is essential for individuals and businesses to accurately declare their earnings and ensure compliance with tax regulations. Understanding the r185 form can help you manage your finances effectively.

-

How can airSlate SignNow help with the r185 form?

airSlate SignNow provides a seamless platform for electronically signing and sending the r185 form. With our user-friendly interface, you can easily fill out and submit the form, ensuring that your documents are processed quickly and securely. This saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the r185 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to manage your documents, including the r185 form, without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the r185 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the r185 form. These tools enhance your workflow, making it easier to manage your documents efficiently. Additionally, our platform ensures that your data is protected with top-notch security measures.

-

Can I integrate airSlate SignNow with other applications for the r185 form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your processes related to the r185 form. Whether you use CRM systems or cloud storage solutions, our platform can connect seamlessly to enhance your document management experience.

-

What are the benefits of using airSlate SignNow for the r185 form?

Using airSlate SignNow for the r185 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to focus on your core business activities while ensuring compliance with tax regulations. Experience the convenience of digital document management today.

-

How secure is airSlate SignNow when handling the r185 form?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your documents, including the r185 form. You can trust that your sensitive information is safe while using our platform for eSigning and document management.

Get more for 12 4 Tax Position Of Beneficiariesincome Of The

- Arkansas school bus driver physical form

- Oakland building permit application service first permits form

- Nursery application form

- Blow the lid off reading 310212460 form

- Tchart form

- Parental consent to share health information for the ohio medicaid bb loganhocking k12 oh

- Divorce financial agreement template form

- Divorce financial settlement draft consent order agreement template form

Find out other 12 4 Tax Position Of Beneficiariesincome Of The

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple