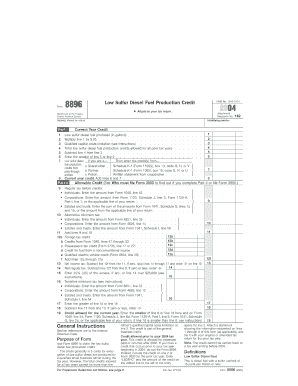

Form 8896 Low Sulfur Diesel Fuel Production Credit

What is the Form 8896 Low Sulfur Diesel Fuel Production Credit

The Form 8896 Low Sulfur Diesel Fuel Production Credit is a tax form used by businesses in the United States to claim a credit for the production of low sulfur diesel fuel. This credit is designed to incentivize the production of cleaner fuels, aligning with environmental regulations aimed at reducing harmful emissions. The credit can significantly lower a business's tax liability, making it an important consideration for eligible producers.

Eligibility Criteria

To qualify for the Low Sulfur Diesel Fuel Production Credit, businesses must meet specific eligibility criteria. These include:

- The fuel produced must meet the low sulfur standards set by the Environmental Protection Agency (EPA).

- The production must occur within the United States.

- Producers must maintain proper documentation to support their claim, including records of production and compliance with relevant regulations.

Steps to complete the Form 8896 Low Sulfur Diesel Fuel Production Credit

Completing Form 8896 involves several key steps:

- Gather necessary documentation, including production records and compliance certificates.

- Fill in the form, ensuring all sections are completed accurately, including details about the fuel produced and the credit amount being claimed.

- Review the form for any errors or omissions before submission.

- Submit the form along with any required supporting documents to the appropriate IRS office.

How to obtain the Form 8896 Low Sulfur Diesel Fuel Production Credit

Form 8896 can be obtained directly from the Internal Revenue Service (IRS) website. It is available for download in PDF format, allowing businesses to print and complete the form manually. Additionally, many tax preparation software programs include the form, making it easier for businesses to complete their tax filings electronically.

Required Documents

When filing Form 8896, businesses must include several required documents to support their claim for the credit. These documents may include:

- Proof of production, such as production logs or invoices.

- Compliance documentation demonstrating adherence to EPA regulations.

- Any additional records that substantiate the credit amount being claimed.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with Form 8896. Generally, the form must be filed by the due date of the tax return for the year in which the credit is being claimed. Extensions may be available, but businesses should ensure timely submission to avoid penalties.

Quick guide on how to complete form 8896 low sulfur diesel fuel production credit

Complete [SKS] effortlessly on any device

Online document administration has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate format and securely keep it online. airSlate SignNow provides you with all the features necessary to create, alter, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The simplest way to alter and electronically sign [SKS] without effort

- Obtain [SKS] and then click Get Form to begin.

- Utilize the features we provide to finish your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to store your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or mistakes requiring new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8896 Low Sulfur Diesel Fuel Production Credit

Create this form in 5 minutes!

How to create an eSignature for the form 8896 low sulfur diesel fuel production credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8896 Low Sulfur Diesel Fuel Production Credit?

The Form 8896 Low Sulfur Diesel Fuel Production Credit is a tax credit available to producers of low sulfur diesel fuel. This form helps businesses claim a credit for the production of eligible diesel, promoting cleaner fuel and environmental benefits. Utilizing airSlate SignNow can streamline the process of submitting this form.

-

How can airSlate SignNow assist with the Form 8896 Low Sulfur Diesel Fuel Production Credit?

airSlate SignNow allows businesses to electronically sign and send documents associated with the Form 8896 Low Sulfur Diesel Fuel Production Credit. This service simplifies the submission process, ensuring that your documents are processed quickly and efficiently. Our user-friendly interface makes it easy for anyone to navigate and complete their forms.

-

What features does airSlate SignNow offer for managing Form 8896 submissions?

With airSlate SignNow, you can access features such as document templates, secure eSigning, and automated workflows specifically designed for managing Form 8896 submissions. These tools enhance efficiency and reduce the chances of errors, ensuring that you submit your credit claims accurately and on time.

-

Is there a cost associated with using airSlate SignNow for the Form 8896 Low Sulfur Diesel Fuel Production Credit?

Yes, there is a subscription fee for using airSlate SignNow, but we offer cost-effective plans that can fit a variety of business needs. The investment in our solution can save you time and potential errors, which may ultimately provide a better return on your business’s investment in claiming the Form 8896 Low Sulfur Diesel Fuel Production Credit.

-

How does airSlate SignNow ensure the security of documents related to the Form 8896?

AirSlate SignNow employs industry-leading security measures, including encryption and secure cloud storage, to protect your documents related to the Form 8896 Low Sulfur Diesel Fuel Production Credit. With our platform, you can trust that your sensitive information is safeguarded against unauthorized access and bsignNowes.

-

Can airSlate SignNow integrate with accounting software for Form 8896-related tasks?

Yes, airSlate SignNow offers integrations with various accounting software, making it easy to incorporate your Form 8896 Low Sulfur Diesel Fuel Production Credit tasks into your existing workflows. This compatibility streamlines the documentation and filing processes, enhancing overall productivity for your business.

-

What benefits can businesses expect from utilizing airSlate SignNow for Form 8896?

By using airSlate SignNow for the Form 8896 Low Sulfur Diesel Fuel Production Credit, businesses can expect increased efficiency, reduced administrative burdens, and improved compliance. Our platform helps you stay organized and ensures that you can claim your credits smoothly, allowing you to focus on your core business activities.

Get more for Form 8896 Low Sulfur Diesel Fuel Production Credit

- Mv 38d form

- Admit discharge death notice for nursing icf mr and acute facility tracking us form

- Lic health extra consent form

- Kotp intake form kids ot play

- Chattel agreement form

- In doctor form how to write fillings

- Ngb form 21 fillable

- Application for certificate of clearance for medical assistance claim minncle form

Find out other Form 8896 Low Sulfur Diesel Fuel Production Credit

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure