Form 13615A September Department of the Treasury Internal Revenue Service Volunteer Agreement Standards of Conduct Volunteer Ret

Understanding Form 13615A

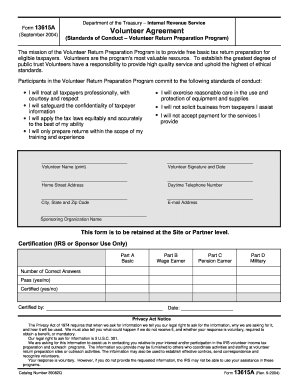

Form 13615A is an essential document issued by the Department of the Treasury, Internal Revenue Service (IRS). This form serves as a Volunteer Agreement that outlines the Standards of Conduct for participants in the Volunteer Return Preparation Program (VRPP). The VRPP aims to provide free tax assistance to individuals and families in need, ensuring they receive the necessary support during tax season. By signing this form, volunteers agree to adhere to specific ethical guidelines and responsibilities, fostering a trustworthy environment for taxpayers.

How to Complete Form 13615A

Completing Form 13615A involves several straightforward steps. First, ensure that you have the latest version of the form, available through the IRS website or directly from the VRPP program coordinators. Fill in your personal information, including your name, address, and contact details. Next, review the Standards of Conduct outlined in the form, which detail the expectations for volunteer behavior. After understanding these guidelines, sign and date the form to confirm your agreement. Finally, submit the completed form to your local VRPP coordinator as instructed.

Key Elements of Form 13615A

Form 13615A includes several critical components that volunteers must understand. Key elements include:

- Volunteer Responsibilities: Clear expectations regarding the conduct and duties of volunteers.

- Confidentiality Agreement: A commitment to protect taxpayer information and maintain privacy.

- Compliance with IRS Regulations: An affirmation to follow all IRS guidelines and policies during volunteer activities.

- Signature Requirement: A section for volunteers to sign, indicating their acceptance of the terms.

Obtaining Form 13615A

To obtain Form 13615A, volunteers can access it through the IRS website or request it from local VRPP coordinators. It is important to ensure you are using the most recent version of the form, as updates may occur annually. Additionally, some community organizations involved in the VRPP may provide printed copies for volunteers during training sessions.

IRS Guidelines for Volunteers

The IRS provides specific guidelines that volunteers must follow while participating in the VRPP. These guidelines include maintaining professionalism, ensuring accuracy in tax preparation, and upholding the confidentiality of taxpayer information. Volunteers are also encouraged to seek assistance from experienced coordinators if they encounter complex tax situations. Adhering to these guidelines helps maintain the integrity of the program and builds trust with the community.

Eligibility Criteria for Volunteers

To participate in the Volunteer Return Preparation Program, individuals must meet certain eligibility criteria. Typically, volunteers should possess a basic understanding of tax laws and filing procedures. Previous experience in tax preparation is beneficial but not always required, as training is provided. Additionally, volunteers must commit to the program's standards of conduct and complete the necessary paperwork, including Form 13615A, to officially join the program.

Quick guide on how to complete form 13615a september department of the treasury internal revenue service volunteer agreement standards of conduct volunteer

Prepare [SKS] effortlessly on any device

Online document management has gained signNow popularity among businesses and individuals alike. It serves as an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools you need to generate, alter, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a classic wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign [SKS] and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 13615A September Department Of The Treasury Internal Revenue Service Volunteer Agreement Standards Of Conduct Volunteer Ret

Create this form in 5 minutes!

How to create an eSignature for the form 13615a september department of the treasury internal revenue service volunteer agreement standards of conduct volunteer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 13615A September Department Of The Treasury Internal Revenue Service Volunteer Agreement Standards Of Conduct?

The Form 13615A September Department Of The Treasury Internal Revenue Service Volunteer Agreement Standards Of Conduct outlines the expectations and responsibilities of volunteers participating in the Volunteer Return Preparation Program. This document ensures all volunteers are aware of ethical standards and operational guidelines, fostering a professional environment for tax return preparation.

-

How can I access the Form 13615A for the Volunteer Return Preparation Program?

You can access the Form 13615A September Department Of The Treasury Internal Revenue Service Volunteer Agreement Standards Of Conduct directly through the IRS website or by contacting your local Volunteer Return Preparation Program coordinator. It's important to familiarize yourself with this form to fully understand your role and the program's objectives.

-

What are the benefits of participating in the Volunteer Return Preparation Program?

Participating in the Volunteer Return Preparation Program allows individuals to gain valuable tax preparation experience while helping others file their taxes. The mission of the Volunteer Return Preparation Program is to provide assistance to those in need, which not only enhances community support but also fosters a sense of achievement and fulfillment among volunteers.

-

Does the airSlate SignNow platform support integration with tax preparation software?

Yes, airSlate SignNow provides seamless integrations with various tax preparation software, enabling users to eSign critical documents and share them easily. This integration is beneficial for ensuring that the Form 13615A September Department Of The Treasury Internal Revenue Service Volunteer Agreement Standards Of Conduct is completed and stored securely during the Volunteer Return Preparation Program.

-

How much does the Volunteer Return Preparation Program cost?

The Volunteer Return Preparation Program is free for volunteers; however, it requires adherence to the standards set forth in the Form 13615A September Department Of The Treasury Internal Revenue Service Volunteer Agreement Standards Of Conduct. Volunteers typically benefit from access to free training resources, certification, and comprehensive support during their volunteer work.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a variety of features for document management, including cloud storage, eSignature capabilities, and customizable templates. By utilizing the platform, volunteers can efficiently manage documents related to the Form 13615A September Department Of The Treasury Internal Revenue Service Volunteer Agreement Standards Of Conduct and streamline their workflows during the Volunteer Return Preparation Program.

-

How do I ensure compliance with the standards set in the Form 13615A?

To ensure compliance with the standards set in the Form 13615A September Department Of The Treasury Internal Revenue Service Volunteer Agreement Standards Of Conduct, volunteers should review the agreement carefully and participate in any provided training sessions. Additionally, regularly checking in with program coordinators and adhering to best practices in tax preparation is essential.

Get more for Form 13615A September Department Of The Treasury Internal Revenue Service Volunteer Agreement Standards Of Conduct Volunteer Ret

Find out other Form 13615A September Department Of The Treasury Internal Revenue Service Volunteer Agreement Standards Of Conduct Volunteer Ret

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple