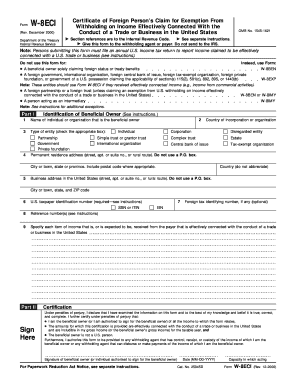

Form W 8ECI Rev December Certificate of Foreign Person's Claim for Exemption from Withholding on Income Effectively Connect

Understanding the Form W-8ECI

The Form W-8ECI, officially titled the Certificate Of Foreign Person's Claim For Exemption From Withholding On Income Effectively Connected With The Conduct Of A Trade Or Business In The United States, is a crucial document for foreign entities. It allows these entities to claim exemption from U.S. withholding taxes on income that is effectively connected with a trade or business conducted within the United States. This form is primarily used by foreign individuals and businesses to certify their foreign status and to establish that the income they receive is not subject to withholding under U.S. tax laws.

How to Use the Form W-8ECI

Using the Form W-8ECI involves several steps to ensure compliance with IRS regulations. Foreign entities must complete the form accurately, providing necessary details such as their name, country of incorporation, and the type of income they are claiming exemption for. Once completed, the form should be submitted to the U.S. withholding agent or payer, who will retain it for their records. It is important to ensure that the information provided is current and reflects any changes in the entity's status or circumstances.

Steps to Complete the Form W-8ECI

Completing the Form W-8ECI requires careful attention to detail. Here are the key steps:

- Provide the name of the foreign entity and its country of incorporation.

- Indicate the type of income being received and its connection to U.S. trade or business.

- Include the foreign entity's taxpayer identification number (if applicable).

- Sign and date the form, certifying that the information is accurate.

Each section of the form must be filled out completely to avoid delays or issues with processing.

Legal Use of the Form W-8ECI

The Form W-8ECI is legally recognized by the IRS for foreign entities conducting business in the United States. It serves as a declaration that the income is effectively connected with a U.S. trade or business, which allows for the exemption from withholding taxes. Proper use of this form is essential for compliance with U.S. tax regulations, and failure to submit it when required can result in withholding taxes being applied to the income received.

Eligibility Criteria for Using the Form W-8ECI

To qualify for using the Form W-8ECI, the entity must meet specific criteria. The entity must be foreign, meaning it is not organized under U.S. laws. Additionally, the income must be effectively connected with a trade or business in the United States. This includes income from services performed in the U.S. or income from property located in the U.S. Entities must ensure they meet these criteria before submitting the form to avoid complications with the IRS.

Filing Deadlines and Important Dates

Filing deadlines for the Form W-8ECI can vary based on the specific circumstances of the foreign entity and the income being reported. Generally, the form should be submitted before the payment is made to ensure that withholding tax exemptions are applied. It is advisable to keep track of any changes in tax regulations or deadlines as they may impact the filing process.

Quick guide on how to complete form w 8eci rev december certificate of foreign persons claim for exemption from withholding on income effectively connected

Complete [SKS] effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize crucial sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, either by email, SMS, invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and eSign [SKS] while ensuring exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form W 8ECI Rev December Certificate Of Foreign Person's Claim For Exemption From Withholding On Income Effectively Connect

Create this form in 5 minutes!

How to create an eSignature for the form w 8eci rev december certificate of foreign persons claim for exemption from withholding on income effectively connected

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 8ECI Rev December Certificate Of Foreign Person's Claim For Exemption From Withholding On Income Effectively Connected With The Conduct Of A Trade Or Business In The United States?

The Form W 8ECI Rev December Certificate Of Foreign Person's Claim For Exemption From Withholding On Income Effectively Connected With The Conduct Of A Trade Or Business In The United States is a tax form used by foreign entities to claim exemption from U.S. withholding tax on income that is effectively connected with a business conducted in the U.S. This form helps foreign persons to ensure they are not overpaying taxes on their U.S. earnings.

-

How does airSlate SignNow simplify the completion of the Form W 8ECI Rev December?

airSlate SignNow makes it easy to complete the Form W 8ECI Rev December through its user-friendly interface. Users can fill out the required information online, ensuring accuracy and compliance with IRS regulations, which ultimately saves time and minimizes errors. The digital signing feature also enhances the process signNowly.

-

Are there any costs associated with using airSlate SignNow for the Form W 8ECI Rev December?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there may be a fee associated with using the platform, the efficiency and convenience provided can lead to cost savings in the long run, especially for businesses frequently handling forms like the Form W 8ECI Rev December.

-

What features does airSlate SignNow offer for managing the Form W 8ECI Rev December?

airSlate SignNow provides features such as templates for the Form W 8ECI Rev December, automated workflows for document routing, and secure e-signature options. These features not only streamline the process of obtaining necessary signatures but also ensure that all documents are stored securely and can be easily accessed.

-

How can airSlate SignNow help with compliance regarding the Form W 8ECI Rev December?

By using airSlate SignNow, businesses can stay compliant with IRS requirements when filling out the Form W 8ECI Rev December. The platform includes built-in compliance checks, document tracking, and secure storage, which ensures that all necessary documentation is complete and readily available for audits or reviews.

-

Is airSlate SignNow compatible with other software for processing the Form W 8ECI Rev December?

Yes, airSlate SignNow offers integration capabilities with various business applications and software, allowing seamless data transfer for the Form W 8ECI Rev December. This interoperability enhances a business's workflow, enabling users to efficiently manage documents and keep their processes streamlined.

-

What benefits does using airSlate SignNow provide for international businesses concerning the Form W 8ECI Rev December?

International businesses can greatly benefit from airSlate SignNow by simplifying the process of completing the Form W 8ECI Rev December. The platform's efficiency reduces the time spent on paperwork and minimizes the risk of tax withholding, which leads to better cash flow management for foreign entities operating in the U.S.

Get more for Form W 8ECI Rev December Certificate Of Foreign Person's Claim For Exemption From Withholding On Income Effectively Connect

Find out other Form W 8ECI Rev December Certificate Of Foreign Person's Claim For Exemption From Withholding On Income Effectively Connect

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure