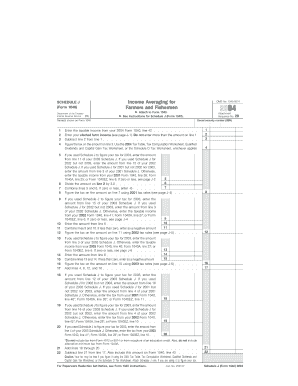

Schedule J Form 1040 Income Averaging for Farmers and Fishermen

What is the Schedule J Form 1040 Income Averaging For Farmers And Fishermen

The Schedule J Form 1040 is specifically designed for farmers and fishermen in the United States to utilize income averaging. This tax form allows eligible individuals to average their income over a three-year period, which can help reduce the tax burden during high-income years. By spreading income across multiple years, farmers and fishermen can potentially lower their overall tax rate, making it easier to manage fluctuating income levels typical in these professions.

How to use the Schedule J Form 1040 Income Averaging For Farmers And Fishermen

To effectively use the Schedule J Form 1040, taxpayers must first determine their eligibility based on their farming or fishing income. Once confirmed, they can complete the form by reporting their income from the previous three years. This includes detailing the income earned in each year and calculating the average. The final step involves transferring the averaged income to the main Form 1040, which will reflect the adjusted tax liability.

Steps to complete the Schedule J Form 1040 Income Averaging For Farmers And Fishermen

Completing the Schedule J Form 1040 involves several key steps:

- Gather your income records for the past three years, including any relevant documents that detail earnings from farming or fishing.

- Fill out the income section on Schedule J, listing your total income for each of the three years.

- Calculate the average income by adding the three years of income and dividing by three.

- Transfer the averaged income to your Form 1040, ensuring all calculations are accurate.

- Review the completed form for accuracy before submission.

Key elements of the Schedule J Form 1040 Income Averaging For Farmers And Fishermen

Several key elements are crucial when completing the Schedule J Form 1040. These include:

- Eligibility Criteria: Only farmers and fishermen with qualifying income can use this form.

- Income Reporting: Accurate reporting of income from the past three years is essential for proper averaging.

- Tax Calculation: The averaged income impacts the overall tax liability, which should be calculated carefully.

- Filing Requirements: Understanding the filing requirements and deadlines is vital to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for using the Schedule J Form 1040. It is important to review these guidelines to ensure compliance with tax laws. This includes understanding the eligibility criteria, the types of income that qualify for averaging, and the proper methods for calculating the average. Taxpayers should also stay informed about any updates or changes to the IRS rules that may affect their filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule J Form 1040 align with the standard tax filing deadlines in the United States. Typically, the deadline for submitting individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial for farmers and fishermen to be aware of these dates to avoid late fees and ensure timely processing of their returns.

Quick guide on how to complete schedule j form 1040 income averaging for farmers and fishermen 1659595

Effortlessly Prepare [SKS] on All Devices

The management of documents online has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Edit and Electronically Sign [SKS] Easily

- Find [SKS] and click on Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule J Form 1040 Income Averaging For Farmers And Fishermen

Create this form in 5 minutes!

How to create an eSignature for the schedule j form 1040 income averaging for farmers and fishermen 1659595

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule J Form 1040 Income Averaging For Farmers And Fishermen?

The Schedule J Form 1040 Income Averaging For Farmers And Fishermen is a tax form that allows qualifying taxpayers to average their income over a three-year period. This can be beneficial for farmers and fishermen whose income may fluctuate signNowly from year to year. By using this form, you can potentially reduce your tax liability in high-income years.

-

How can airSlate SignNow help with filling out the Schedule J Form 1040 Income Averaging For Farmers And Fishermen?

airSlate SignNow provides a user-friendly platform to securely fill out and eSign your Schedule J Form 1040 Income Averaging For Farmers And Fishermen digitally. Our tool simplifies the document preparation process, helping you focus on the essential details of your tax submission. With airSlate SignNow, you can ensure your forms are completed accurately and submitted on time.

-

Are there any costs associated with using airSlate SignNow for the Schedule J Form 1040?

Yes, there are costs associated with using airSlate SignNow, but they are competitively priced to provide an easy-to-use solution for managing your Schedule J Form 1040 Income Averaging For Farmers And Fishermen. We offer various subscription plans tailored to different needs, providing value for individuals, small businesses, and larger operations.

-

What features does airSlate SignNow offer that are beneficial for the Schedule J Form 1040?

airSlate SignNow offers features such as document templates, eSignature capabilities, and cloud storage, all of which can enhance your experience when working on the Schedule J Form 1040 Income Averaging For Farmers And Fishermen. These features streamline the process, improve accessibility, and ensure your documents are securely stored for future reference.

-

Can I integrate other software with airSlate SignNow for tax purposes, including the Schedule J Form 1040?

Absolutely! airSlate SignNow offers integration with various software solutions commonly used for tax preparation and accounting. This integration makes it easier to manage your financial documents and supports a smoother workflow when preparing your Schedule J Form 1040 Income Averaging For Farmers And Fishermen.

-

What benefits does the Schedule J Form 1040 Income Averaging For Farmers And Fishermen provide?

The key benefit of using the Schedule J Form 1040 Income Averaging For Farmers And Fishermen is the potential tax savings it offers that can ease the financial burden of high-income years. By averaging your income, you may qualify for a lower tax bracket, thereby reducing your overall tax liability. This can be a signNow advantage for farmers and fishermen with fluctuating incomes.

-

Who is eligible to use the Schedule J Form 1040 Income Averaging For Farmers And Fishermen?

Eligible taxpayers include farmers and fishermen who meet specific criteria regarding their income and the nature of their business. Generally, you should have a substantial amount of income from farming or fishing activities and have filed appropriate returns for the past three years to benefit from income averaging.

Get more for Schedule J Form 1040 Income Averaging For Farmers And Fishermen

Find out other Schedule J Form 1040 Income Averaging For Farmers And Fishermen

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online